ABOUT US

About Us

Welcome to Epic Loan Solutions, your premier source for comprehensive information on mortgages and real estate across the United States. Our blog is dedicated to providing valuable insights, expert advice, and up-to-date news to help you navigate the complex world of mortgages and real estate with confidence and ease.

Our Mission

At Epic Loan Solutions, our mission is to empower individuals and professionals with the knowledge they need to make informed decisions in the mortgage and real estate markets. We strive to simplify the intricacies of home financing and real estate investment, making it accessible and understandable for everyone.

What We Offer

Latest News: Stay on top of the latest developments in the mortgage and real estate industries. From changes in interest rates and housing policies to market trends and economic updates, we keep you informed about the factors that influence your financial decisions.

Expert Advice: Benefit from the wisdom of seasoned professionals. Our expert advice covers a wide range of topics, including mortgage options, refinancing strategies, real estate investment, and more. We provide practical tips and actionable insights to help you achieve your financial goals.In-Depth Guides: Our comprehensive guides break down complex topics into easy-to-understand information. Whether you're a first-time homebuyer, looking to refinance, or exploring real estate investment opportunities, our guides offer step-by-step instructions and valuable tips.

Tools and Resources: Access a variety of tools and resources designed to assist you in your mortgage and real estate journey. From mortgage calculators and checklists to informative articles and webinars, we provide everything you need to make well-informed decisions.

Community Engagement: Join a vibrant community of individuals who share your interest in mortgages and real estate. Engage with our content, participate in discussions, and connect with others to share experiences and gain new perspectives.

Why Choose Us?

Epic Loan Solutions is dedicated to delivering high-quality, reliable content that you can trust. Our team of experienced writers and industry experts is passionate about helping you succeed in your real estate and mortgage endeavors. We understand that every financial journey is unique, and we are committed to providing personalized advice and valuable resources to support you every step of the way.

Thank you for visiting Epic Loan Solutions. We look forward to being your trusted partner in navigating the mortgage and real estate markets. If you have any questions or need further assistance, please don't hesitate to contact us.

The VA Home Loan Advantage: What Every Veteran Should Know Right Now

The VA Home Loan Advantage: What Every Veteran Should Know Right Now

(Serving West Palm Beach • North Palm Beach • Wellington, Florida)

Introduction

If you’ve served in the military (or if your spouse has), you have access to one of the most powerful home-buying tools out there. You have the rare chance to buy a home without spending years saving up, thanks to the Department of Veteran Affairs-backed program known as VA Home Loans.

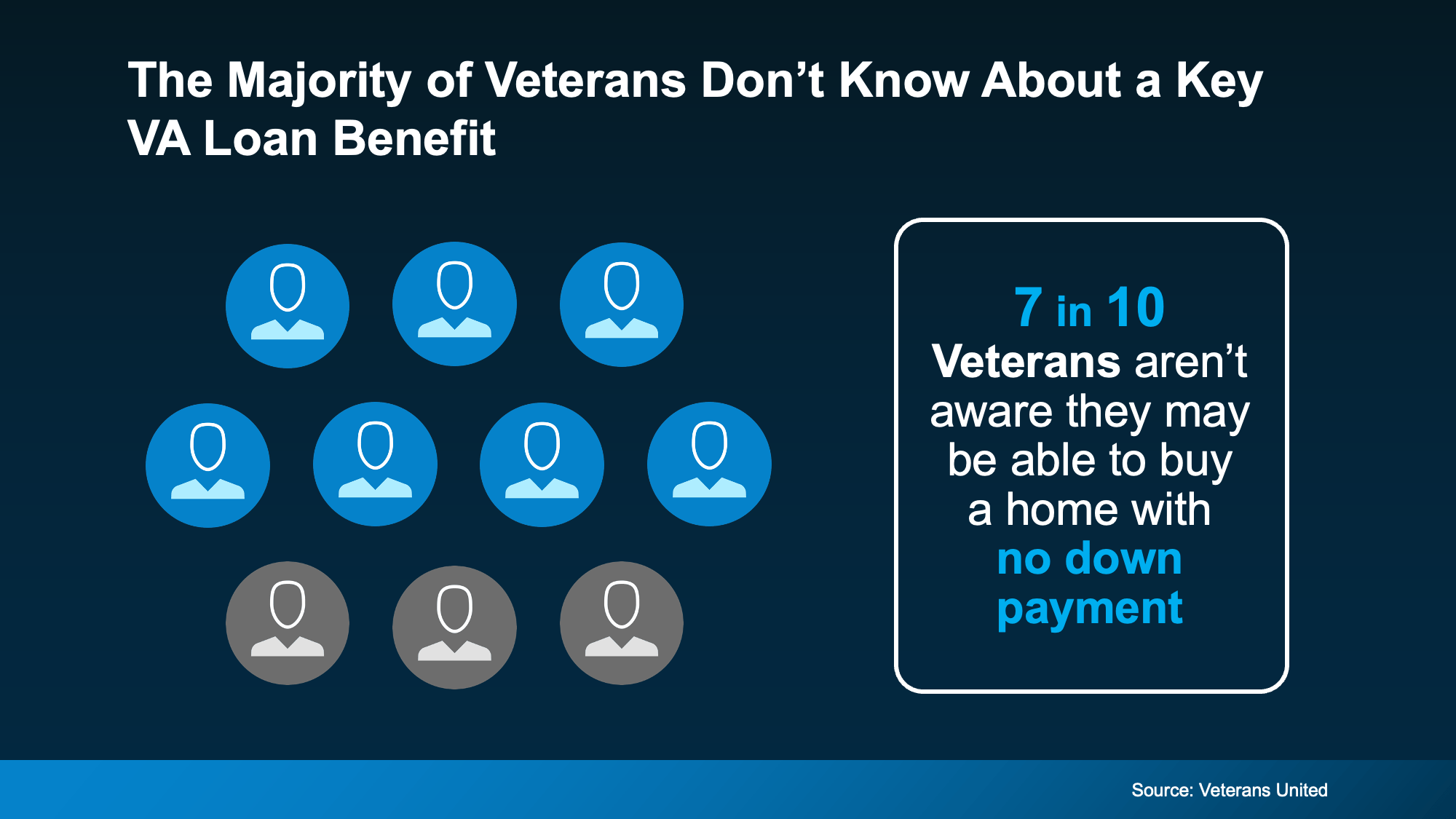

Unfortunately, many eligible veterans do not realize they are sitting on this advantage. According to industry sources, about 70% of veterans don’t even know about this benefit. In Palm Beach County, Florida, that means many service-members may be missing the opportunity to build real Homeownership and long-term stability.

In this article, we’ll walk you through everything you need to know right now—especially if you’re looking to buy or refinance in West Palm Beach, North Palm Beach or Wellington. We’ll cover the benefits, the steps, the myths, and how to connect with a trusted agent, military-friendly broker, or experienced lender to make this work for you.

What Is the VA Home Loan Benefit?

This section explains the foundational program so you understand why it matters.

How the Program Works

The VA does not make the loans itself. Instead, the Department of Veteran Affairs guarantees a portion of loans made by private lenders through the VA Home Loan program. That guarantee allows those lenders to offer more favorable terms. Veterans Affairs+2Benefits+2

Who Is Eligible?

Eligible service-members, veterans, active duty, National Guard/Reservists and certain surviving spouses may qualify. The VA outlines eligibility based on service history, duty status, and other criteria. Veterans Affairs+1

Reusable & Lifetime Benefit

One of the lesser-known facts: this isn’t a one-time only deal. You may reuse your benefit if you sold your home or paid off the loan, etc. The benefit is lifetime and reusable under the right conditions. Veterans United Home Loans+1

Top Benefits of the VA Home Loan in 2025

If you’re considering using your benefit in West Palm Beach, North Palm Beach or Wellington, here’s why this program stands out.

$0 Down Payment Opportunity

One of the biggest perks: qualified veterans can buy a home without having a down payment—in other words, $0 Down Payment is possible. This is especially meaningful for those who might otherwise have to spend years saving up. Veterans United Home Loans+1

No Private Mortgage Insurance (PMI)

Unlike conventional or FHA loans, the VA loan does not require ongoing Private Mortgage Insurance. This means your monthly payment can be lower—and you avoid that extra cost. Veterans United Home Loans+1

Limited Closing Costs & Competitive Rates

The program includes protections such as caps on allowable closing costs, plus many veterans benefit from lower interest rates compared to standard loan types. Veterans United Home Loans+1

Flexible Credit & Loan Types

Credit requirements tend to be more forgiving in the VA program compared to many other loan types. Also, there are options not just for purchase but for refinance an existing mortgage (for instance, the VA Interest Rate Reduction Refinance Loan or “IRRRL”). Veterans United Home Loans+1

A Door to Homeownership, Building Equity & Stability

At its core, this is about Homeownership—giving veterans the opportunity to build long-term wealth and stability. A good VA mortgage lender, a knowledgeable agent, and a military-friendly broker (or experienced lender) are key to maximizing the benefit.

What’s New or Important Right Now (in Florida)

Because local markets matter (especially in West Palm Beach, North Palm Beach and Wellington), let’s look at what’s fresh.

Full-entitlement veterans (those who haven’t used the benefit or have restored entitlement) may face no loan limits in many counties. Veterans Affairs

The VA recently updated its guidance on VA funding fee and closing costs, helping clarify what is paid by whom. Veterans Affairs

Even when headlines mention processing delays (like government shutdown concerns), the fact remains: VA lending is still active, and you can use your home loan benefit to buy a home. Veterans Affairs

If you’re shopping in West Palm Beach or Wellington where property values may be higher, working with a good VA mortgage lender and agent who understands the VA home loan application process is more important than ever.

The Home-Buying Process Using a VA Loan — Step by Step

Here’s how you can move forward locally in Florida.

Step 1: Secure Your Certificate of Eligibility (COE)

Before you can fully proceed, you need your COE from the VA. This document shows you’re eligible to use the benefit. Your lender can help you pull this. Veterans Affairs+1

Step 2: Choose the Right Agent & Lender

Because the process can differ from conventional loans, you’ll want a knowledgeable agent in West Palm Beach/North Palm Beach/Wellington who knows the local market and the VA rules. Likewise, an experienced lender who regularly handles VA home loans will guide you smoothly.

Here’s where Christian Penner at America’s Mortgage Solutions (AMS) comes in: as a Mortgage Broker, Mortgage Lender, Real Estate Agent, and Real Estate Advisor, he works with veterans in West Palm Beach-area Florida to make sure you take full advantage of the benefits you’ve earned.

Step 3: Get Pre-Approved & Shop Homes

Once approved, you begin shopping for homes in the Palm Beach area—be it West Palm Beach, North Palm Beach, or Wellington. Your team will help you buy a home without having a down payment, look at neighborhoods, and set realistic expectations.

Step 4: Make an Offer, Underwriting & Appraisal

When you make an offer, your lender and agent will coordinate the tasks: appraisal, underwriting, title, etc. Because this is a VA loan, your team will ensure the offer is strong and the home meets VA-appraisal requirements. A military-friendly broker can help overcome seller concerns about VA appraisal.

Step 5: Closing and Moving In

At closing, you’ll finalize the loan types, sign documents, pay or roll in the VA Funding Fee (if applicable), and finalize any limited closing costs allowed by the program. After that—you move into your home in Florida.

Common Misconceptions & Pitfalls to Avoid

To truly make the most of this benefit, you should be aware of frequent myths and mistakes.

Misconception: “You can only use the VA loan if you’re a first-time homebuyer.”

Reality: You can use the benefit multiple times, provided you meet the terms. Veterans United Home LoansMisconception: “You’ll still need a massive down payment.”

Reality: With the VA program you can often buy a home without having a down payment.Pitfall: Working with an agent or lender unfamiliar with VA specifics. This can cause delays or mistakes. A good VA mortgage lender and agent who understands the VA home loan application process matter.

Pitfall: Not factoring in the VA Funding Fee and not discussing how it’s handled. Veterans Affairs

Pitfall: Assuming the seller will always accept offers from VA buyers. Some local sellers may be unfamiliar. That’s why using a military-friendly broker matters. Veterans United Home Loans

Is a VA Loan the Right Choice for You?

In local terms—West Palm Beach, North Palm Beach & Wellington—what should you consider?

Quick Comparison: VA vs. Conventional vs. FHA

VA: $0 Down Payment, No Private Mortgage Insurance, fewer upfront costs, service-connected benefits.

Conventional: Typically 3-20% down, PMI required if <20%, less flexible.

FHA: Lower down (3.5%) but requires mortgage insurance and has other limits.

Consider Your Situation

How long do you plan to stay in the home?

What is your credit score and debt-to-income ratio?

Do you want to buy a home without spending years saving up?

Do you feel comfortable working with a specialized team?

Are you planning to refinance an existing mortgage later using the VA benefit?

When Another Loan Type Might Make Sense

If you have a large down payment, excellent credit, plan to move in 1-2 years, or want a property that doesn’t qualify under VA rules, you might consider conventional. But for many veterans in Florida looking to settle and build equity, the VA path often makes sense.

Why the Right Agent and Lender Matter (Especially in FL Markets)

In West Palm Beach, North Palm Beach and Wellington, real-estate markets move fast and local knowledge is key.

An agent who is familiar with regional pricing, neighborhood trends, and the nuances of Palm Beach-County transactions will make your experience smoother. Combine that with a good VA mortgage lender who uses the VA guidelines regularly and you’ll avoid unnecessary delays.

Christian Penner at America’s Mortgage Solutions (AMS) checks all the boxes: He acts as a Mortgage Broker, Mortgage Lender, Real Estate Agent, and Real Estate Advisor, working with veterans and active service members across Palm Beach County. His team understands VA home loans, and they will help ensure you get the full benefit of your home loan benefit to buy a home in Florida.

Working with this type of team lets you focus on the exciting part—choosing your home—while they handle the specialized mechanics of the VA process.

Bottom Line

If you are a veteran or service member in West Palm Beach, North Palm Beach, or Wellington, Florida, the VA Home Loan Advantage is a major opportunity. It offers you the chance to buy a home without having a down payment, avoid Private Mortgage Insurance, keep limited closing costs, and work with professionals who understand the system.

Don’t leave this benefit on the table when you’ve earned it through your service. Talk to a lender and agent who understands the VA home loan application process—and work with a team like Christian Penner at America’s Mortgage Solutions (AMS) to help you navigate the path to homeownership.

Take the first step today: check your eligibility, connect with a knowledgeable agent, and position yourself to take full advantage of the benefits you’ve earned. Your home in Palm Beach County could be closer than you think.

Frequently Asked Questions (FAQs)

Q1: What service members qualify for a VA home loan?

Eligible veterans, active duty members, National Guard/Reservists and surviving spouses may qualify under the VA program. Veterans Affairs

Q2: Can I buy a home with no down payment using a VA loan in Florida?

Yes —one of the signature advantages of the program is the ability to buy a home without spending years saving up thanks to $0 Down Payment eligibility. Veterans United Home Loans

Q3: Are there closing costs with a VA home loan?

Yes, but they are more limited than many other loan types. The VA sets rules about what veterans can be charged, and sellers can often pay many of those costs. Military.com

Q4: Can I use a VA loan more than once?

Yes. The benefit is generally reusable, so long as you meet the terms and restore your entitlement. Veterans United Home Loans

Q5: What happens if I have a conventional mortgage now — can I refinance under the VA program?

Yes. There are VA refinance options designed for existing VA loans, and in some cases conventional loans can be refinanced into a VA loan (depending on eligibility and entitlement). Veterans United Home Lo

Source: “America's Mortgage Solutions (AMS)”

© Copyright 2025 Epic Loan Solutions and its licensors | All Rights Reserved.