We write about Epic Loan Solutions!

Subscribe to our newsletter and keep up to date!

We write about Epic Loan Solutions!

Subscribe to our newsletter and keep up to date!

What You Should Know About Getting a Mortgage Today

What You Should Know About Getting a Mortgage Today

If you’ve been putting off buying a home because you thought getting approved would be too hard, know this: qualifying for a mortgage is starting to get a bit more achievable, but lending standards are still strong.

Lenders are making it slightly easier for well-qualified buyers to access financing, which is opening more doors for people ready to make a move.

So, if strict requirements were holding you back, this shift could be the opportunity you’ve been waiting for, without repeating the risky lending practices that led to the housing crash back in 2008.

Lenders Are Opening More Doors

Banks are offering credit to more people in an effort to boost activity in the housing market, including buyers who have lower credit scores or smaller down payments. And that means more people are getting approved for mortgages.

But it doesn’t mean we’re heading for another crash like 2008. Even with the slight easing lately, lending standards today are still much tighter than they were back then.

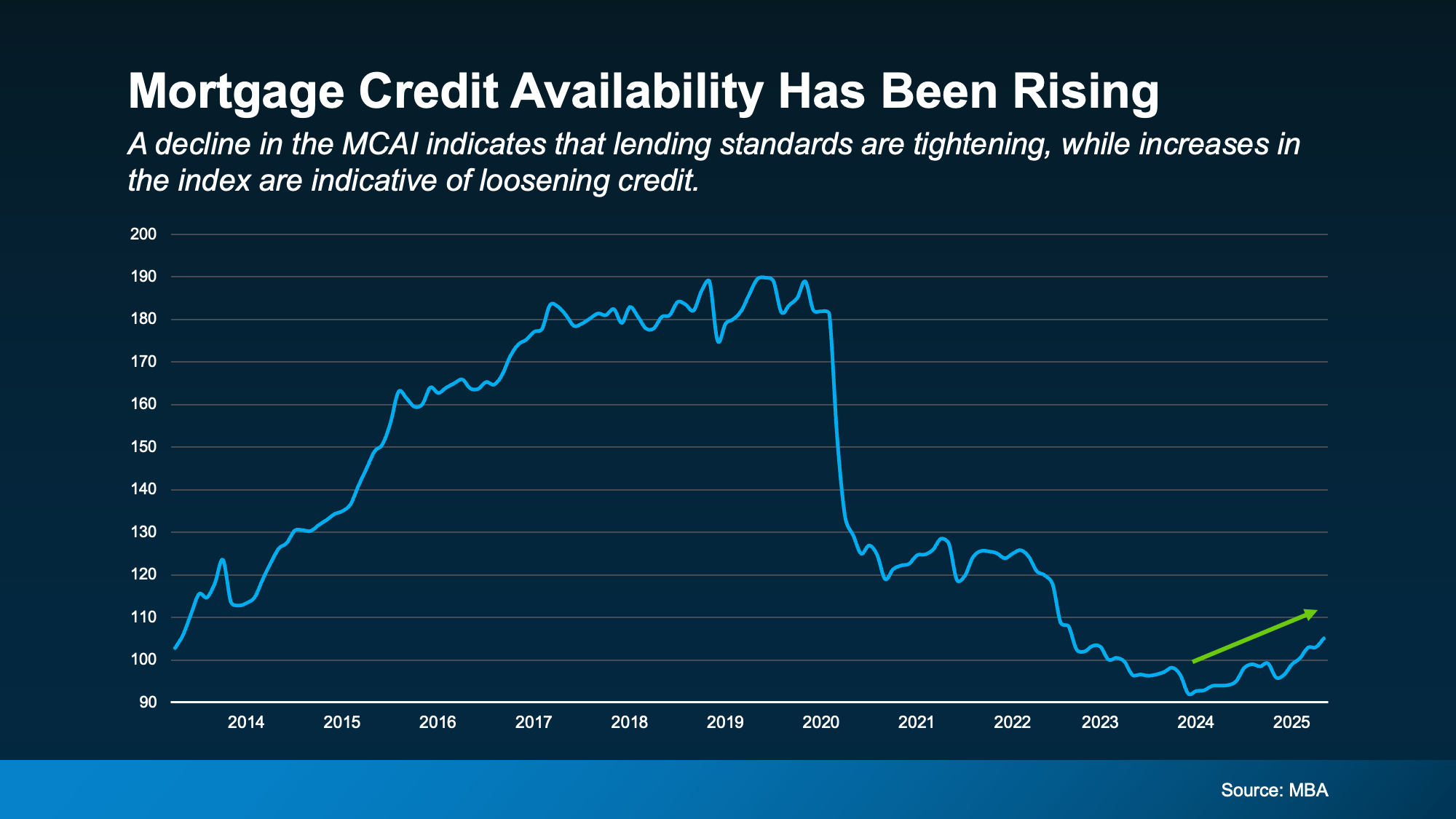

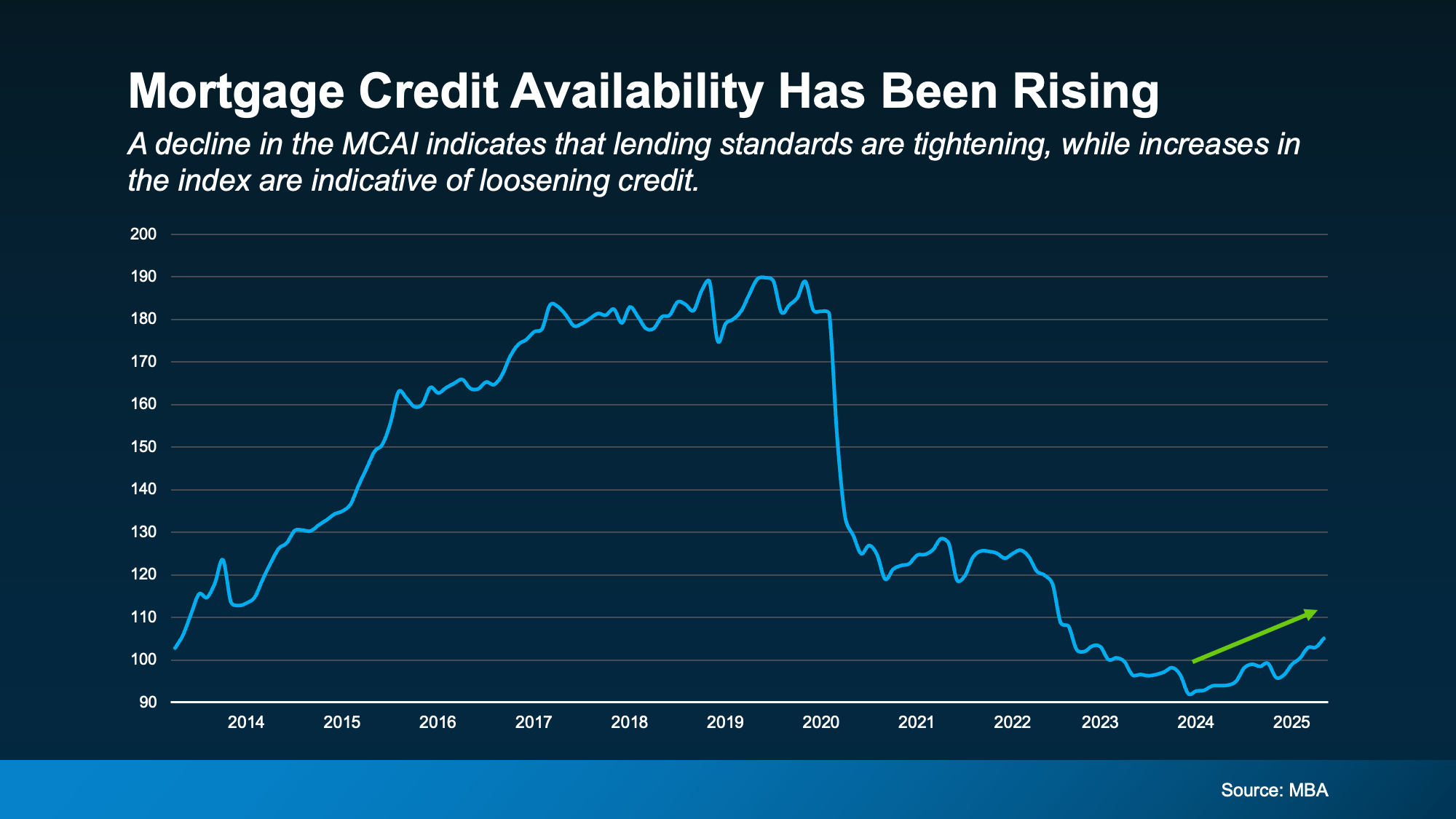

According to the Mortgage Bankers Association (MBA), the Mortgage Credit Availability Index (MCAI) has been going up. This index shows how easy or hard it is for people to get a mortgage.

When the index rises, it means banks are easing their lending standards. And in May, credit availability hit its highest point in almost three years (see graph below):

Why does this matter to you? It means you may now be able to qualify for a mortgage that you wouldn’t have just a few months ago. The National Association of Underwriters (NAMU) explains:

“Mortgage credit availability surged in May, reaching its highest level since August 2022. The uptick signals that lenders are increasingly willing to loosen underwriting standards, providing borrowers with greater access to financing options . . .”

But What About 2008?

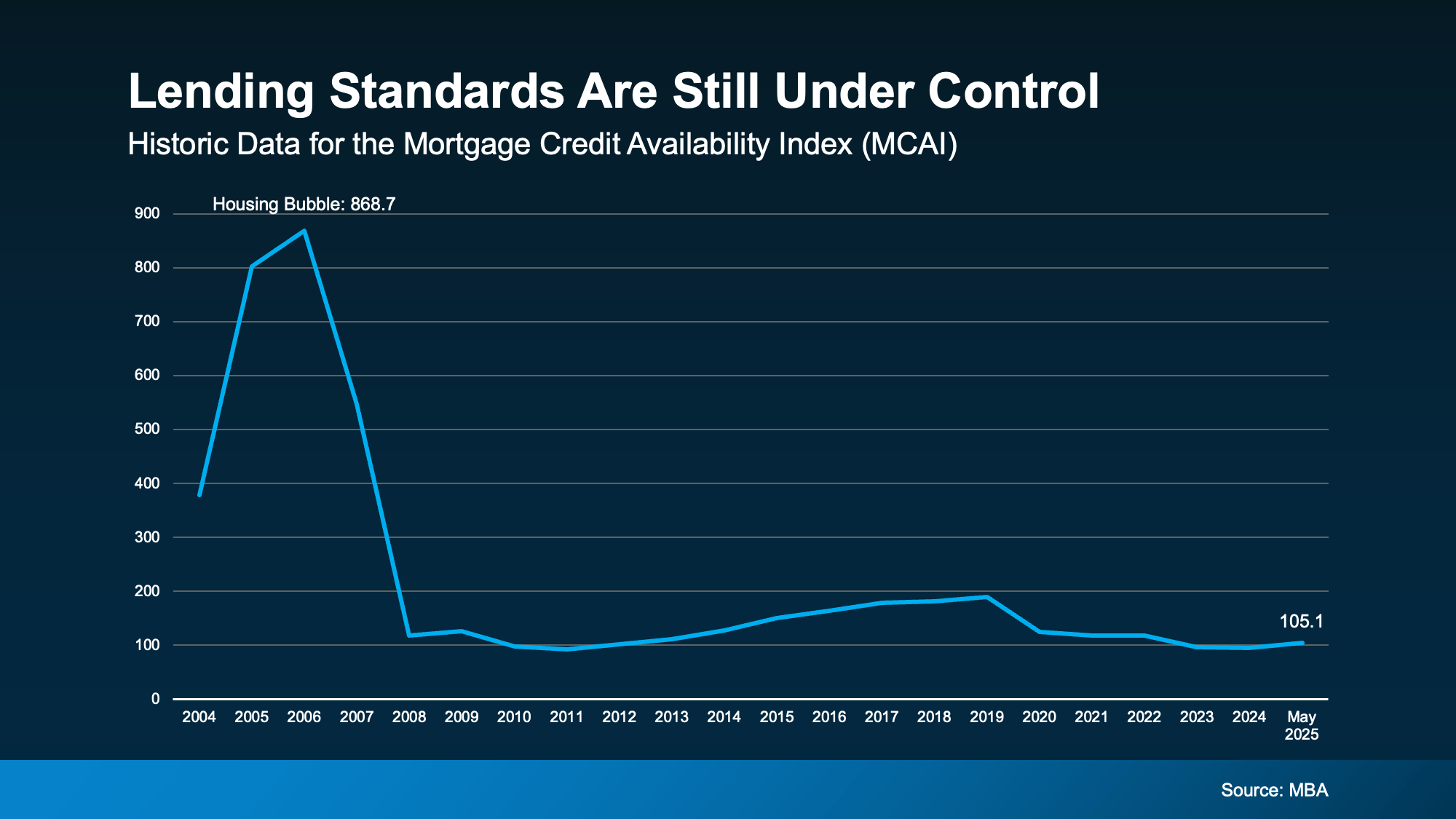

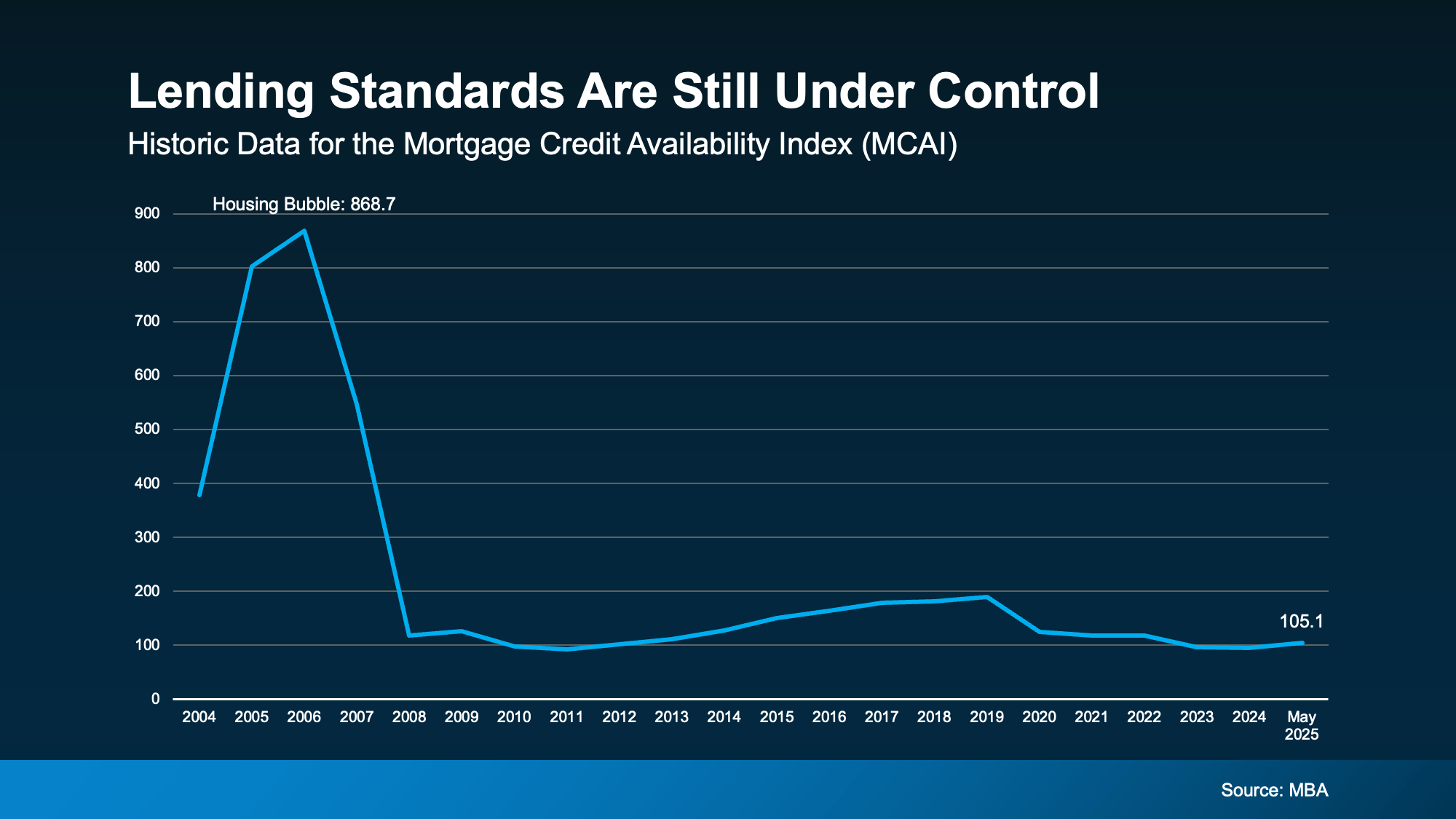

Now, you might be thinking, “Didn’t looser lending standards play a role in the 2008 housing crash?” That’s a smart question – and an important one. But here’s the difference. While credit availability is rising, lending standards are still under control.

Based on MCAI data going all the way back to 2004, today’s lending levels are still way below what they were leading up to the housing bubble (see graph below):

So, increasing mortgage credit availability right now isn’t a concern. It’s just a good thing for anyone looking to buy a home. As Brett Hively, SVP of Mortgage, Finance, and Strategy at Ameris Bancorp, recently said:

“This uptick is opening the door for many borrowers to move forward with a home purchase or a refinance program.”

So, if you’ve been holding back because you thought you couldn’t get approved for a mortgage, it’s worth finding out what’s possible today. Let’s talk with a lender about your options and see if you’re ready to take that next step toward homeownership.

More About:

What You Should Know About Getting a Mortgage Today

The path to homeownership is paved with a thousand questions, but one stands out for most aspiring buyers: How do I actually get a mortgage today? The terrain may feel unfamiliar, even intimidating, especially after hearing horror stories from the 2008 Housing Crisis. But take a breath—because the rules of engagement have evolved, and if you know how to navigate them, the doors to your dream home could swing wide open.

Let’s talk about what’s happening in the housing market, how lenders are changing their tune, and what it truly means to get approved for a mortgage in this new era.

The Lending Landscape: A Market in Motion

Gone are the reckless, fast-and-loose lending days that led to the housing crash. Today’s lending standards are no longer based on a “fog-the-mirror” qualification test. Instead, they’re grounded in stability. And yet, something interesting is happening.

Lenders are opening more doors.

They’re not throwing out caution, but they are becoming more flexible. We’re witnessing a deliberate trend—easing lending standards without echoing the risky lending practices that once set the stage for disaster. That’s a crucial distinction.

The Mortgage Bankers Association (MBA) recently reported a noticeable mortgage credit surge, and its Mortgage Credit Availability Index (MCAI) is rising steadily. That’s the pulse of how easy it is to obtain mortgage financing. And right now? The patient is healthy.

What does this mean for you? It means credit access is expanding. It means people with credit scores that are “good enough” may finally find themselves qualifying for loans they were locked out of just a year ago.

Not 2008 All Over Again

The shadow of the 2008 Housing Crisis still haunts many would-be buyers. Understandably so. But context is everything.

Back then, credit availability was so loose, it was barely tethered to reality. Loans were issued with no income verification, no asset checks—sometimes no job at all. The housing bubble inflated beyond reason. When it popped, the economic fallout was catastrophic.

But let’s be very clear: today’s lending levels are nothing like what we saw back then.

The Mortgage Credit Availability Index may be up, but it’s still well below pre-crash levels. The bar for loan qualifications remains responsibly high. Think of it as a “flexible but firm” approach. You’re not being set up for failure; you’re being invited to prove readiness.

The Rise of the Well-Qualified Borrower

Today’s lending model favors well-qualified buyers to access financing. That includes those with solid employment, a steady income stream, reasonable debt-to-income ratios, and—yes—a decent credit score.

But here’s the surprising twist: even first-time homebuyers or borrowers with smaller down payments are finding options.

Mortgage lenders aren’t just looking for perfection—they’re looking for potential.

The National Association of Mortgage Underwriters (NAMU) reported that underwriting standards have started to loosen just enough to give more people a fair shot. Think of it as widening the gate—not lowering the fence.

What It Takes to Get Approved for a Mortgage Today

There’s a mystique around getting approved for mortgages, but it boils down to five essential pillars:

Credit Score

The higher, the better. But don’t panic if you’re not in the 800s. A score above 620 can get you in the game, especially if other metrics are strong.Down Payment

While 20% used to be the golden rule, it’s not required today. Plenty of programs exist that accommodate smaller down payments, especially for first-time homebuyers.Income Verification

W-2s, pay stubs, tax returns—expect a thorough examination. The stronger and more stable your income, the easier your path.Debt-to-Income Ratio (DTI)

This is your monthly debt divided by your gross income. Most lenders prefer a DTI below 43%, but some may stretch a little depending on other strengths.Assets and Reserves

Cash in the bank counts. So do retirement accounts and other investments. Mortgage lenders want to know you have a cushion.

Once you align these stars, your mortgage application has a high probability of approval. The best part? The process, while still detailed, has never been more digital-friendly or streamlined than it is now.

Local Advantage: West Palm Beach Mortgage Insights

If you’re in South Florida and searching for Affordable West Palm Beach home loans, you’re in a particularly favorable environment.

Working with a West Palm Beach mortgage broker means tapping into local insight, tailored financing options, and access to some of the best mortgage rates in West Palm Beach. This isn’t about fitting into a national box—it’s about finding a loan structure that works for you.

And if you’re exploring first time home buyer loans in West Palm Beach, options abound—from FHA loans to grant assistance programs that can ease the burden of your down payment.

Need to run the numbers? Plug into West Palm Beach mortgage calculators to get a clear snapshot of affordability. Want a second look at refinancing your current loan? Check out West Palm Beach refinancing options that could lower your monthly payments or cut your term in half.

From single-family homes to duplex investments, even those seeking commercial properties can benefit from a commercial mortgage broker in West Palm Beach who understands the nuances of local zoning, asset class, and economic drivers.

The Power of Mortgage Preapproval

Before house hunting takes over your weekends, invest time in mortgage preapproval in West Palm Beach. It’s more than just a green light—it’s leverage.

A mortgage preapproval shows sellers you’re serious. It gives you clarity on your budget. And it allows you to move fast when the right listing appears. It’s not the final commitment, but it’s a critical step in the mortgage approval journey.

The beauty of getting a mortgage today is that once you have this preapproval in hand, the process unfolds with precision.

Navigating the Maze: Tips to Strengthen Your Mortgage Application

Want to improve your odds even more? Consider these less-discussed (but powerfully strategic) moves:

Avoid large purchases or new credit lines before applying. That new car can sabotage your loan qualifications.

Keep your job (or at least don’t change it mid-application). Lenders prize stability.

Check your credit reports. Fix inaccuracies. A 20-point jump in your credit score could unlock better terms.

Document everything. Especially if you’re self-employed or have multiple income streams. Paper trails impress lenders.

Shop around. Don’t settle for the first offer. Compare local mortgage lenders in West Palm Beach to find your best fit.

Refinance Renaissance: A Second Chance to Save

Not buying—but already own? Let’s talk refinance programs.

With credit availability rising, those who bought at higher rates last year may now qualify for better terms. A strategic refi could mean a lower payment, a shorter term, or even pulling equity for renovations or investments.

The rise in mortgage credit availability benefits more than just buyers—it reopens doors for owners ready to retool.

Shifting Standards Without Losing Stability

The current climate feels refreshingly balanced. We’re seeing a responsible expansion in credit access, with banks cautiously broadening their criteria.

Yes, stricter requirements still apply compared to 2005. But the presence of guardrails doesn’t mean the road is closed. It means the journey is safer, smarter, and more sustainable.

For the motivated borrower with a realistic view and the right support, getting approved for a mortgage is absolutely within reach.

Bottom Line: The Moment is Now

Whether you’re a first-time homebuyer in West Palm, an investor seeking a commercial mortgage broker in West Palm Beach, or someone exploring West Palm Beach refinancing options, the landscape is inviting.

The combination of easing lending standards, renewed credit availability, and strategic financing options means that you have more tools than ever before.

This is not 2008.

This is a recalibrated market—one where today’s lending levels offer opportunity without jeopardizing stability.

So if you’ve been hesitating, wondering whether this is your moment to get a mortgage, the data, the experts, and the trends all point to yes.

Your future address may already be waiting.

Now all you need is the key.

Need Help Exploring the Best Mortgage Rates in West Palm Beach or Understanding Your Credit Access Today?

Connect with a trusted West Palm Beach mortgage broker or local expert. Leverage tools like mortgage calculators, lock in preapproval, and turn your dream into a contract.

It’s time to unlock your opportunity.

Read from source: “Click Me”

What You Should Know About Getting a Mortgage Today

What You Should Know About Getting a Mortgage Today

If you’ve been putting off buying a home because you thought getting approved would be too hard, know this: qualifying for a mortgage is starting to get a bit more achievable, but lending standards are still strong.

Lenders are making it slightly easier for well-qualified buyers to access financing, which is opening more doors for people ready to make a move.

So, if strict requirements were holding you back, this shift could be the opportunity you’ve been waiting for, without repeating the risky lending practices that led to the housing crash back in 2008.

Lenders Are Opening More Doors

Banks are offering credit to more people in an effort to boost activity in the housing market, including buyers who have lower credit scores or smaller down payments. And that means more people are getting approved for mortgages.

But it doesn’t mean we’re heading for another crash like 2008. Even with the slight easing lately, lending standards today are still much tighter than they were back then.

According to the Mortgage Bankers Association (MBA), the Mortgage Credit Availability Index (MCAI) has been going up. This index shows how easy or hard it is for people to get a mortgage.

When the index rises, it means banks are easing their lending standards. And in May, credit availability hit its highest point in almost three years (see graph below):

Why does this matter to you? It means you may now be able to qualify for a mortgage that you wouldn’t have just a few months ago. The National Association of Underwriters (NAMU) explains:

“Mortgage credit availability surged in May, reaching its highest level since August 2022. The uptick signals that lenders are increasingly willing to loosen underwriting standards, providing borrowers with greater access to financing options . . .”

But What About 2008?

Now, you might be thinking, “Didn’t looser lending standards play a role in the 2008 housing crash?” That’s a smart question – and an important one. But here’s the difference. While credit availability is rising, lending standards are still under control.

Based on MCAI data going all the way back to 2004, today’s lending levels are still way below what they were leading up to the housing bubble (see graph below):

So, increasing mortgage credit availability right now isn’t a concern. It’s just a good thing for anyone looking to buy a home. As Brett Hively, SVP of Mortgage, Finance, and Strategy at Ameris Bancorp, recently said:

“This uptick is opening the door for many borrowers to move forward with a home purchase or a refinance program.”

So, if you’ve been holding back because you thought you couldn’t get approved for a mortgage, it’s worth finding out what’s possible today. Let’s talk with a lender about your options and see if you’re ready to take that next step toward homeownership.

More About:

What You Should Know About Getting a Mortgage Today

The path to homeownership is paved with a thousand questions, but one stands out for most aspiring buyers: How do I actually get a mortgage today? The terrain may feel unfamiliar, even intimidating, especially after hearing horror stories from the 2008 Housing Crisis. But take a breath—because the rules of engagement have evolved, and if you know how to navigate them, the doors to your dream home could swing wide open.

Let’s talk about what’s happening in the housing market, how lenders are changing their tune, and what it truly means to get approved for a mortgage in this new era.

The Lending Landscape: A Market in Motion

Gone are the reckless, fast-and-loose lending days that led to the housing crash. Today’s lending standards are no longer based on a “fog-the-mirror” qualification test. Instead, they’re grounded in stability. And yet, something interesting is happening.

Lenders are opening more doors.

They’re not throwing out caution, but they are becoming more flexible. We’re witnessing a deliberate trend—easing lending standards without echoing the risky lending practices that once set the stage for disaster. That’s a crucial distinction.

The Mortgage Bankers Association (MBA) recently reported a noticeable mortgage credit surge, and its Mortgage Credit Availability Index (MCAI) is rising steadily. That’s the pulse of how easy it is to obtain mortgage financing. And right now? The patient is healthy.

What does this mean for you? It means credit access is expanding. It means people with credit scores that are “good enough” may finally find themselves qualifying for loans they were locked out of just a year ago.

Not 2008 All Over Again

The shadow of the 2008 Housing Crisis still haunts many would-be buyers. Understandably so. But context is everything.

Back then, credit availability was so loose, it was barely tethered to reality. Loans were issued with no income verification, no asset checks—sometimes no job at all. The housing bubble inflated beyond reason. When it popped, the economic fallout was catastrophic.

But let’s be very clear: today’s lending levels are nothing like what we saw back then.

The Mortgage Credit Availability Index may be up, but it’s still well below pre-crash levels. The bar for loan qualifications remains responsibly high. Think of it as a “flexible but firm” approach. You’re not being set up for failure; you’re being invited to prove readiness.

The Rise of the Well-Qualified Borrower

Today’s lending model favors well-qualified buyers to access financing. That includes those with solid employment, a steady income stream, reasonable debt-to-income ratios, and—yes—a decent credit score.

But here’s the surprising twist: even first-time homebuyers or borrowers with smaller down payments are finding options.

Mortgage lenders aren’t just looking for perfection—they’re looking for potential.

The National Association of Mortgage Underwriters (NAMU) reported that underwriting standards have started to loosen just enough to give more people a fair shot. Think of it as widening the gate—not lowering the fence.

What It Takes to Get Approved for a Mortgage Today

There’s a mystique around getting approved for mortgages, but it boils down to five essential pillars:

Credit Score

The higher, the better. But don’t panic if you’re not in the 800s. A score above 620 can get you in the game, especially if other metrics are strong.Down Payment

While 20% used to be the golden rule, it’s not required today. Plenty of programs exist that accommodate smaller down payments, especially for first-time homebuyers.Income Verification

W-2s, pay stubs, tax returns—expect a thorough examination. The stronger and more stable your income, the easier your path.Debt-to-Income Ratio (DTI)

This is your monthly debt divided by your gross income. Most lenders prefer a DTI below 43%, but some may stretch a little depending on other strengths.Assets and Reserves

Cash in the bank counts. So do retirement accounts and other investments. Mortgage lenders want to know you have a cushion.

Once you align these stars, your mortgage application has a high probability of approval. The best part? The process, while still detailed, has never been more digital-friendly or streamlined than it is now.

Local Advantage: West Palm Beach Mortgage Insights

If you’re in South Florida and searching for Affordable West Palm Beach home loans, you’re in a particularly favorable environment.

Working with a West Palm Beach mortgage broker means tapping into local insight, tailored financing options, and access to some of the best mortgage rates in West Palm Beach. This isn’t about fitting into a national box—it’s about finding a loan structure that works for you.

And if you’re exploring first time home buyer loans in West Palm Beach, options abound—from FHA loans to grant assistance programs that can ease the burden of your down payment.

Need to run the numbers? Plug into West Palm Beach mortgage calculators to get a clear snapshot of affordability. Want a second look at refinancing your current loan? Check out West Palm Beach refinancing options that could lower your monthly payments or cut your term in half.

From single-family homes to duplex investments, even those seeking commercial properties can benefit from a commercial mortgage broker in West Palm Beach who understands the nuances of local zoning, asset class, and economic drivers.

The Power of Mortgage Preapproval

Before house hunting takes over your weekends, invest time in mortgage preapproval in West Palm Beach. It’s more than just a green light—it’s leverage.

A mortgage preapproval shows sellers you’re serious. It gives you clarity on your budget. And it allows you to move fast when the right listing appears. It’s not the final commitment, but it’s a critical step in the mortgage approval journey.

The beauty of getting a mortgage today is that once you have this preapproval in hand, the process unfolds with precision.

Navigating the Maze: Tips to Strengthen Your Mortgage Application

Want to improve your odds even more? Consider these less-discussed (but powerfully strategic) moves:

Avoid large purchases or new credit lines before applying. That new car can sabotage your loan qualifications.

Keep your job (or at least don’t change it mid-application). Lenders prize stability.

Check your credit reports. Fix inaccuracies. A 20-point jump in your credit score could unlock better terms.

Document everything. Especially if you’re self-employed or have multiple income streams. Paper trails impress lenders.

Shop around. Don’t settle for the first offer. Compare local mortgage lenders in West Palm Beach to find your best fit.

Refinance Renaissance: A Second Chance to Save

Not buying—but already own? Let’s talk refinance programs.

With credit availability rising, those who bought at higher rates last year may now qualify for better terms. A strategic refi could mean a lower payment, a shorter term, or even pulling equity for renovations or investments.

The rise in mortgage credit availability benefits more than just buyers—it reopens doors for owners ready to retool.

Shifting Standards Without Losing Stability

The current climate feels refreshingly balanced. We’re seeing a responsible expansion in credit access, with banks cautiously broadening their criteria.

Yes, stricter requirements still apply compared to 2005. But the presence of guardrails doesn’t mean the road is closed. It means the journey is safer, smarter, and more sustainable.

For the motivated borrower with a realistic view and the right support, getting approved for a mortgage is absolutely within reach.

Bottom Line: The Moment is Now

Whether you’re a first-time homebuyer in West Palm, an investor seeking a commercial mortgage broker in West Palm Beach, or someone exploring West Palm Beach refinancing options, the landscape is inviting.

The combination of easing lending standards, renewed credit availability, and strategic financing options means that you have more tools than ever before.

This is not 2008.

This is a recalibrated market—one where today’s lending levels offer opportunity without jeopardizing stability.

So if you’ve been hesitating, wondering whether this is your moment to get a mortgage, the data, the experts, and the trends all point to yes.

Your future address may already be waiting.

Now all you need is the key.

Need Help Exploring the Best Mortgage Rates in West Palm Beach or Understanding Your Credit Access Today?

Connect with a trusted West Palm Beach mortgage broker or local expert. Leverage tools like mortgage calculators, lock in preapproval, and turn your dream into a contract.

It’s time to unlock your opportunity.

Read from source: “Click Me”

© Copyright 2025 Epic Loan Solutions and its licensors | All Rights Reserved.