ABOUT US

About Us

Welcome to Epic Loan Solutions, your premier source for comprehensive information on mortgages and real estate across the United States. Our blog is dedicated to providing valuable insights, expert advice, and up-to-date news to help you navigate the complex world of mortgages and real estate with confidence and ease.

Our Mission

At Epic Loan Solutions, our mission is to empower individuals and professionals with the knowledge they need to make informed decisions in the mortgage and real estate markets. We strive to simplify the intricacies of home financing and real estate investment, making it accessible and understandable for everyone.

What We Offer

Latest News: Stay on top of the latest developments in the mortgage and real estate industries. From changes in interest rates and housing policies to market trends and economic updates, we keep you informed about the factors that influence your financial decisions.

Expert Advice: Benefit from the wisdom of seasoned professionals. Our expert advice covers a wide range of topics, including mortgage options, refinancing strategies, real estate investment, and more. We provide practical tips and actionable insights to help you achieve your financial goals.In-Depth Guides: Our comprehensive guides break down complex topics into easy-to-understand information. Whether you're a first-time homebuyer, looking to refinance, or exploring real estate investment opportunities, our guides offer step-by-step instructions and valuable tips.

Tools and Resources: Access a variety of tools and resources designed to assist you in your mortgage and real estate journey. From mortgage calculators and checklists to informative articles and webinars, we provide everything you need to make well-informed decisions.

Community Engagement: Join a vibrant community of individuals who share your interest in mortgages and real estate. Engage with our content, participate in discussions, and connect with others to share experiences and gain new perspectives.

Why Choose Us?

Epic Loan Solutions is dedicated to delivering high-quality, reliable content that you can trust. Our team of experienced writers and industry experts is passionate about helping you succeed in your real estate and mortgage endeavors. We understand that every financial journey is unique, and we are committed to providing personalized advice and valuable resources to support you every step of the way.

Thank you for visiting Epic Loan Solutions. We look forward to being your trusted partner in navigating the mortgage and real estate markets. If you have any questions or need further assistance, please don't hesitate to contact us.

Most Experts Are Not Worried About a Recession

Why Experts Aren’t Panicking About a Recession — Even If Homebuyers in West Palm Beach, North Palm Beach & Wellington Are

Introduction

Buying a home is one of the biggest purchases most people ever make — especially in markets like West Palm Beach, North Palm Beach, or Wellington, Florida. Lately, though, growing talk of a downturn has many potential buyers hitting pause. According to recent surveys, most Americans expect a recession, and that fear is affecting financial decisions across the country.

But here’s the counterpoint: expert economists don’t seem nearly as worried. And for homebuyers in South Florida, that disconnect could present a real opportunity — if you know how to play it smart.

In this article, we’ll explore: why the public is nervous, what the experts are actually saying, and — most importantly — practical tips for buying a home in this moment of economic uncertainty. We'll also highlight how working with a trusted local professional like Christian Penner of America’s Mortgage Solutions (AMS) can help you navigate these shifting waters.

1. The Recession Fear vs. the Expert View

1.1 Why So Many Americans Are Worried

According to national sentiment surveys, many Americans expect a recession soon, and that concern is influencing their financial decisions — from delaying investments to holding off on big purchases.

That kind of fear is understandable: a recession could mean tighter credit, higher unemployment, and more cost pressure. And for someone considering buying a house, it’s not a trivial risk.

1.2 What the Experts Actually Think

Despite widespread consumer anxiety, many expert economists are sounding more calm. While some predict a slowdown, few are calling for a full-blown collapse.

Locally, in Palm Beach County, real estate data supports a more balanced outlook. According to recent housing market reports, inventory in West Palm Beach has surged — hinting at a shift toward a buyer’s market. Palm Beach Now+2Reventure News+2

More homes for sale gives buyers negotiating power and more choices. BRG International+1

At the same time, sales volume in Palm Beach County remains resilient: early-2025 data from the Miami Association of Realtors shows a year-over-year rise in transactions. The World Property Journal+1

According to a comprehensive housing market analysis for the West Palm Beach metro, non-farm payrolls continue to grow, indicating strength in the broader economy. HUD User

Bottom line: While the average consumer worries about recession, the economic and real estate signals in West Palm Beach, North Palm Beach, and Wellington suggest a more nuanced picture — not panic, but cautious opportunity.

2. Why Waiting on the Sidelines Could Cost You More

2.1 The Risks of Trying to Time the Market

If you base your decisions purely on headlines, you risk missing out on favorable deals. Economic forecasts are inherently uncertain — using fear to drive timing rarely pays off.

As Christian Penner, Mortgage Broker and Real Estate Advisor at America’s Mortgage Solutions (AMS), often advises: “Timing the economy is less important than timing your life.”

2.2 Real-Life Needs Trump Market Noise

Many people buy homes because of life milestones — growing families, career changes, or relocating. These reasons people buy homes don’t vanish just because the economy jitters.

In this region (West Palm Beach, North Palm Beach, Wellington), people are still moving for jobs, lifestyle, and long-term plans. Waiting too long could mean losing the perfect home — or paying more later.

2.3 The Strength of Local Fundamentals

The real estate market in Palm Beach County is showing signs of stabilization rather than collapse. Great Report

More inventory means more homes for sale, which gives local buyers more leverage — especially in neighborhoods where demand is cooling. Capital Analytics Associates

Mortgage rates may be volatile, but with the right strategy (more on that below), buyers can manage risk and tap into favorable deals.

3. Proven Tips for Buying a Home During Economic Uncertainty

If you’re thinking of making a move in West Palm Beach, North Palm Beach, or Wellington, here are expert-backed, actionable strategies to navigate a potential downturn.

3.1 Work with a Local, Trusted Real Estate Team

Enlist the help of an experienced local real estate agent — someone who knows the Palm Beach County neighborhoods, inventory trends, and seller behavior.

For example, working with Christian Penner, who is not only a Mortgage Broker and Lender but also a Real Estate Agent and Advisor with America’s Mortgage Solutions (AMS), gives you dual expertise. He understands both financing and local market dynamics — a valuable combination when managing your mortgage payments and negotiating deals.

3.2 Set a Realistic Budget

Work with your lender (like Christian at AMS) to figure out what mortgage payment is comfortably manageable, even if the economy shifts.

Build in a cushion for unexpected costs — property taxes, insurance, maintenance — especially given Florida’s variable insurance landscape.

Stick to your budget. One of the most important tips for buying a home in uncertain times is not overextending.

3.3 Negotiate Smartly

More inventory = more leverage. With more homes for sale now in Palm Beach County, buyers are in a stronger negotiation position. Palm Beach Now+1

Don’t be afraid to ask for seller concessions — repairs, closing costs, or even interest rate buydowns can make a deal significantly more favorable.

3.4 Talk to Lenders About Flexible Options

Talk to lenders (like Christian Penner) about your current qualifying rate — and also your options if rates go down later.

Consider a mortgage structure that gives flexibility: adjustable-rate mortgages, rate buydowns, or even the option to refinance later if conditions improve.

Knowing the rate you can qualify for today helps you plan, and discussing future scenarios can help you hedge against risk.

3.5 Build a Financial Cushion

If you’re buying now, make sure your savings can cover at least 6–12 months of expenses, including mortgage, insurance, and property tax.

This cushion gives resilience in a downturn and peace of mind if your job stability shifts.

3.6 Consider Selling Before Buying (If You Already Own)

If you already own a home, think about selling first before you buy. This strategy can solidify your budget for your next home, reduce financial risk, and give you more negotiating power in your purchase.

Christian Penner and his team at AMS can help you run a net proceeds analysis to determine whether selling first makes sense for you.

3.7 Use Local Market Insights to Your Advantage

In West Palm Beach, the housing inventory has surged to decade-high levels, which is creating a buyer’s market in some segments. Reventure News

According to Capital Analytics, homes in Palm Beach County are staying on the market longer — average days to sale have increased. Capital Analytics Associates

When supply is rising and demand is cooling, buyers can often negotiate more aggressively or ask for favorable terms.

3.8 Stay Focused on Long-Term Value

Even if you’re buying now, think long-term. If you plan to stay in the home for 5+ years, temporary economic dips are less risky.

Florida’s real estate has strong fundamentals: population growth, high demand for coastal living, and continued influx of remote or high-net-worth buyers. These factors support long-term value.

A trusted real estate advisor like Christian Penner can help you evaluate not just the purchase, but long-term equity potential, resale strategy, and more.

4. Why Christian Penner / America’s Mortgage Solutions (AMS) Are Especially Valuable Right Now

Deep Local Expertise: Christian knows the Palm Beach County market — West Palm Beach, North Palm Beach, Wellington — inside and out. He understands where inventory is growing, which neighborhoods offer value, and which sellers are motivated.

Financial Guidance + Mortgage Strategy: As a Mortgage Broker, Mortgage Lender, Real Estate Agent, and Real Estate Advisor, Christian provides a 360° view. He can help you figure out how to manage your mortgage payments, negotiate mortgage rate options, and plan for future refinancing.

Negotiation Power: In a market shifting toward buyers, having someone who knows local trends can make all the difference. Christian can help you leverage more homes for sale to negotiate price, concessions, or favorable terms.

Risk Management: He’s skilled in helping clients think through whether to consider selling before you buy, how to build a financial cushion, and how to move forward even if there’s economic uncertainty.

Long-Term Planning: Beyond just buying — Christian helps clients strategize for the future. Whether you're looking at resale in Wellington, investment potential in North Palm Beach, or long-term wealth accumulation in West Palm Beach, he’s there as both a lender and a advisor.

5. Local Market Snapshot: West Palm Beach, North Palm Beach & Wellington

To ground this advice in reality, let’s take a quick look at what’s happening locally in 2025:

Inventory Surge: In West Palm Beach, active listings have reached levels not seen in over a decade — giving buyers significantly more options. Reventure News

Days on Market: Homes in Palm Beach County are taking longer to sell. Median days on market for single-family homes have increased year over year. Realty Times

Price Trends: While some segment prices are cooling, others remain relatively strong. According to a local analysis, buyers are finding better deals — particularly in entry- to mid-range homes. Capital Analytics Associates

Economic Growth: The West Palm Beach metro continues to see non-farm payroll growth, which supports local buying power. HUD User

Future Rate Outlook: Mortgage rates may ease. According to projections discussed by local experts, rates could moderate over the next year — potentially improving affordability. America's Mortgage Solutions

All of this supports the idea that now might be a very strategic time to act — not because the economy is perfect, but because the conditions could favor well-prepared buyers.

6. Addressing Common Concerns About Buying Now

Here are some of the top worries people have — and how to address them:

Concern: “Won’t I Be Overpaying If There’s a Recession?”

While future economic shifts are possible, real estate is rarely perfectly timed. If you’re working with expert economists, building a budget cushion, and buying in a growing market, the risk is mitigated.

Plus, given current inventory trends, you may actually be buying at a discount compared to peak competition, not overpaying.

Concern: “What if Mortgage Rates Drop Later?”

That’s a real possibility. But by talking to lenders like Christian Penner now, you can explore mortgage structures that allow refinancing or rate adjustments later — without locking yourself into a bad deal today.

He can run projections for you: What does your payment look like now, vs. with a future lower rate? That way, you make informed decisions.

Concern: “Is My Job Safe Enough to Take on a Mortgage?”

Job stability is a top factor. But if your income is steady and you’ve saved for an emergency fund, buying now doesn’t necessarily mean reckless risk.

Consider building a buffer (6-12 months of expenses) to cushion potential shocks.

Concern: “Should I Wait Until the Market Stabilizes More?”

Waiting could make sense — but it could also backfire. Houses that look affordable now might appreciate, or mortgage rates could rise again.

And as Christian Penner often says, life-driven motives often outweigh market timing. If you’re ready and your situation is solid, moving now could set you up for long-term success.

7. Final Thoughts: Making a Decision That Works for You

Yes, a lot of Americans are worried about a recession. But expert economists and local market data don’t necessarily support a dramatic downturn, especially in places like West Palm Beach, North Palm Beach, and Wellington.

If your finances are in order, your job is stable, and you're ready for a long-term commitment, you don’t have to wait.

Use this moment of increased inventory to your advantage. Negotiate, plan your mortgage wisely, and work with a trusted advisor who understands the local landscape — someone like Christian Penner of America’s Mortgage Solutions (AMS).

Whether you're buying your first home, selling before you buy again, or securing a strategic investment, the right strategy can help you balance risk and opportunity.

Call to Action:

Thinking of making a move in South Florida? Reach out to Christian Penner at America’s Mortgage Solutions — he can walk you through your mortgage options, help you analyze your budget, and connect you with local real estate opportunities in West Palm Beach, North Palm Beach, or Wellington. Let’s talk about your next step.

FAQ (Voice-Search Optimized)

Q: Is now a smart time to buy a home in West Palm Beach or Wellington?

A: With rising inventory, longer days on market, and expert economists signaling balanced risk, now can be a strong opportunity — especially if you’re financially prepared and working with a trusted local expert like Christian Penner of America’s Mortgage Solutions.

Q: What should I budget for when buying a home during uncertain economic times?

A: Prioritize a clear budget that includes mortgage payments, taxes, insurance, and a cushion for unexpected expenses. Use a mortgage broker like Christian Penner to help model your payments and explore flexible mortgage rate options.

Q: Should I sell my current home before buying another one?

A: Consider selling before you buy if you want to reduce financial risk or solidify your budget for your next home. Christian Penner can run a net proceeds analysis to help you decide.

Q: Can I negotiate better deals right now?

A: Yes. With more homes for sale and a cooling local market, buyers in Palm Beach County may have more power to negotiate. Use a real estate agent who knows the area well and can help you get favorable terms.

Q: How can I protect myself if mortgage rates go down in the future?

A: Talk to a lender about refinancing options, rate buydowns, or adjustable mortgage structures. Christian Penner can help you plan for both the current rate and potential future scenarios.

FOR MORE INFO:

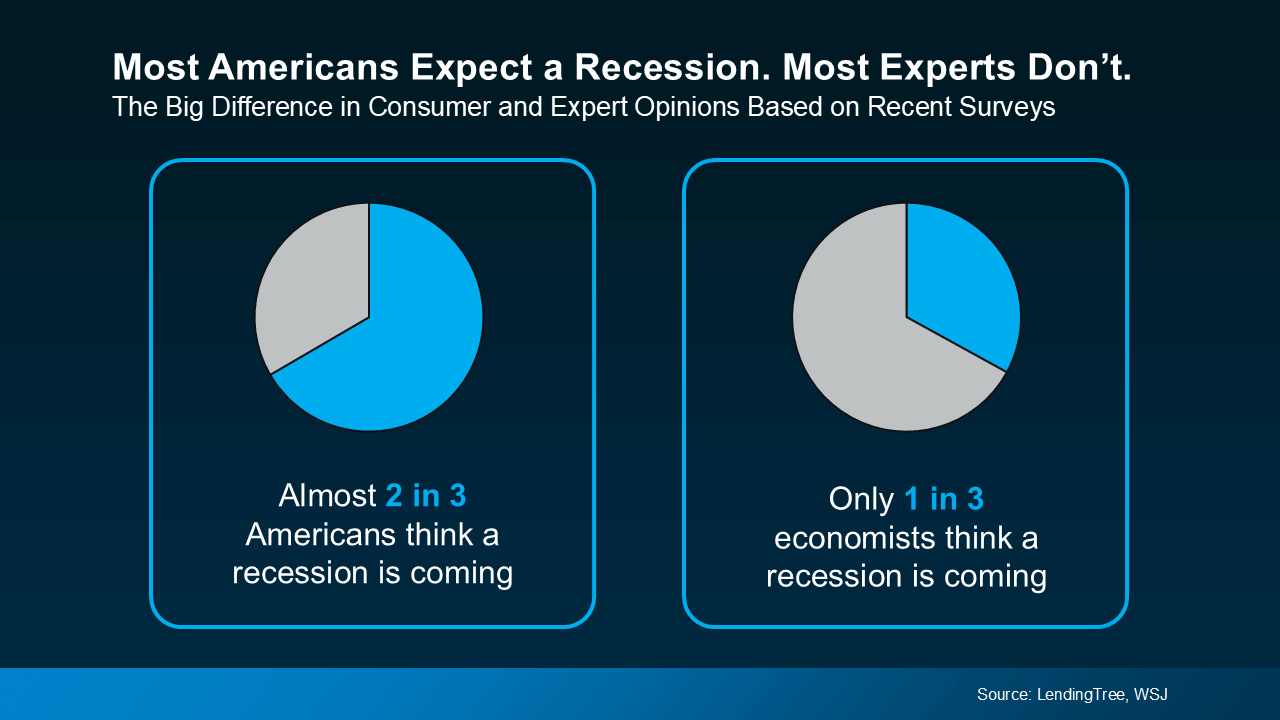

Most Americans Expect a Recession, But Most Experts Don’t

According to an October report from the Wall Street Journal (WSJ), only 1 in 3 experts surveyed say we may be headed for a recession sometime in the next 12 months (see graph below):

If the expert economists aren’t super worried, should you be? We’re not in a recession right now. And there’s no guarantee we’re heading into one.

Source: “America's Mortgage Solutions (AMS)”

© Copyright 2025 Epic Loan Solutions and its licensors | All Rights Reserved.