ABOUT US

About Us

Welcome to Epic Loan Solutions, your premier source for comprehensive information on mortgages and real estate across the United States. Our blog is dedicated to providing valuable insights, expert advice, and up-to-date news to help you navigate the complex world of mortgages and real estate with confidence and ease.

Our Mission

At Epic Loan Solutions, our mission is to empower individuals and professionals with the knowledge they need to make informed decisions in the mortgage and real estate markets. We strive to simplify the intricacies of home financing and real estate investment, making it accessible and understandable for everyone.

What We Offer

Latest News: Stay on top of the latest developments in the mortgage and real estate industries. From changes in interest rates and housing policies to market trends and economic updates, we keep you informed about the factors that influence your financial decisions.

Expert Advice: Benefit from the wisdom of seasoned professionals. Our expert advice covers a wide range of topics, including mortgage options, refinancing strategies, real estate investment, and more. We provide practical tips and actionable insights to help you achieve your financial goals.In-Depth Guides: Our comprehensive guides break down complex topics into easy-to-understand information. Whether you're a first-time homebuyer, looking to refinance, or exploring real estate investment opportunities, our guides offer step-by-step instructions and valuable tips.

Tools and Resources: Access a variety of tools and resources designed to assist you in your mortgage and real estate journey. From mortgage calculators and checklists to informative articles and webinars, we provide everything you need to make well-informed decisions.

Community Engagement: Join a vibrant community of individuals who share your interest in mortgages and real estate. Engage with our content, participate in discussions, and connect with others to share experiences and gain new perspectives.

Why Choose Us?

Epic Loan Solutions is dedicated to delivering high-quality, reliable content that you can trust. Our team of experienced writers and industry experts is passionate about helping you succeed in your real estate and mortgage endeavors. We understand that every financial journey is unique, and we are committed to providing personalized advice and valuable resources to support you every step of the way.

Thank you for visiting Epic Loan Solutions. We look forward to being your trusted partner in navigating the mortgage and real estate markets. If you have any questions or need further assistance, please don't hesitate to contact us.

What a Government Shutdown Really Means for the Housing Market

What a Government Shutdown Really Means for the Housing Market

By Christian Penner (Mortgage Broker | Mortgage Lender | Real Estate Agent | Real Estate Advisor) – America’s Mortgage Solutions (AMS) – West Palm Beach / North Palm Beach / Wellington, Florida FL

Introduction

When the topic of a government shutdown takes the spotlight, many in the housing sector ask: what does this really mean for the housing market? In the areas of West Palm Beach, North Palm Beach and Wellington, Florida FL, where real estate activity is robust and closely tied to national macro‐factors, the question matters.

Here’s the short version: the market doesn’t stop. Homes are still being bought or sold, buyers keep buying, and sellers keep selling. But certain aspects, especially those tied to federal programs, may experience disruptions.

As your trusted local real estate professional and mortgage advisor, I’ll walk you through how a shutdown can impact the typical housing market cycle, what to watch for, and how you as agents, applicants for FHA, and local buyers/sellers can navigate things effectively.

What Happens During a Government Shutdown?

When the federal government pauses funding, many agencies either scale back or suspend non-essential operations. That leads to ripple effects across sectors – including real estate.

Key federal programs at risk

The National Flood Insurance Program (NFIP) can’t issue new or renewal policies during a lapse. MarketWatch+4National Association of REALTORS®+4Proof+4

Agencies like the U.S. Department of Housing and Urban Development (HUD), the Federal Housing Administration (FHA) and the Department of Veterans Affairs (VA) see processing delays for certain loans. CBS News+2National Housing Conference+2

The Internal Revenue Service (IRS) may reduce verification services (tax transcripts, income verification) which lenders rely on. Better Mortgage+1

Why this affects real estate

In flood‐prone regions (like many parts of Florida including Palm Beach County) where flood insurance is required for mortgage approval, the inability to issue policies can delay closings. Realtor+1

For applicants for FHA, VA, or USDA loans, these federal backups may delay loan endorsements or guarantees. CBS News

Even conventional mortgages may be affected insofar as they rely on federal verifications or insurance contingencies. Better Mortgage+1

What This Means for the Local Market in West Palm Beach / North Palm Beach / Wellington

Living and operating in Florida FL, in areas like West Palm Beach, North Palm Beach, and Wellington, we are especially attentive to disruptions because:

A high number of homes lie in flood zones or require flood insurance.

Buyers often rely on federal loan programs (FHA, VA, USDA) or work with local motivated sellers negotiating in a competitive housing market.

The local existing home sales environment is tied both to seasonal trends and broader national shifts.

For buyers

If you’re thinking about buying or selling a home, or actively in the process of buying or selling a home, you should ask: is the transaction dependent on a federal program or insurance? If so, we’d build in extra buffer time.

The good news: For transactions not dependent on federal underwriting (e.g., conventional loans, cash purchases) the housing market continues to move. In fact, in times of uncertainty, well-prepared buyers may find less competition for homes, and motivated sellers may be more willing to negotiate.

As your local real estate advisor, I monitor the process closely to help you stay ahead of potential delays.

For sellers

While national headlines may suggest a pause, locally you may still see sellers keep selling. Some homeowners may become cautious in a shutdown environment, creating opportunities.

If you’re prepping to list a home in West Palm Beach or Wellington, timing remains important. Still, the typical housing market cycle (listing, showing, contract, close) will proceed. We just recommend being transparent about potential timing adjustments with buyers.

For agents and mortgage brokers

As a local professional at America’s Mortgage Solutions (AMS), I advise agents to check any closing timelines and loan contingencies if government‐backed financing is involved.

For agents, part of your value is helping clients anticipate hiccups in processing certain types of government loans (FHA, VA, USDA) so the transaction keeps moving.

As a mortgage broker, I can provide guidance on alternatives (e.g., conventional financing) if one route becomes slower.

How a Government Shutdown Impacts Key Metrics in the Housing Market

Existing Home Sales

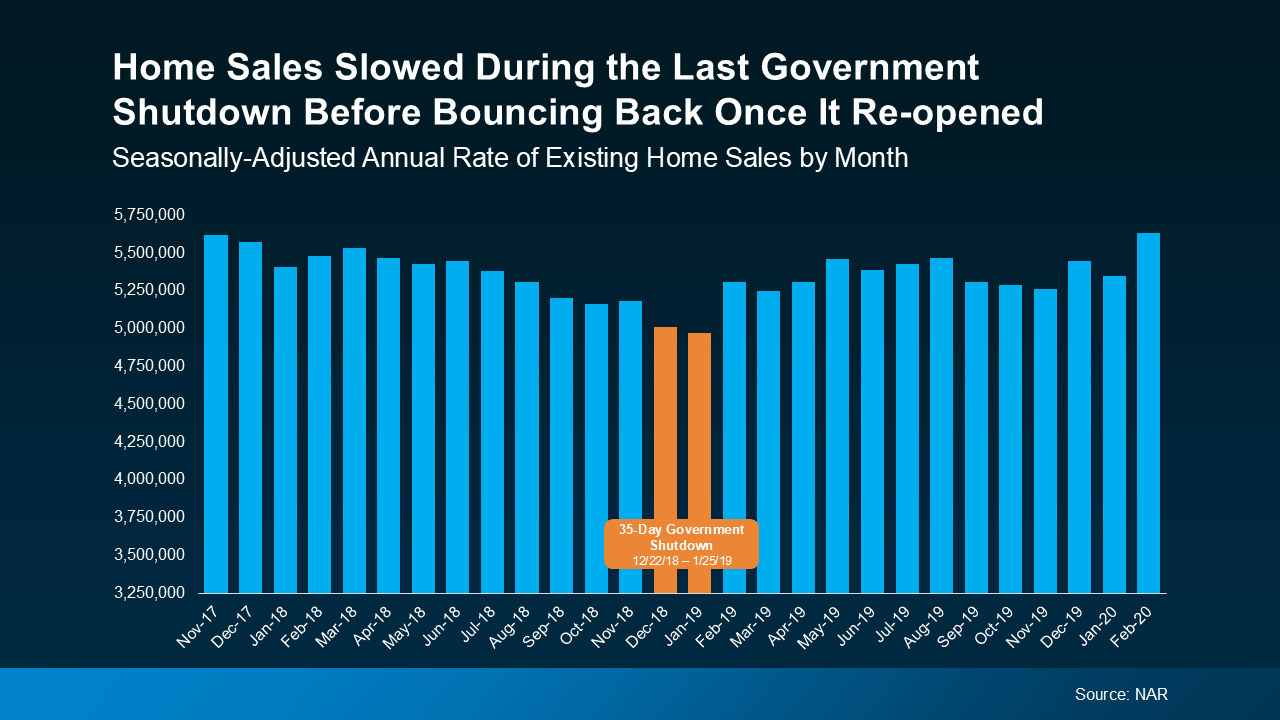

The National Association of Realtors (NAR) and other industry groups track sales of previously owned homes. During past shutdowns, the drop in activity has been modest and short‐lived. For example, when the previous major shutdown lasted 35 days, sales activity dipped for about two months then rebounded. CLA+1

But in flood-exposed states like Florida, the risk is slightly higher due to flood insurance dependencies. The more prolonged the shutdown persists, the greater the chance for a more visible dip in existing home sales. National Association of REALTORS®+1

Mortgage Originations

Mortgage originations tied to federal backing (FHA, VA, USDA) represent a meaningful slice of the market — in some estimates roughly one-quarter of all mortgage applications. CBS News+1

If those programs slow or pause, lenders may experience pipeline issues or have to shift borrowers to alternative loan types. Mortgage Professional

Delays in tax/income verification or flood insurance could stall originations across segments. Better Mortgage

Buyer/Seller Confidence & Market Behavior

Beyond operational delays, a shutdown affects sentiment. According to one survey, ~17% of Americans said they were delaying major purchases like a home because of the current shutdown environment. Newsweek

When buyers and sellers may become cautious, listing activity could decline, competition might soften, and pricing power could shift slightly toward buyers. At the same time, some motivated participants will still act—and may benefit.

Why the Local Market in Florida Could Weather This Better (or Worse)

Strengths

Florida remains a high‐demand market, especially in desirable areas like Wellington, West Palm Beach and North Palm Beach.

Even with national uncertainty, local factors (migration, lifestyle, weather, tax benefits) continue to drive interest.

For buyers not reliant on government‐backed programs, there are still opportunities to act while others hesitate.

Risk Factors

Florida has a higher exposure to flood zones and insurers often require flood coverage. If the NFIP is disrupted, many closings could stall. AP News+1

A large seller pool may hesitate listing until uncertainty resolves, reducing available inventory temporarily, or alternatively push through listings to capitalize on less competition—either way, timing is key.

If sentiment sours significantly, it could compress local prices or slow activity. But in most scenarios, we expect few long‐term negative effects.

Practical Tips for Buyers, Sellers, Agents & Mortgage Professionals in this Environment

For Buyers (especially local to West Palm Beach / Wellington)

Check whether your transaction depends on a government‐backed loan program (like FHA, VA, USDA) or flood insurance. If yes, build in extra time for potential delays.

Stay pre‐approved with a lender who monitors federal agency status and has contingency options if one program slows. As I do at AMS, we keep buyers updated on timing changes.

If you’re thinking about buying or selling, consider acting now: in times when buyers keep buying and others pull back, you may find less competition and more negotiation leverage.

Focus on properties with cleaner financing/closing paths (e.g., conventional loans, lower exposure to flood zone issues) to minimize risk.

For Sellers

If you’re listing a property, highlight any aspects that reduce financing risk (e.g., already have clear insurance, exempt from flood insurance requirement, strong buyer qualification) to give buyers confidence.

Be flexible with closing timelines if your buyer is using a government‐backed loan; preparing for a little extra time can avoid last‐minute hiccups.

If you’re a motivated seller (moving on, relocating, or upgrading) the current uncertainty may actually give you a slight edge; some buyers will step back, but the best ones remain serious.

For Agents

Make sure your contracts reflect potential delays related to processing certain types of government loans and insurance. Add language/disclosures accordingly.

Educate both your buyers and sellers about the impact of contingency programs (FHA, VA, USDA) and insurance programs like NFIP. As fluid as things are, clear communication builds trust.

In markets like West Palm Beach / North Palm Beach / Wellington, ensure your marketing emphasizes that the housing market remains active—even with potential delays—and highlight properties with smoother paths to close.

For Mortgage Professionals

Monitor federal agency operations (FHA, VA, USDA, IRS, FEMA / NFIP) closely. During a shutdown, the companies that track these lines and anticipate delays will have a competitive edge.

For motivated sellers may be more willing to negotiate, we as brokers can facilitate conversations that emphasize the relative stability of conventional alternatives or explain when to expect a potential slowdown.

Maintain contingency options for clients locked into government‐backed programs. For example: if an FHA endorsement is delayed, what fallback financing route is viable?

Keep your local market (West Palm Beach area) informed with clear, actionable communication so clients feel confident, not fearful.

What Happens if the Shutdown Lingers?

A short shutdown will often be a blip. Historical data suggests markets recover quickly once funding is restored. But if the shutdown becomes prolonged, risks increase:

More deals could fall out or be cancelled altogether. HousingWire

Processing backlogs could cause ripple effects well beyond the immediate timeframe. National Housing Conference+1

Inventory may tighten if sellers become cautious, slowing supply while demand remains latent.

The local impact in flood‐exposed states like Florida could be higher due to dependency on flood insurance protocols.

In West Palm Beach, North Palm Beach and Wellington, this means that if the shutdown drags on, buyers using government programs may face longer wait times; sellers may need to adjust timelines; and agents/mortgage brokers need to be proactive about communication and timelines.

The Bottom Line for the Palm Beach County Region

A government shutdown does not mean the housing market stops. Whether you’re buying or selling a home in West Palm Beach, North Palm Beach or Wellington, Florida FL, the transaction paths remain open. Most deals will still move forward.

However:

If your deal relies on a government‐backed loan (FHA, VA, USDA) or flood insurance under the NFIP, plan for potential delays.

For those who are currently thinking about buying or selling, this may be a moment of opportunity: some buyers and sellers may become more cautious, meaning less competition or stronger negotiation positions.

As your local advisor at America’s Mortgage Solutions (AMS), I recommend staying ready, but not reactive—preparation and proactive communication matter more than panic.

Whether you are an agent helping clients, a buyer looking to purchase, or a seller ready to list, tailoring your strategy to local market dynamics and national policy developments is key.

If you’d like a one-on-one conversation to assess your position and options—whether you’re looking to buy in Wellington, sell in West Palm Beach, or need expert guidance on financing and market timing—feel free to reach out. Let’s ensure your next move is smart, strategic, and rooted in one of Florida’s most resilient real estate markets.

Data from the National Association of Realtors (NAR) shows existing home sales slowed for about two months, and then rebounded quickly as delayed closings worked their way through the system when the government reopened (see graph below):

What’s important to note is that the slowdown you see in the orange bars on this graph wasn’t simply due to seasonality in a typical housing market cycle. The sharper, shorter drop in this case lines up exactly with the 35-day government shutdown, and then sales bounced back as soon as it ended.

Source: “America's Mortgage Solutions (AMS)”

© Copyright 2025 Epic Loan Solutions and its licensors | All Rights Reserved.