We write about Epic Loan Solutions!

Subscribe to our newsletter and keep up to date!

We write about Epic Loan Solutions!

Subscribe to our newsletter and keep up to date!

Why Your Home Equity Still Puts You Way Ahead

Why Your Home Equity in West Palm Beach, North Palm Beach & Wellington Still Puts You Way Ahead

Introduction

If you’ve seen the headlines about home prices dropping and wondered what it means for the value of your home, you’re not alone. The good news? Even with some cooling you’re still very likely ahead — and it’s all thanks to Home Equity.

Whether you live in West Palm Beach, North Palm Beach or Wellington, FL, the story is a powerful one: years of strong appreciation mean you’ve built up more equity than many realize. And if you’re thinking “if you want to sell” or to downsize, now is a great time to understand your position.

Let’s dig into why your your home equity remains robust, why the market shift is not a crash but a balancing act, and how you can make the most of this moment — with help from Christian Penner, Mortgage Broker / Mortgage Lender / Real Estate Agent / Real Estate Advisor at America’s Mortgage Solutions (AMS).

Understanding the Link Between Home Prices and Equity

To appreciate why you’re still ahead, we must start with how home prices and Home Equity are intertwined.

What is Home Equity?

Simply put, Home Equity is the difference between what your home is worth today and how much you still owe on your mortgage. As home values climb, or as you pay down your loan, your equity increases. Conversely, if home prices drop significantly, equity could shrink.

When home prices rise, equity builds. When home price growth slows, equity gains may slow too — but in most cases they don’t vanish altogether.

How Equity Builds Over Time

During the pandemic years, especially 2020 and 2021, many markets saw surging Home Values. Limited inventory and high demand meant rapid appreciation — meaning many homeowners built up substantial equity quickly.

As that surge leveled off, what we’re now seeing is that while price growth has moderated, many homeowners are still sitting on sizeable equity thanks to earlier gains.

Analysts note that total home equity in the U.S. hit record levels, and even in markets where appreciation has slowed, the base is strong. The Mortgage Reports+1

Why that matters for you

If you bought your home a few years ago, chances are you’ve already captured most of the big gains. Even if your local market sees prices coming down in some markets, that doesn’t erase the equity you’ve built. In other words: what matters for how much equity you have is your purchase timing, down payment, and position, not just the latest monthly change.

Why Homeowners in South Florida (West Palm Beach/North Palm Beach/Wellington) Are Still Ahead

Let’s make this local. If you’ve lived in or around West Palm Beach, North Palm Beach or Wellington, FL, here’s why your home equity story is especially strong.

Local Inventory & Price Trends

In Palm Beach County, recent data shows that for homes priced $1 million and up, single‐family home sales in February 2025 increased year-over-year by 14.5%, and total dollar volume rose 16.64%. MIAMI REALTORS® That kind of activity speaks to sustained demand.

At the same time, the number of homes for sale remains tight compared to pre-pandemic levels, especially for quality homes. Limited supply helps support values — meaning your equity built during peak years remains meaningful.

Substantial Local Equity Gains

In Southeast Florida — which includes Palm Beach County — homeowners who purchased a typical single‐family home 15 years ago have accumulated incredible equity. For example, median home equity in Palm Beach County for homes held 15 years is around $495,592. MIAMI REALTORS®+1

That means many homeowners in our region are far ahead of their peers nationally.

Realizing “More Equity”

Because the local market has out-paced many others, you likely have equity many people could only dream of. The combination of years of appreciation plus principal pay-down means you’re not just in the game — you’re well ahead.

Even if today’s growth is more measured, you’re starting from a strong base.

Putting It Into Perspective: State-by-State and Local Data

When you look at a state-by-state level, the picture reiterates that most homeowners are in strong positions.

Statewide Florida Snapshot

In Q4 2024, Florida reported that 60.7% of mortgaged residential properties were considered “equity-rich,” meaning the loan to value (LTV) ratio was 50% or less. Florida Realtors That means a majority of homeowners already held substantial equity.

However, Florida has seen some moderation: in Q1 2025 the proportion of equity-rich homes fell to about 49.3% in Florida. ATTOM+1

What this means: even though the relative share is slightly down, the numerical equity dollar amounts remain significant. Also, the drop doesn’t mean you’re losing equity — it reflects slower growth across many homes.

Local Palm Beach Insights

In Palm Beach County, the expected equity on a home purchased 15 years ago is among the highest in the region: roughly $474,900 as of Q4 2024. MIAMI REALTORS®

So when you consider your own ownership tenure, purchase price and payment history, you’re in the sweet spot of benefit.

What That Means for You

Take a moment and ask: “what my home is actually worth today”? Then ask: “how much equity I have”? You may be pleasantly surprised. And knowing these numbers gives you leverage whether you’re thinking of moving, refinancing or just enjoying your wealth.

The Price Moderation Isn’t a Crash — It’s a Market Finding Its Balance

A key distinction: what we’re seeing now is The price moderation, not a collapse. The housing market is simply adjusting.

What’s Happening Now

Nationally, home price growth has slowed. In some metros values are declining modestly. For example, some condo markets in the Sunbelt—including Florida—have seen drops. mortgagetech.ice.com

Industry forecasts suggest that while appreciation will continue, it may be closer to 2% in many markets during 2025. HousingWire

This slowdown may feel alarming if you focus on headlines about falling home prices, but remember: your equity is the sum of past growth + current value + principal pay-down.

Why this is a good thing

When the market stabilizes, it's a signal of a market that’s finding its balance. Supply is catching up, demand remains decent, and pricing becomes more realistic.

For homeowners, this means fewer bidding wars, more predictable pricing, and less risk of sharp declines.

For the homeowner in South Florida

In West Palm Beach, North Palm Beach and Wellington, FL, the market remains desirable. The luxury segment is active, and for quality homes, the combination of strong location plus limited inventory keeps pressure on values. MIAMI REALTORS®+1

So even if growth is slower, you already built a substantial base of sitting on near record amounts of equity.

What This Means If You Want to Sell or Downsize

If you’re thinking about downsize, relocating or just evaluating your options, here’s what this data means for you.

You’re in a strong equity position

Because you've built years of growth and likely pay-down, the question isn’t whether you’re “ahead” anymore — it’s how to make your equity work for you.

You’ve accumulated equity gains that many wished for a decade ago. Now you have real choices: if you want to sell, you can utilize that equity to:

Move to a smaller home (in Wellington or another Florida region)

Move up to a larger home or luxury property

Relocate out of state, using your equity for cash-out

Invest elsewhere (rental property, second home, business)

Steps to evaluating your home equity

Determine your estimated current home value — ask a local agent (like Christian Penner) for a comparative market analysis.

Check your remaining mortgage / loan balance.

Subtract to get how much equity you have.

Determine what your goal is: downsizing, selling, moving, or staying.

Evaluate costs/benefits — home sale costs, moving costs, new mortgage/rate, tax implications.

Why now might be a good time to act

Because the market is more balanced, you might have less competition, more buyer interest for well-priced homes in strong neighborhoods, and still the benefit of your built-up equity. You don’t have to chase big gains — you’ve got them already.

If your life stage suggests downsizing (empty nest, retirement, relocation), this is a favourable scenario.

How to Maximize the Value of Your Home Today

Leveraging your home equity effectively means knowing your options and being strategic.

Understanding what your home is actually worth today

Even in a moderating market, if your home is in a strong location (West Palm Beach, North Palm Beach, Wellington) and well-maintained, you may still command a premium. Reach out to a local expert—like Christian Penner-AMS—to get a detailed valuation and understand local comparables.

Leveraging your home equity

Your home equity is more than a number — it’s a tool. Here are some options:

Cash-out refinance or HELOC: With rates still favourable relative to alternatives, tapping your equity can help fund renovations, a second home or consolidate debt. Experian+1

Using as down payment: If you sell and move, you can apply your equity to the next purchase — effectively reducing debt or purchasing a new home with less borrowing.

Strategic downsizing: Sell a large home in Wellington, purchase a smaller residence and use leftover equity for other goals — retirement, travel, business.

Reinvesting: Some homeowners convert their equity into investment property or alternative asset classes. National data shows homeowners with equity often use it to build wealth. NFM Lending

Why your equity is a strong asset in this market

Because you likely secured much of your equity during high-growth years, you’re not relying solely on future gains. That gives you flexibility, less risk and more options — especially in an environment where growth is slower.

When you partner with a Mortgage Broker / Mortgage Lender / Real Estate Agent / Real Estate Advisor like Christian Penner of America’s Mortgage Solutions (AMS), you get tailored local insight into West Palm Beach, North Palm Beach and Wellington markets — allowing you to make the most of your position.

Common Questions (FAQs) – Voice Search Friendly

Here are some frequently asked questions, phrased in a way that aligns with how people talk when using voice search. Feel free to refer to these when you’re talking to family, or when you’re on the go with your smartphone.

Q1: “How much equity do I have in my house in West Palm Beach?”

You can estimate by taking the current market value of your home in West Palm Beach, subtracting your remaining mortgage balance. Because the local market has seen years of appreciation, many homeowners in this region are holding equity many people could only dream of. Connect with a local advisor like Christian Penner at AMS to get a professional estimate.

Q2: “Are home values in Florida dropping?”

While home prices have cooled in some markets and growth has slowed, large‐scale declines are extremely unlikely nationally. The data shows instead that the market is shifting into balance. Florida remains one of the states where many homeowners still have strong equity positions. CBS News+1

Q3: “Is it a good time to sell in North Palm Beach?”

Yes—if you’ve owned your home for several years, especially in a desirable area of North Palm Beach, you likely have built considerable equity. Because you’re already ahead, selling to downsize or move up is a viable choice with strong possible outcomes. Use the local inventory and demand data to time your listing strategically.

Q4: “How can I tap into my home equity without selling?”

You can explore options like a cash-out refinance or a home equity line of credit (HELOC). These allow you to tap your home equity while still living in the home. Given the elevated equity levels in Florida and nationally, many homeowners view this as a smart strategic tool. The Mortgage Reports

Q5: “What does it mean when they say the market is coming into better balance?”

It means that supply and demand are moving into more equilibrium. Home-value growth is moderating, instead of skyrocketing. That’s not bad—it reduces risk of volatility. In other words, it’s a signal of a market that’s finding its balance, which can be positive for long-term homeowners.

Q6: “Can I downsize and still come out ahead in Wellington, FL?”

Absolutely. If you’ve built up equity, you have the flexibility to sell a larger home, purchase a smaller one (perhaps freeing up cash in the process), and use your leftover equity for other goals — retirement, travel, investment. It’s a way to convert your housing wealth into lifestyle flexibility.

Q7: “What steps should I take to figure out what my home is actually worth today?”

Contact a local real-estate professional (such as Christian Penner at AMS) to get a comparative market analysis.

Review recent sales in your neighbourhood (West Palm Beach, North Palm Beach or Wellington) and compare home sizes, condition, features.

Subtract your remaining mortgage to calculate how much equity you have.

Factor in selling costs, moving costs, and your next-home strategy if you plan to sell.

Consider financing options if you intend to stay and tap equity.

Bottom Line

Even with some adjustments in the market and modest price moderation, homeowners in West Palm Beach, North Palm Beach and Wellington, FL are still sitting on incredible value thanks to years of upward momentum in home values and well-timed mortgage pay-down.

If you’ve been in your home for several years, the odds are very good that you’re well ahead of where you were just a few years ago — even if you don’t feel it every day. That equity empowers you with choices: whether you want to downsize, move up, convert your wealth into cash, or simply live differently.

If you’re asking “if you want to sell” or just want to explore your options — reach out to Christian Penner (Mortgage Broker, Mortgage Lender, Real Estate Agent, Real Estate Advisor) at America’s Mortgage Solutions (AMS). He can show you exactly what your home is actually worth today, map out your equity position, and help tailor a strategic plan unique to you and your goals.

You don’t just own a house — you’ve built an asset. And now’s the time to make it work for you.

Next Steps (Call to Action)

Request a no-obligation comparative market analysis to find your current value.

Review your remaining mortgage balance and calculate the value of your home minus debt = your home equity.

Consider whether you’d rather stay, remodel, move, or downsize — whichever fits your life stage.

Speak with Christian Penner at AMS about options: cash-out refinance, HELOC, selling, purchasing next home.

When you’re ready—take action. Whether it’s capturing value now or planning for future moves, you’re in a strong position.

Check below for more information:

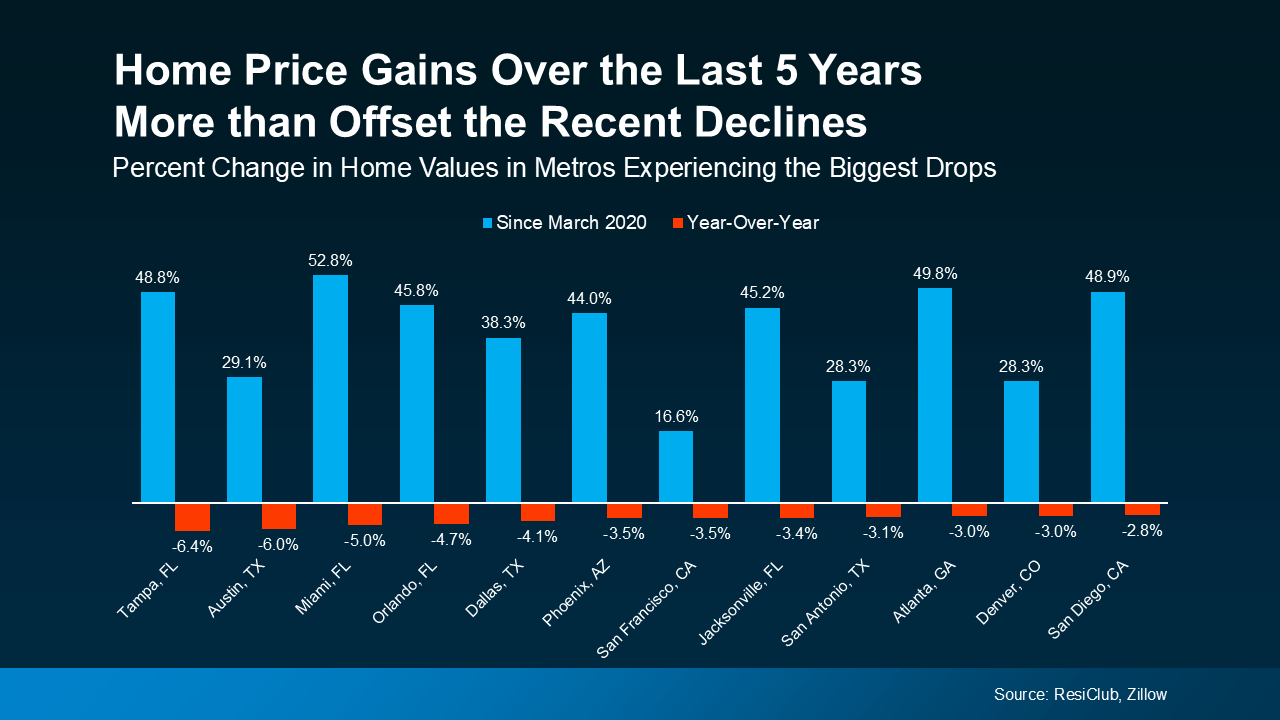

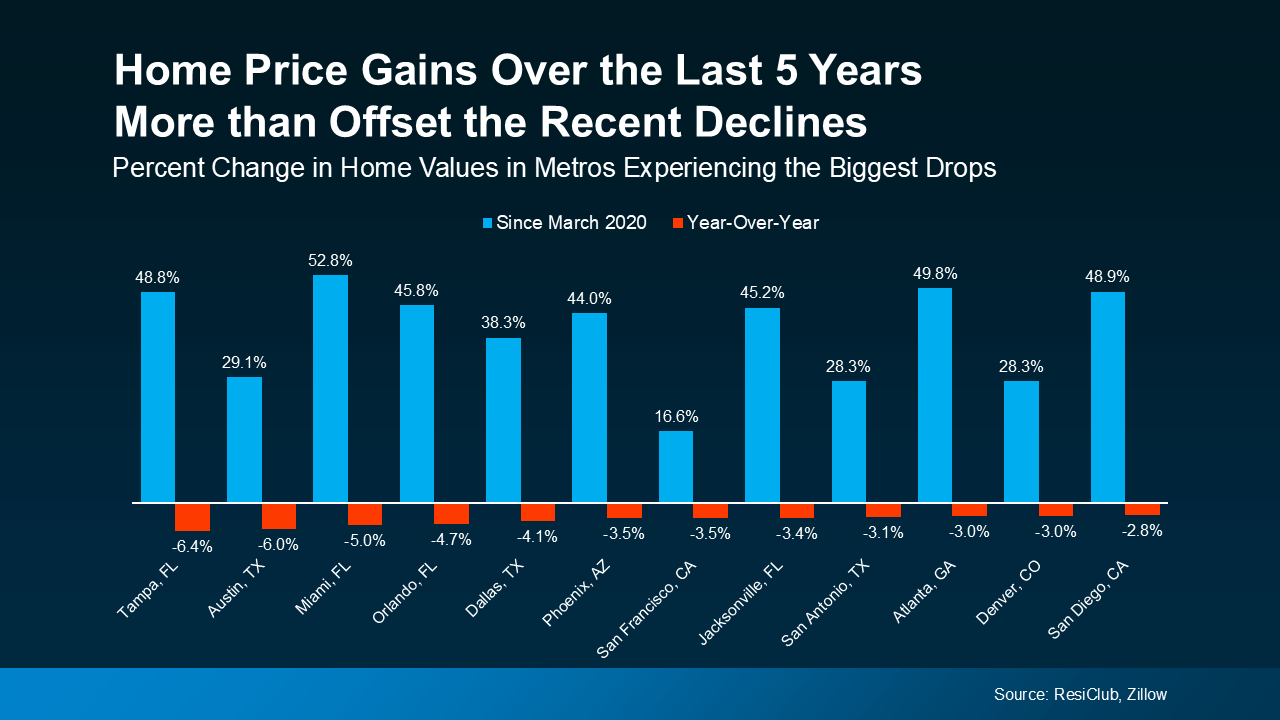

In other words, these modest declines can’t erase years of growth. Homeowners who’ve been in their houses for several years are still way ahead. Big time. And that’s true pretty much everywhere.

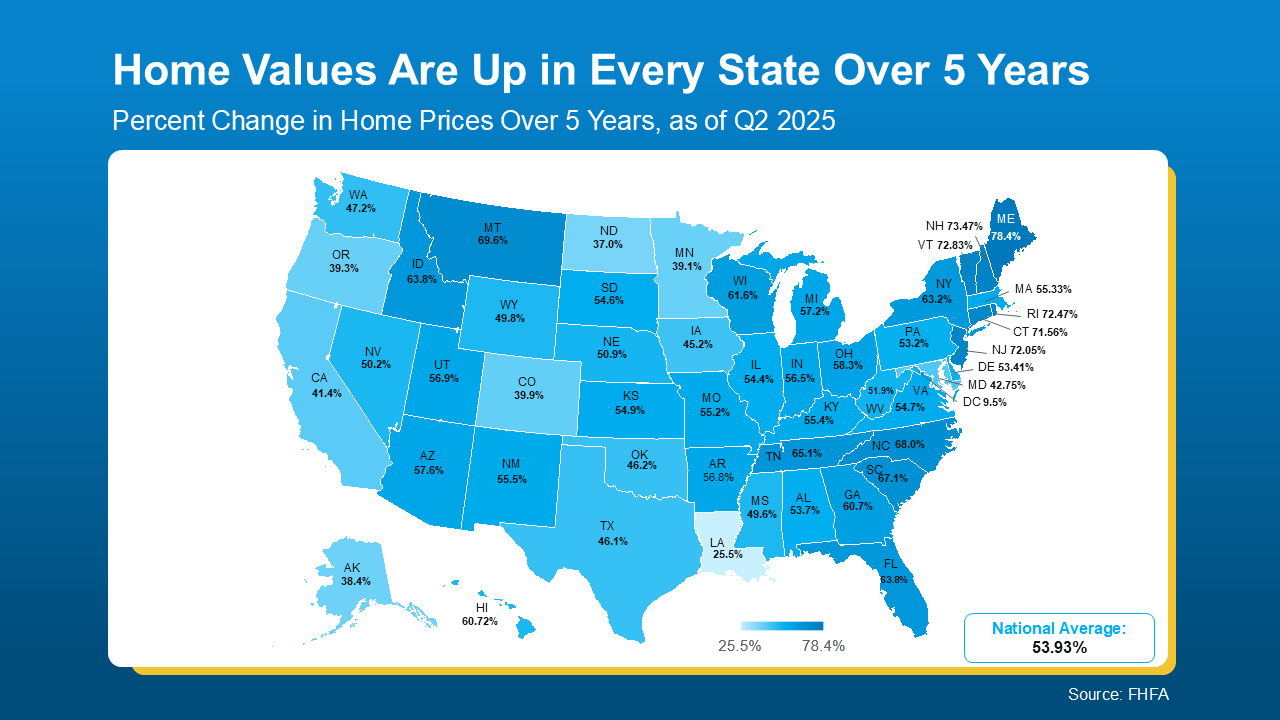

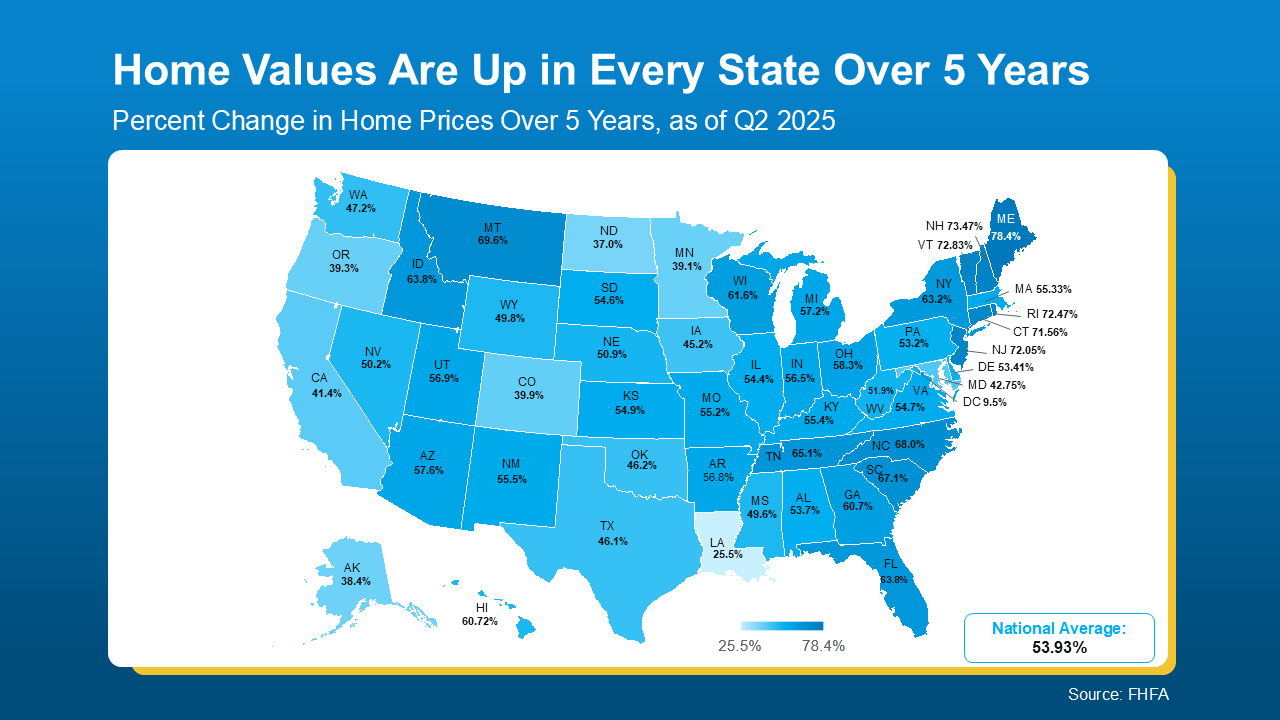

Data from the Federal Housing Finance Agency (FHFA) helps paint this picture. Let’s cast a slightly wider net and look at a state-by-state level this time. Every single state has seen prices go up over the last 5 years. And that means homeowners in each state have much more equity than they did just 5 years ago (see graph below):

Odds are, in most places, if you’ve owned your home for more than a few years, you’ve already built the kind of equity many people could only dream about before the pandemic. And if you sell, you can use it to help you downsize, or move up.

And just in case you’re worried prices will crash and your equity will take a bigger hit in the near future, here’s what Jake Krimmel, Senior Economist at Realtor.com, has to say:

“The slight recent declines in aggregate value and total home equity are not cause for concern . . . Although the market is coming into better balance, large price declines nationally are extremely unlikely in the near term . . .”

The price moderation we’ve seen lately isn’t a cause for concern. It’s a signal of a market that’s finding its balance again after several years of unsustainable price growth. And after several years of major price appreciation, most homeowners are still in an incredibly strong position.

Source: “America's Mortgage Solutions (AMS)”

Why Your Home Equity Still Puts You Way Ahead

Why Your Home Equity in West Palm Beach, North Palm Beach & Wellington Still Puts You Way Ahead

Introduction

If you’ve seen the headlines about home prices dropping and wondered what it means for the value of your home, you’re not alone. The good news? Even with some cooling you’re still very likely ahead — and it’s all thanks to Home Equity.

Whether you live in West Palm Beach, North Palm Beach or Wellington, FL, the story is a powerful one: years of strong appreciation mean you’ve built up more equity than many realize. And if you’re thinking “if you want to sell” or to downsize, now is a great time to understand your position.

Let’s dig into why your your home equity remains robust, why the market shift is not a crash but a balancing act, and how you can make the most of this moment — with help from Christian Penner, Mortgage Broker / Mortgage Lender / Real Estate Agent / Real Estate Advisor at America’s Mortgage Solutions (AMS).

Understanding the Link Between Home Prices and Equity

To appreciate why you’re still ahead, we must start with how home prices and Home Equity are intertwined.

What is Home Equity?

Simply put, Home Equity is the difference between what your home is worth today and how much you still owe on your mortgage. As home values climb, or as you pay down your loan, your equity increases. Conversely, if home prices drop significantly, equity could shrink.

When home prices rise, equity builds. When home price growth slows, equity gains may slow too — but in most cases they don’t vanish altogether.

How Equity Builds Over Time

During the pandemic years, especially 2020 and 2021, many markets saw surging Home Values. Limited inventory and high demand meant rapid appreciation — meaning many homeowners built up substantial equity quickly.

As that surge leveled off, what we’re now seeing is that while price growth has moderated, many homeowners are still sitting on sizeable equity thanks to earlier gains.

Analysts note that total home equity in the U.S. hit record levels, and even in markets where appreciation has slowed, the base is strong. The Mortgage Reports+1

Why that matters for you

If you bought your home a few years ago, chances are you’ve already captured most of the big gains. Even if your local market sees prices coming down in some markets, that doesn’t erase the equity you’ve built. In other words: what matters for how much equity you have is your purchase timing, down payment, and position, not just the latest monthly change.

Why Homeowners in South Florida (West Palm Beach/North Palm Beach/Wellington) Are Still Ahead

Let’s make this local. If you’ve lived in or around West Palm Beach, North Palm Beach or Wellington, FL, here’s why your home equity story is especially strong.

Local Inventory & Price Trends

In Palm Beach County, recent data shows that for homes priced $1 million and up, single‐family home sales in February 2025 increased year-over-year by 14.5%, and total dollar volume rose 16.64%. MIAMI REALTORS® That kind of activity speaks to sustained demand.

At the same time, the number of homes for sale remains tight compared to pre-pandemic levels, especially for quality homes. Limited supply helps support values — meaning your equity built during peak years remains meaningful.

Substantial Local Equity Gains

In Southeast Florida — which includes Palm Beach County — homeowners who purchased a typical single‐family home 15 years ago have accumulated incredible equity. For example, median home equity in Palm Beach County for homes held 15 years is around $495,592. MIAMI REALTORS®+1

That means many homeowners in our region are far ahead of their peers nationally.

Realizing “More Equity”

Because the local market has out-paced many others, you likely have equity many people could only dream of. The combination of years of appreciation plus principal pay-down means you’re not just in the game — you’re well ahead.

Even if today’s growth is more measured, you’re starting from a strong base.

Putting It Into Perspective: State-by-State and Local Data

When you look at a state-by-state level, the picture reiterates that most homeowners are in strong positions.

Statewide Florida Snapshot

In Q4 2024, Florida reported that 60.7% of mortgaged residential properties were considered “equity-rich,” meaning the loan to value (LTV) ratio was 50% or less. Florida Realtors That means a majority of homeowners already held substantial equity.

However, Florida has seen some moderation: in Q1 2025 the proportion of equity-rich homes fell to about 49.3% in Florida. ATTOM+1

What this means: even though the relative share is slightly down, the numerical equity dollar amounts remain significant. Also, the drop doesn’t mean you’re losing equity — it reflects slower growth across many homes.

Local Palm Beach Insights

In Palm Beach County, the expected equity on a home purchased 15 years ago is among the highest in the region: roughly $474,900 as of Q4 2024. MIAMI REALTORS®

So when you consider your own ownership tenure, purchase price and payment history, you’re in the sweet spot of benefit.

What That Means for You

Take a moment and ask: “what my home is actually worth today”? Then ask: “how much equity I have”? You may be pleasantly surprised. And knowing these numbers gives you leverage whether you’re thinking of moving, refinancing or just enjoying your wealth.

The Price Moderation Isn’t a Crash — It’s a Market Finding Its Balance

A key distinction: what we’re seeing now is The price moderation, not a collapse. The housing market is simply adjusting.

What’s Happening Now

Nationally, home price growth has slowed. In some metros values are declining modestly. For example, some condo markets in the Sunbelt—including Florida—have seen drops. mortgagetech.ice.com

Industry forecasts suggest that while appreciation will continue, it may be closer to 2% in many markets during 2025. HousingWire

This slowdown may feel alarming if you focus on headlines about falling home prices, but remember: your equity is the sum of past growth + current value + principal pay-down.

Why this is a good thing

When the market stabilizes, it's a signal of a market that’s finding its balance. Supply is catching up, demand remains decent, and pricing becomes more realistic.

For homeowners, this means fewer bidding wars, more predictable pricing, and less risk of sharp declines.

For the homeowner in South Florida

In West Palm Beach, North Palm Beach and Wellington, FL, the market remains desirable. The luxury segment is active, and for quality homes, the combination of strong location plus limited inventory keeps pressure on values. MIAMI REALTORS®+1

So even if growth is slower, you already built a substantial base of sitting on near record amounts of equity.

What This Means If You Want to Sell or Downsize

If you’re thinking about downsize, relocating or just evaluating your options, here’s what this data means for you.

You’re in a strong equity position

Because you've built years of growth and likely pay-down, the question isn’t whether you’re “ahead” anymore — it’s how to make your equity work for you.

You’ve accumulated equity gains that many wished for a decade ago. Now you have real choices: if you want to sell, you can utilize that equity to:

Move to a smaller home (in Wellington or another Florida region)

Move up to a larger home or luxury property

Relocate out of state, using your equity for cash-out

Invest elsewhere (rental property, second home, business)

Steps to evaluating your home equity

Determine your estimated current home value — ask a local agent (like Christian Penner) for a comparative market analysis.

Check your remaining mortgage / loan balance.

Subtract to get how much equity you have.

Determine what your goal is: downsizing, selling, moving, or staying.

Evaluate costs/benefits — home sale costs, moving costs, new mortgage/rate, tax implications.

Why now might be a good time to act

Because the market is more balanced, you might have less competition, more buyer interest for well-priced homes in strong neighborhoods, and still the benefit of your built-up equity. You don’t have to chase big gains — you’ve got them already.

If your life stage suggests downsizing (empty nest, retirement, relocation), this is a favourable scenario.

How to Maximize the Value of Your Home Today

Leveraging your home equity effectively means knowing your options and being strategic.

Understanding what your home is actually worth today

Even in a moderating market, if your home is in a strong location (West Palm Beach, North Palm Beach, Wellington) and well-maintained, you may still command a premium. Reach out to a local expert—like Christian Penner-AMS—to get a detailed valuation and understand local comparables.

Leveraging your home equity

Your home equity is more than a number — it’s a tool. Here are some options:

Cash-out refinance or HELOC: With rates still favourable relative to alternatives, tapping your equity can help fund renovations, a second home or consolidate debt. Experian+1

Using as down payment: If you sell and move, you can apply your equity to the next purchase — effectively reducing debt or purchasing a new home with less borrowing.

Strategic downsizing: Sell a large home in Wellington, purchase a smaller residence and use leftover equity for other goals — retirement, travel, business.

Reinvesting: Some homeowners convert their equity into investment property or alternative asset classes. National data shows homeowners with equity often use it to build wealth. NFM Lending

Why your equity is a strong asset in this market

Because you likely secured much of your equity during high-growth years, you’re not relying solely on future gains. That gives you flexibility, less risk and more options — especially in an environment where growth is slower.

When you partner with a Mortgage Broker / Mortgage Lender / Real Estate Agent / Real Estate Advisor like Christian Penner of America’s Mortgage Solutions (AMS), you get tailored local insight into West Palm Beach, North Palm Beach and Wellington markets — allowing you to make the most of your position.

Common Questions (FAQs) – Voice Search Friendly

Here are some frequently asked questions, phrased in a way that aligns with how people talk when using voice search. Feel free to refer to these when you’re talking to family, or when you’re on the go with your smartphone.

Q1: “How much equity do I have in my house in West Palm Beach?”

You can estimate by taking the current market value of your home in West Palm Beach, subtracting your remaining mortgage balance. Because the local market has seen years of appreciation, many homeowners in this region are holding equity many people could only dream of. Connect with a local advisor like Christian Penner at AMS to get a professional estimate.

Q2: “Are home values in Florida dropping?”

While home prices have cooled in some markets and growth has slowed, large‐scale declines are extremely unlikely nationally. The data shows instead that the market is shifting into balance. Florida remains one of the states where many homeowners still have strong equity positions. CBS News+1

Q3: “Is it a good time to sell in North Palm Beach?”

Yes—if you’ve owned your home for several years, especially in a desirable area of North Palm Beach, you likely have built considerable equity. Because you’re already ahead, selling to downsize or move up is a viable choice with strong possible outcomes. Use the local inventory and demand data to time your listing strategically.

Q4: “How can I tap into my home equity without selling?”

You can explore options like a cash-out refinance or a home equity line of credit (HELOC). These allow you to tap your home equity while still living in the home. Given the elevated equity levels in Florida and nationally, many homeowners view this as a smart strategic tool. The Mortgage Reports

Q5: “What does it mean when they say the market is coming into better balance?”

It means that supply and demand are moving into more equilibrium. Home-value growth is moderating, instead of skyrocketing. That’s not bad—it reduces risk of volatility. In other words, it’s a signal of a market that’s finding its balance, which can be positive for long-term homeowners.

Q6: “Can I downsize and still come out ahead in Wellington, FL?”

Absolutely. If you’ve built up equity, you have the flexibility to sell a larger home, purchase a smaller one (perhaps freeing up cash in the process), and use your leftover equity for other goals — retirement, travel, investment. It’s a way to convert your housing wealth into lifestyle flexibility.

Q7: “What steps should I take to figure out what my home is actually worth today?”

Contact a local real-estate professional (such as Christian Penner at AMS) to get a comparative market analysis.

Review recent sales in your neighbourhood (West Palm Beach, North Palm Beach or Wellington) and compare home sizes, condition, features.

Subtract your remaining mortgage to calculate how much equity you have.

Factor in selling costs, moving costs, and your next-home strategy if you plan to sell.

Consider financing options if you intend to stay and tap equity.

Bottom Line

Even with some adjustments in the market and modest price moderation, homeowners in West Palm Beach, North Palm Beach and Wellington, FL are still sitting on incredible value thanks to years of upward momentum in home values and well-timed mortgage pay-down.

If you’ve been in your home for several years, the odds are very good that you’re well ahead of where you were just a few years ago — even if you don’t feel it every day. That equity empowers you with choices: whether you want to downsize, move up, convert your wealth into cash, or simply live differently.

If you’re asking “if you want to sell” or just want to explore your options — reach out to Christian Penner (Mortgage Broker, Mortgage Lender, Real Estate Agent, Real Estate Advisor) at America’s Mortgage Solutions (AMS). He can show you exactly what your home is actually worth today, map out your equity position, and help tailor a strategic plan unique to you and your goals.

You don’t just own a house — you’ve built an asset. And now’s the time to make it work for you.

Next Steps (Call to Action)

Request a no-obligation comparative market analysis to find your current value.

Review your remaining mortgage balance and calculate the value of your home minus debt = your home equity.

Consider whether you’d rather stay, remodel, move, or downsize — whichever fits your life stage.

Speak with Christian Penner at AMS about options: cash-out refinance, HELOC, selling, purchasing next home.

When you’re ready—take action. Whether it’s capturing value now or planning for future moves, you’re in a strong position.

Check below for more information:

In other words, these modest declines can’t erase years of growth. Homeowners who’ve been in their houses for several years are still way ahead. Big time. And that’s true pretty much everywhere.

Data from the Federal Housing Finance Agency (FHFA) helps paint this picture. Let’s cast a slightly wider net and look at a state-by-state level this time. Every single state has seen prices go up over the last 5 years. And that means homeowners in each state have much more equity than they did just 5 years ago (see graph below):

Odds are, in most places, if you’ve owned your home for more than a few years, you’ve already built the kind of equity many people could only dream about before the pandemic. And if you sell, you can use it to help you downsize, or move up.

And just in case you’re worried prices will crash and your equity will take a bigger hit in the near future, here’s what Jake Krimmel, Senior Economist at Realtor.com, has to say:

“The slight recent declines in aggregate value and total home equity are not cause for concern . . . Although the market is coming into better balance, large price declines nationally are extremely unlikely in the near term . . .”

The price moderation we’ve seen lately isn’t a cause for concern. It’s a signal of a market that’s finding its balance again after several years of unsustainable price growth. And after several years of major price appreciation, most homeowners are still in an incredibly strong position.

Source: “America's Mortgage Solutions (AMS)”

© Copyright 2025 Epic Loan Solutions and its licensors | All Rights Reserved.