We write about Epic Loan Solutions!

Subscribe to our newsletter and keep up to date!

We write about Epic Loan Solutions!

Subscribe to our newsletter and keep up to date!

Why You Don’t Need To Be Afraid of Today’s Mortgage Rates

Why You Don’t Need To Be Afraid of Today’s Mortgage Rates

Meta Description:

Unlock confidence in your home-buying journey —discover why today’s mortgage rates aren’t as scary as they seem and how acting now could save you more in the long run

Why You Don’t Need To Be Afraid of Today’s Mortgage Rates

Mortgage rates have felt like the monster under the bed for many homebuyers. Each time they tick up, people flinch and say, “Maybe I’ll wait until rates drop.” But here’s the twist—waiting for that “perfect” 5-something rate might actually cost you more in the long run.

In reality, today’s mortgage rates—hovering around 6.2% for a 30-year fixed-rate mortgage—aren’t as frightening as they seem. In fact, when you look at the numbers, market psychology, and expert forecasts, acting now might be one of the smartest financial moves you can make.

1. The Current Mortgage Rate Landscape (and What It Means for You)

As of October 2025, the national average 30-year fixed mortgage rate stands around 6.2%, according to data from Bankrate and Realtor.com. That’s only a slight dip from early-year highs but still far below the double-digit rates seen in the 1980s.

Understanding What Drives Mortgage Rates

Mortgage rates are influenced by:

Federal Reserve policy: The Fed’s battle against inflation directly affects Treasury yields, which shape mortgage rates.

Economic strength: Strong job growth, wage gains, and spending tend to keep rates higher.

Investor demand: When investors flock to safer assets like U.S. Treasury bonds, yields (and therefore mortgage rates) tend to fall.

So, rates around 6% aren’t “high” in a historical sense—they’re a sign of a resilient, balanced economy.

Voice Search Tip:

“What is a good mortgage rate today?”

“Is 6 percent a bad rate for a home loan?”

In most markets, a 6% mortgage rate is considered average—and historically healthy.

2. Why Waiting for a Lower Rate Could Cost You More

The “Magic Number” Myth

According to the National Association of Realtors (NAR), a 30-year fixed mortgage at 6% would make the median-priced home affordable for roughly 5.5 million more households, including 1.6 million renters. If rates fell to that “magic” level, about 550,000 of those potential buyers could enter the market within a year.

Now imagine the competition when that happens. Prices rise when demand surges. Even a slight rate dip can unleash pent-up demand.

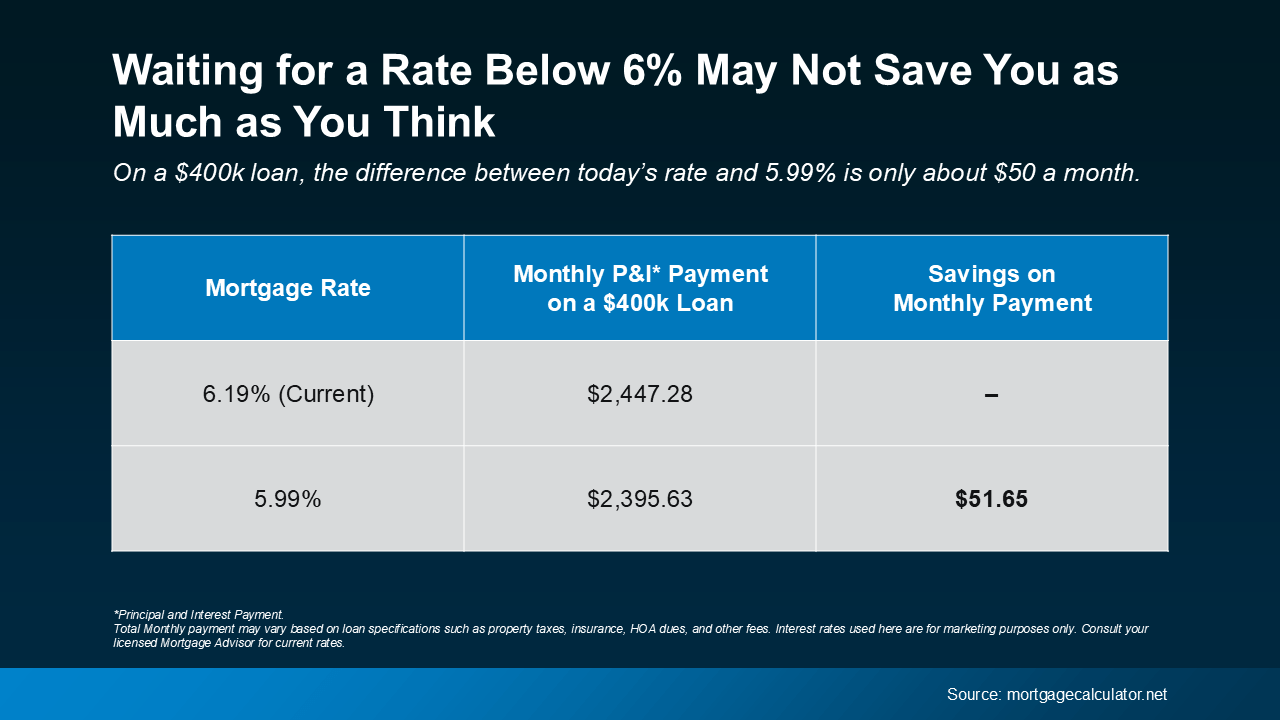

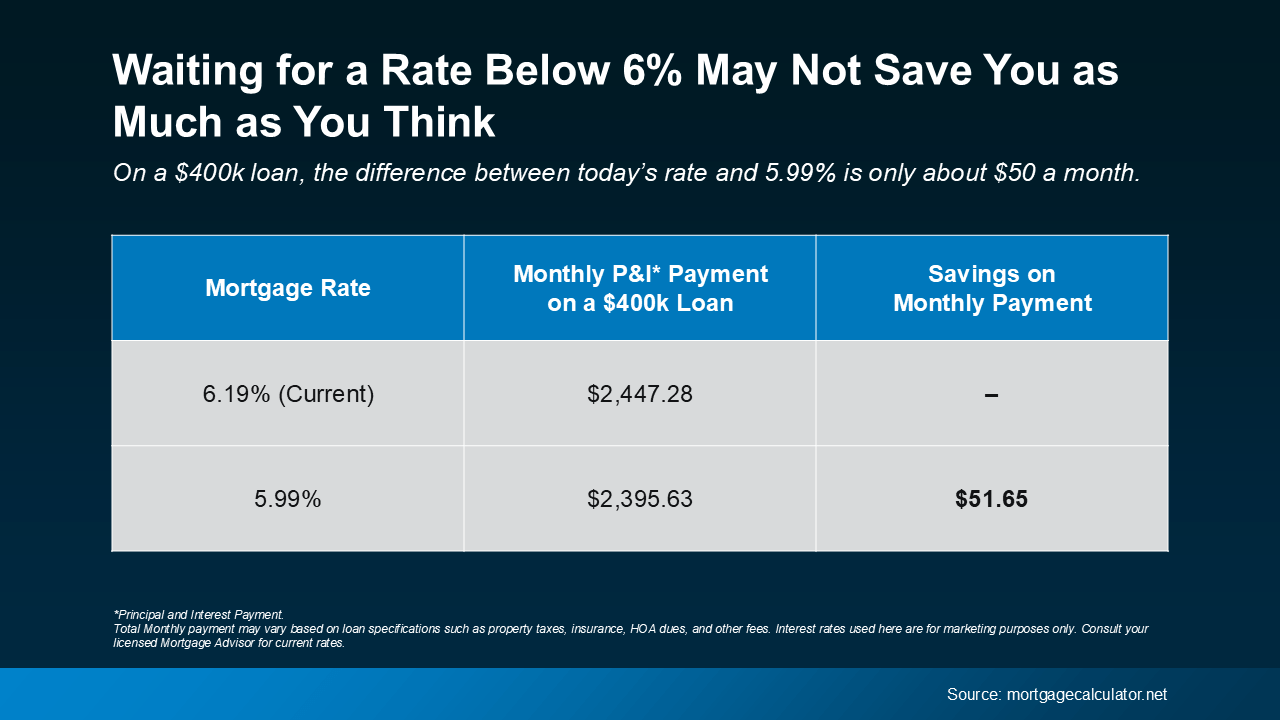

The Math Behind the Myth

Let’s compare two buyers looking at a $400,000 home:

Buyer A: Buys now at 6.2%, monthly payment ≈$2,456 (principal + interest).

Buyer B: Waits for 5.99%, monthly payment ≈$2,406.

That’s only a $50 difference per month—less than the average person spends on coffee or take-out.

But if home prices increase even 2%, that same house could cost $408,000, adding $500–$600 to closing costs and thousands more in lifetime interest.

So the “wait for the perfect rate” strategy often backfires.

3. Your Personal Home-Buying Snapshot: Are You Ready?

Buying at today’s rates doesn’t mean settling—it means being strategic. The key is to evaluate your readiness, not the headlines.

Step 1: Evaluate Your Financial Health

Review your credit score (aim for 680+ for best rates).

Calculate debt-to-income ratio (ideally < 43%).

Secure down payment funds (3%–20% depending on loan type).

Build an emergency fund covering 3–6 months of expenses.

Step 2: Define the Home You Need

For first-time buyers, the median-priced home is around $420,000 nationally in late 2025. At today’s rate, that’s manageable with the right budget and mortgage program (e.g., FHA, VA, or first-time buyer assistance).

If you’re a move-up buyer, consider how increased equity from your current home can offset the higher rate.

Step 3: Market-Timing vs Life-Timing

Voice Search Examples:

“Is now a good time to buy a home if rates are 6%?”

“Should I wait until next year to buy a house?”

The honest answer: buy when your life and finances align. The “perfect” rate won’t matter if prices rise faster or inventory shrinks.

Step 4: Shop Smart

Compare at least 3 lenders.

Ask about rate locks and buy-down options.

Understand points and fees—sometimes paying a little upfront reduces your rate long-term.

4. Strategies to Make the Most of Today’s Rates

1. Choose a Fixed-Rate Loan for Stability

Locking in today’s rate protects you from future volatility. With inflation cooling but still unpredictable, a 30-year fixed mortgage gives long-term peace of mind.

2. Use “Rate Buy-Down” Programs

Many lenders offer temporary buy-downs where your rate starts lower (for example, 4.99% for the first year) and gradually increases. Great for buyers expecting future income growth.

3. Negotiate With Confidence

Today’s market favors proactive buyers. You can often negotiate:

Seller-paid closing costs

Home-repair credits

Price reductions if the property has lingered on the market

4. Plan to Refinance Later

Rates are cyclical. When they drop again, refinancing can save thousands. The key is: marry the house, date the rate.

5. Focus on the Total Payment

Don’t obsess over interest rate alone. Include:

Taxes

Insurance

Maintenance

HOA fees

If the total monthly cost fits comfortably within your budget (ideally ≤ 28% of income), the rate is secondary.

5. What the Experts Are Saying

Jessica Lautz, NAR: “Over the last five weeks, mortgage rates have averaged 6.31%. This provides savvy buyers a sweet spot with more inventory and choices.”

Matt Vernon, Bank of America: “Rather than waiting for a rate they like better, buyers should assess their personal finances. If the home fits, it may be time to act.”

Realtors Group Forecast (Reuters, 2025): 30-year fixed rates are expected to average near 6% through 2026.

Economists warn that rates are unlikely to fall below 6% in the short term.

What It Means for You

Rates around 6% are likely the new normal—at least for a while. Waiting for 4–5% may mean waiting years.

6. Case Studies & Quick Math

Case 1 – The Early Bird Buyer

Buys a $400k home now at 6.2%.

Home value grows 4% next year → $416k.

Equity gained: $16,000.

Monthly difference vs. waiting: $50.

→ Total gain: Equity > monthly savings × 12 months.

Case 2 – The Wait-and-See Buyer

Waits for 5.9%.

Home price rises 4%.

Net effect: higher principal, same monthly payment, lost negotiation leverage.

Voice Search Example:

“How much do I save if my mortgage rate drops half a percent?”

Answer: On a $400,000 loan, roughly $120 per month, or $1,440 per year—but rising prices can offset that in months.

7. Common Myths About Mortgage Rates

Myth Reality Mortgage rates will fall back to 4% soon. Experts forecast rates near 6% through 2026 due to inflation and economic strength. Always wait for the lowest rate. Lower rates often mean higher prices and more competition. A high rate means it’s a bad time to buy. Total affordability depends on home price, taxes, and terms—not just rate. I’m stuck if rates drop later. You can refinance or build equity and upgrade later.

8. Bottom Line: What’s Right for You Right Now

If buying at today’s rate scares you, remember—waiting doesn’t always pay off.

When rates eventually dip below 6%, thousands of buyers will re-enter the market, driving prices and competition up again. Acting before that happens can give you:

More homes to choose from

Better negotiating power

Less buyer competition

Ask yourself:

Am I financially ready?

Is this home right for my goals?

Can I afford the monthly payment comfortably?

If you answered yes, then it’s time to act confidently—not fearfully.

FAQs

What mortgage rate can I expect right now?

As of October 2025, the national average for a 30-year fixed loan is about 6.2%, depending on credit score and lender.

Should I wait until mortgage rates drop?

Not necessarily. If rates dip, home prices often rise, offsetting savings. Buying now could secure a better home and more leverage.

How much does a 0.3% rate drop save me each month?

About $50 per $400,000 borrowed, but that small difference can be lost if home prices rise even 2%.

Can I refinance if rates drop later?

Yes. Refinancing is common once rates fall 0.5–1% below your current rate.

How do I know if a house is a good deal even with higher rates?

Focus on affordability, condition, location, and long-term value—not just the interest rate.

Author Bio / Call to Action

Are you ready to explore your next move? Whether you’re a first-time buyer, move-up homeowner, or investor, don’t let rates hold you back.

Contact your local mortgage advisor today to discover personalized strategies that make buying at today’s rates work for you.

Read from source: “Click Me”

Why You Don’t Need To Be Afraid of Today’s Mortgage Rates

Why You Don’t Need To Be Afraid of Today’s Mortgage Rates

Meta Description:

Unlock confidence in your home-buying journey —discover why today’s mortgage rates aren’t as scary as they seem and how acting now could save you more in the long run

Why You Don’t Need To Be Afraid of Today’s Mortgage Rates

Mortgage rates have felt like the monster under the bed for many homebuyers. Each time they tick up, people flinch and say, “Maybe I’ll wait until rates drop.” But here’s the twist—waiting for that “perfect” 5-something rate might actually cost you more in the long run.

In reality, today’s mortgage rates—hovering around 6.2% for a 30-year fixed-rate mortgage—aren’t as frightening as they seem. In fact, when you look at the numbers, market psychology, and expert forecasts, acting now might be one of the smartest financial moves you can make.

1. The Current Mortgage Rate Landscape (and What It Means for You)

As of October 2025, the national average 30-year fixed mortgage rate stands around 6.2%, according to data from Bankrate and Realtor.com. That’s only a slight dip from early-year highs but still far below the double-digit rates seen in the 1980s.

Understanding What Drives Mortgage Rates

Mortgage rates are influenced by:

Federal Reserve policy: The Fed’s battle against inflation directly affects Treasury yields, which shape mortgage rates.

Economic strength: Strong job growth, wage gains, and spending tend to keep rates higher.

Investor demand: When investors flock to safer assets like U.S. Treasury bonds, yields (and therefore mortgage rates) tend to fall.

So, rates around 6% aren’t “high” in a historical sense—they’re a sign of a resilient, balanced economy.

Voice Search Tip:

“What is a good mortgage rate today?”

“Is 6 percent a bad rate for a home loan?”

In most markets, a 6% mortgage rate is considered average—and historically healthy.

2. Why Waiting for a Lower Rate Could Cost You More

The “Magic Number” Myth

According to the National Association of Realtors (NAR), a 30-year fixed mortgage at 6% would make the median-priced home affordable for roughly 5.5 million more households, including 1.6 million renters. If rates fell to that “magic” level, about 550,000 of those potential buyers could enter the market within a year.

Now imagine the competition when that happens. Prices rise when demand surges. Even a slight rate dip can unleash pent-up demand.

The Math Behind the Myth

Let’s compare two buyers looking at a $400,000 home:

Buyer A: Buys now at 6.2%, monthly payment ≈$2,456 (principal + interest).

Buyer B: Waits for 5.99%, monthly payment ≈$2,406.

That’s only a $50 difference per month—less than the average person spends on coffee or take-out.

But if home prices increase even 2%, that same house could cost $408,000, adding $500–$600 to closing costs and thousands more in lifetime interest.

So the “wait for the perfect rate” strategy often backfires.

3. Your Personal Home-Buying Snapshot: Are You Ready?

Buying at today’s rates doesn’t mean settling—it means being strategic. The key is to evaluate your readiness, not the headlines.

Step 1: Evaluate Your Financial Health

Review your credit score (aim for 680+ for best rates).

Calculate debt-to-income ratio (ideally < 43%).

Secure down payment funds (3%–20% depending on loan type).

Build an emergency fund covering 3–6 months of expenses.

Step 2: Define the Home You Need

For first-time buyers, the median-priced home is around $420,000 nationally in late 2025. At today’s rate, that’s manageable with the right budget and mortgage program (e.g., FHA, VA, or first-time buyer assistance).

If you’re a move-up buyer, consider how increased equity from your current home can offset the higher rate.

Step 3: Market-Timing vs Life-Timing

Voice Search Examples:

“Is now a good time to buy a home if rates are 6%?”

“Should I wait until next year to buy a house?”

The honest answer: buy when your life and finances align. The “perfect” rate won’t matter if prices rise faster or inventory shrinks.

Step 4: Shop Smart

Compare at least 3 lenders.

Ask about rate locks and buy-down options.

Understand points and fees—sometimes paying a little upfront reduces your rate long-term.

4. Strategies to Make the Most of Today’s Rates

1. Choose a Fixed-Rate Loan for Stability

Locking in today’s rate protects you from future volatility. With inflation cooling but still unpredictable, a 30-year fixed mortgage gives long-term peace of mind.

2. Use “Rate Buy-Down” Programs

Many lenders offer temporary buy-downs where your rate starts lower (for example, 4.99% for the first year) and gradually increases. Great for buyers expecting future income growth.

3. Negotiate With Confidence

Today’s market favors proactive buyers. You can often negotiate:

Seller-paid closing costs

Home-repair credits

Price reductions if the property has lingered on the market

4. Plan to Refinance Later

Rates are cyclical. When they drop again, refinancing can save thousands. The key is: marry the house, date the rate.

5. Focus on the Total Payment

Don’t obsess over interest rate alone. Include:

Taxes

Insurance

Maintenance

HOA fees

If the total monthly cost fits comfortably within your budget (ideally ≤ 28% of income), the rate is secondary.

5. What the Experts Are Saying

Jessica Lautz, NAR: “Over the last five weeks, mortgage rates have averaged 6.31%. This provides savvy buyers a sweet spot with more inventory and choices.”

Matt Vernon, Bank of America: “Rather than waiting for a rate they like better, buyers should assess their personal finances. If the home fits, it may be time to act.”

Realtors Group Forecast (Reuters, 2025): 30-year fixed rates are expected to average near 6% through 2026.

Economists warn that rates are unlikely to fall below 6% in the short term.

What It Means for You

Rates around 6% are likely the new normal—at least for a while. Waiting for 4–5% may mean waiting years.

6. Case Studies & Quick Math

Case 1 – The Early Bird Buyer

Buys a $400k home now at 6.2%.

Home value grows 4% next year → $416k.

Equity gained: $16,000.

Monthly difference vs. waiting: $50.

→ Total gain: Equity > monthly savings × 12 months.

Case 2 – The Wait-and-See Buyer

Waits for 5.9%.

Home price rises 4%.

Net effect: higher principal, same monthly payment, lost negotiation leverage.

Voice Search Example:

“How much do I save if my mortgage rate drops half a percent?”

Answer: On a $400,000 loan, roughly $120 per month, or $1,440 per year—but rising prices can offset that in months.

7. Common Myths About Mortgage Rates

Myth Reality Mortgage rates will fall back to 4% soon. Experts forecast rates near 6% through 2026 due to inflation and economic strength. Always wait for the lowest rate. Lower rates often mean higher prices and more competition. A high rate means it’s a bad time to buy. Total affordability depends on home price, taxes, and terms—not just rate. I’m stuck if rates drop later. You can refinance or build equity and upgrade later.

8. Bottom Line: What’s Right for You Right Now

If buying at today’s rate scares you, remember—waiting doesn’t always pay off.

When rates eventually dip below 6%, thousands of buyers will re-enter the market, driving prices and competition up again. Acting before that happens can give you:

More homes to choose from

Better negotiating power

Less buyer competition

Ask yourself:

Am I financially ready?

Is this home right for my goals?

Can I afford the monthly payment comfortably?

If you answered yes, then it’s time to act confidently—not fearfully.

FAQs

What mortgage rate can I expect right now?

As of October 2025, the national average for a 30-year fixed loan is about 6.2%, depending on credit score and lender.

Should I wait until mortgage rates drop?

Not necessarily. If rates dip, home prices often rise, offsetting savings. Buying now could secure a better home and more leverage.

How much does a 0.3% rate drop save me each month?

About $50 per $400,000 borrowed, but that small difference can be lost if home prices rise even 2%.

Can I refinance if rates drop later?

Yes. Refinancing is common once rates fall 0.5–1% below your current rate.

How do I know if a house is a good deal even with higher rates?

Focus on affordability, condition, location, and long-term value—not just the interest rate.

Author Bio / Call to Action

Are you ready to explore your next move? Whether you’re a first-time buyer, move-up homeowner, or investor, don’t let rates hold you back.

Contact your local mortgage advisor today to discover personalized strategies that make buying at today’s rates work for you.

Read from source: “Click Me”

© Copyright 2025 Epic Loan Solutions and its licensors | All Rights Reserved.