We write about Epic Loan Solutions!

Subscribe to our newsletter and keep up to date!

We write about Epic Loan Solutions!

Subscribe to our newsletter and keep up to date!

Many Veterans Don’t Know about This VA Home Loan Benefit

Many Veterans Don’t Know about This VA Home Loan Benefit

For 80 years, Veterans Affairs (VA) home loans have helped countless Veterans buy a home. But even though a lot of Veterans have access to this powerful program, the majority don’t know about one of its core benefits.

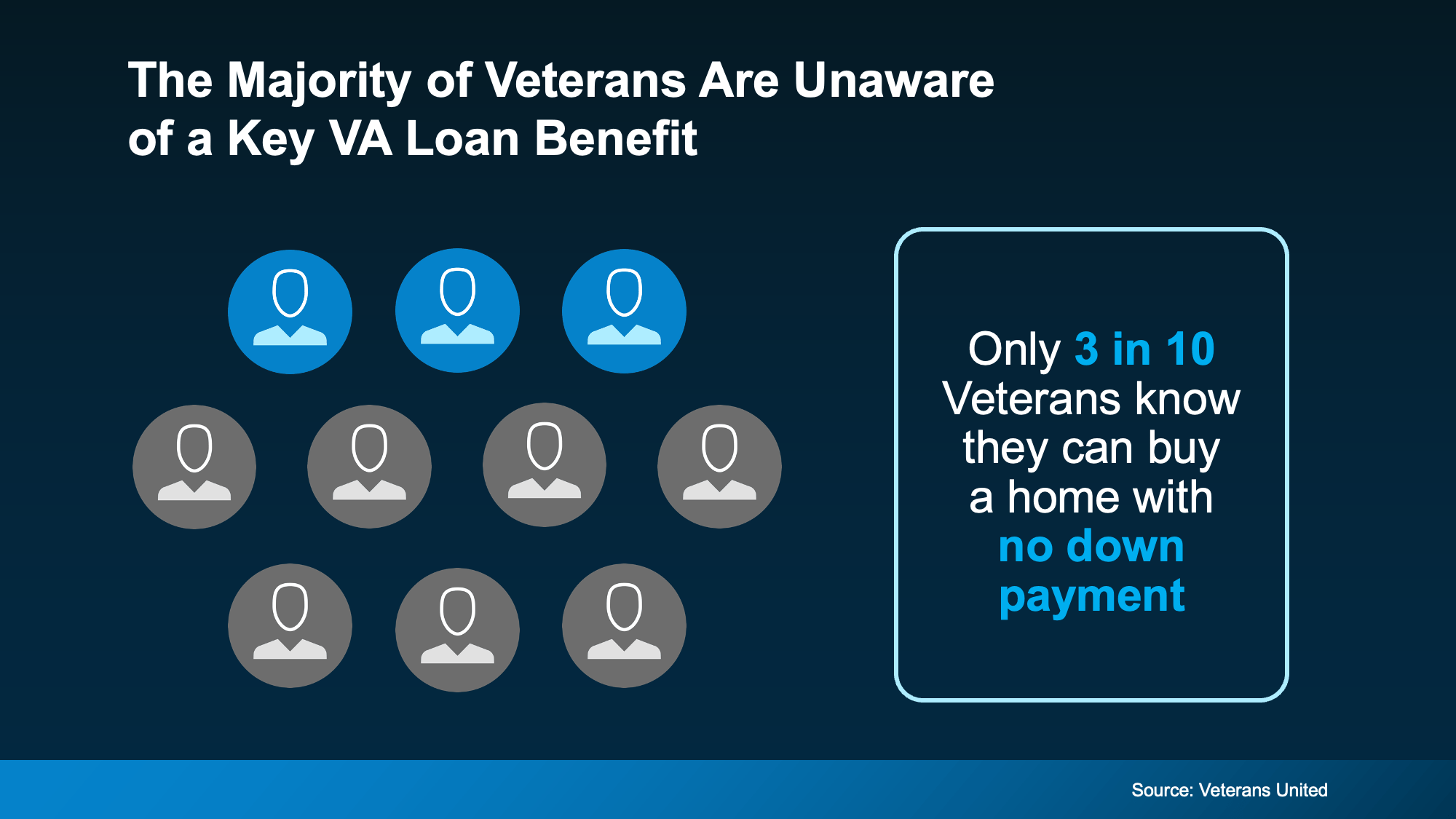

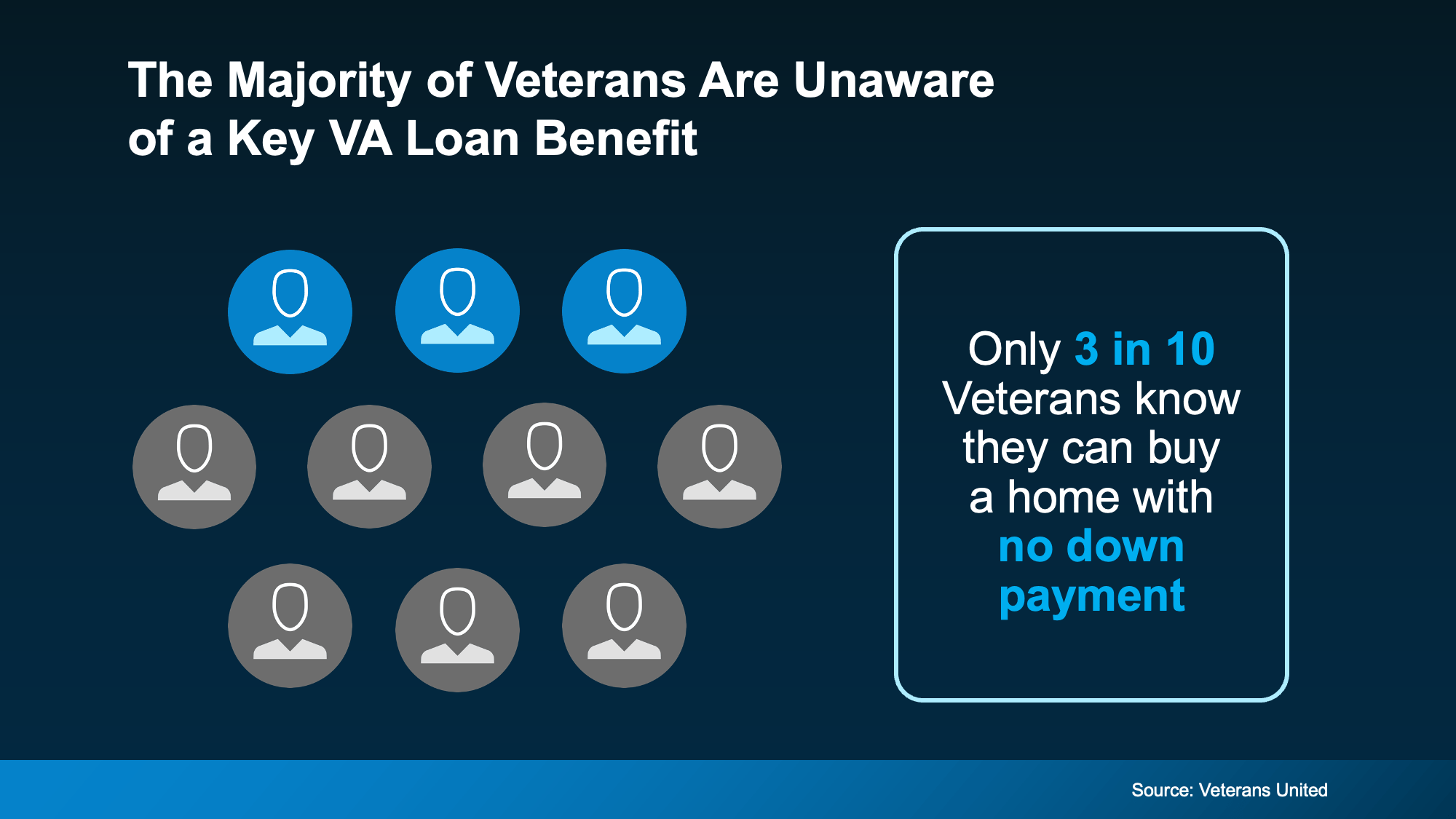

According to a report from Veterans United only 3 in 10 Veterans are aware they may be able to buy a home with no down payment with a VA loan (see visual below):

That means 7 out of every 10 Veterans could be missing out on a key homebuying advantage.

That’s why it’s so important for Veterans, and anyone who cares about a Veteran, to be aware of this program. As Veterans United explains, VA home loans:

“. . . come with a list of big-time benefits, including $0 down payment, no mortgage insurance, flexible and forgiving credit guidelines and the industry’s lowest average fixed interest rates.”

The Benefits of VA Home Loans

These loans are designed to make buying a home more achievable for those who have served. And, by extension, they also give their families the opportunity to plant roots and build equity in a home of their own. Here are some of the biggest advantages for this type of loan according to the Department of Veterans Affairs:

Options for No Down Payment: One of the biggest perks is that many Veterans can buy a home with no down payment at all.

Limited Closing Costs: With VA loans, there are limits on the types of closing costs Veterans have to pay. This helps keep more money in your pocket when you’re finalizing your purchase.

No Private Mortgage Insurance (PMI): Unlike many other loan types, VA loans don’t require PMI, even with lower down payments. This means lower monthly payments, which can add up to big savings over time.

If you want to learn more, your best resource for all the options and advantages of VA loans is your team of expert real estate professionals, including a local agent and a trusted lender.

VA home loans offer life-changing assistance, and a trusted lender and agent can help make sure you understand the details and are ready to move forward with a solid plan.

Do you know if you’re eligible for a VA home loans? Talk to a trusted lender who can help you see if you’d qualify.

Many Veterans Don’t Know About This VA Home Loan Benefit

The Hidden Financial Power of VA Home Loans Every Veteran Should Know

For over 80 years, Veterans Affairs (VA) home loans have quietly revolutionized the dream of homeownership for those who’ve worn the uniform. And yet, astonishingly, millions of Veterans are unaware of one of the most powerful benefits embedded within this extraordinary program: the ability for Veterans to buy a home with no down payment at all.

That’s not just helpful—it’s life-changing.

In an era where housing affordability seems like a fading myth, VA home loans still stand as a lighthouse in the storm. But if Veterans don’t know about them, they can’t use them. And that’s a problem. Because buried within the robust toolbox of VA loan benefits is a key homebuying advantage that slashes barriers, reduces costs, and opens doors wide open—literally.

Let’s pull back the curtain.

The Secret That Shouldn’t Be a Secret: No Down Payment

This is not a gimmick. It’s not a limited-time offer. It’s not something buried in legal jargon that disappears with fine print.

Veterans can buy a home with no down payment at all. Zero. Zilch. Nada.

This unique VA home loan benefit removes the single largest roadblock standing in the way for most first-time homebuyers—saving up for a hefty down payment. Traditional loans might require anywhere from 3% to 20% upfront. On a $350,000 home, that’s a minimum of $10,500—and possibly up to $70,000 or more.

With VA loans, qualified Veterans skip that entirely. That means the dream of buying a home doesn’t have to be years away. It can happen now.

And it’s not just about accessibility. It’s about dignity. It’s about recognizing the sacrifices made and honoring them with tangible, practical help that builds a future.

The Overlooked Perks: More Than Just the Down Payment

While the no down payment feature steals the spotlight, VA loans are a veritable treasure chest of other advantages. Let’s unpack the rest of this elite lineup of VA loan benefits:

1. No Private Mortgage Insurance (PMI)

Most conventional loans stick you with Private Mortgage Insurance (PMI) if you don’t pony up a 20% down payment. PMI can be an expensive burden that quietly drains your wallet every single month.

With VA home loans, there’s no mortgage insurance required. Ever. That’s real money staying in your pocket—every single month.

2. Lowest Average Fixed Interest Rates in the Industry

Yes, really. According to multiple mortgage industry reports, VA loans consistently offer the lowest average fixed interest rates. That means lower monthly payments, more manageable budgeting, and a lighter financial load over the life of the loan.

3. Flexible Credit Guidelines

Traditional loan programs often require a pristine credit history. Miss a couple of payments in your past, and you’re often out of luck.

Not so with VA home loans. These loans offer credit guidelines that are more flexible and forgiving. They’re designed to work with real people who’ve faced real challenges—not punish them for it.

4. Limited Closing Costs

Wondering about the types of closing costs Veterans have to pay? The Department of Veterans Affairs puts a cap on them. There are strict limits to how much Veterans can be charged, making the process more affordable and transparent.

These closing costs savings make a huge difference, especially in competitive housing markets where every dollar matters.

The Importance of Building Equity—Fast

Owning a home isn’t just a point of pride—it’s a financial game-changer. Each monthly payment you make isn’t vanishing into a landlord’s account. It’s building wealth. It’s creating security.

You build equity in a home every time you pay down your loan or your property value rises. Over time, that equity becomes one of your most valuable assets. It can fund renovations, support retirement, help send your kids to college—or provide a legacy.

When Veterans use VA home loans to buy a home, they’re not just moving into four walls and a roof. They’re stepping into a wealth-building machine with rocket fuel.

Who’s Eligible?

Eligibility for VA loans is broader than many think. Active-duty service members, certain members of the National Guard and Reserves, Veterans, and in some cases even surviving spouses may qualify.

But here’s the kicker: many who qualify don’t even know they’re eligible.

That’s why working with expert real estate professionals—people who know the ins and outs of VA home loan benefits—is crucial. A trusted lender, a real estate agent familiar with the program, and a local agent who knows the market can be your guiding team.

Local Power: West Palm Beach and the VA Advantage

For those looking to settle in South Florida, especially around West Palm Beach, VA loans can open up golden opportunities.

There’s a strong Veteran presence in this region, and Affordable West Palm Beach home loans tailored for Veterans make the dream attainable.

Looking for the best mortgage rates in West Palm Beach? VA home loans often outperform conventional rates—even more so when you team up with the right West Palm Beach mortgage broker.

Need help navigating the maze? Whether you’re hunting for first time home buyer loans in West Palm Beach, checking West Palm Beach refinancing options, or just playing with numbers on West Palm Beach mortgage calculators, the resources are here.

From property loan advice in West Palm Beach to finding a commercial mortgage broker in West Palm Beach, the key is finding local mortgage lenders in West Palm Beach who understand how to unlock the VA home loan benefit.

Even better, get mortgage preapproval in West Palm Beach before you begin shopping. This makes your offer stronger and your buying process smoother.

Why This Is So Important for Veterans

Let’s face it: Veterans face a unique set of challenges transitioning from military life to civilian life. The structure changes. The income shifts. The benefits can feel confusing or buried in red tape.

That’s why this program matters so much. The VA home loan is one of the most powerful tools Veterans have at their disposal—and too many are leaving it on the table.

It’s not just about loan options. It’s about giving Veterans the homebuying advantage they earned through their service.

What to Do Next

If you’re a Veteran, or know someone who is, now is the time to act. The real estate market moves fast. Interest rates fluctuate. But the benefits of the VA home loan are steady, solid, and ready for action.

Your first step? Connect with expert real estate professionals. Talk to a trusted lender who knows the VA process inside and out. Pair up with a local agent who can show you properties that fit your lifestyle and your budget.

With a good team behind you, the path from “maybe someday” to “welcome home” becomes crystal clear.

The Bottom Line

The fact that only 3 in 10 Veterans know about this VA home loan benefit is more than surprising—it’s unacceptable.

Because when you tally it all up—the no down payment, the lowest average fixed interest rates, the lack of mortgage insurance, the limited closing costs, and the ability to build equity fast—there is no better homebuying advantage in America today for those who’ve served.

So, whether you’re eyeing a cozy condo in Delray, a waterfront villa in Palm Beach, or a suburban retreat in Wellington, know this:

VA loans make it possible.

Your service deserves a home.

Your journey deserves a future.

And your legacy deserves equity.

Let a VA home loan carry you across the threshold.

Keywords included: Benefits, Build Equity, Build Equity In A Home, Buy A Home, Buying A Home, Closing Costs, Credit Guidelines, Department Of Veterans Affairs, Eligibility, Expert Real Estate Professionals, Fixed Interest Rates, Homebuying Advantage, Important For Veterans, Key Homebuying Advantage, Lender, Loan Options, Local Agent, Lowest Average Fixed Interest Rates, Monthly Payments, Mortgage Insurance, No Down Payment, Private Mortgage Insurance (PMI), Real Estate Agent, Real Estate Professionals, The Types Of Closing Costs Veterans Have, Trusted Lender, VA Home Loan, VA Home Loan Benefit, VA Home Loans, VA Loan Benefits, VA Loans, Veterans, Veterans Affairs (VA), Veterans Affairs (VA) Home Loans, Veterans Buy A Home, Veterans Can Buy A Home With No Down Payment At All, Veterans VA Home Loan, West Palm Beach mortgage broker, Affordable West Palm Beach home loans, Best mortgage rates in West Palm Beach, First time home buyer loans in West Palm Beach, West Palm Beach refinancing options, Local mortgage lenders in West Palm Beach, West Palm Beach mortgage calculators, Property loan advice in West Palm Beach, Commercial mortgage broker in West Palm Beach, Mortgage preapproval in West Palm Beach.

Read from source: “Click Me”

Many Veterans Don’t Know about This VA Home Loan Benefit

Many Veterans Don’t Know about This VA Home Loan Benefit

For 80 years, Veterans Affairs (VA) home loans have helped countless Veterans buy a home. But even though a lot of Veterans have access to this powerful program, the majority don’t know about one of its core benefits.

According to a report from Veterans United only 3 in 10 Veterans are aware they may be able to buy a home with no down payment with a VA loan (see visual below):

That means 7 out of every 10 Veterans could be missing out on a key homebuying advantage.

That’s why it’s so important for Veterans, and anyone who cares about a Veteran, to be aware of this program. As Veterans United explains, VA home loans:

“. . . come with a list of big-time benefits, including $0 down payment, no mortgage insurance, flexible and forgiving credit guidelines and the industry’s lowest average fixed interest rates.”

The Benefits of VA Home Loans

These loans are designed to make buying a home more achievable for those who have served. And, by extension, they also give their families the opportunity to plant roots and build equity in a home of their own. Here are some of the biggest advantages for this type of loan according to the Department of Veterans Affairs:

Options for No Down Payment: One of the biggest perks is that many Veterans can buy a home with no down payment at all.

Limited Closing Costs: With VA loans, there are limits on the types of closing costs Veterans have to pay. This helps keep more money in your pocket when you’re finalizing your purchase.

No Private Mortgage Insurance (PMI): Unlike many other loan types, VA loans don’t require PMI, even with lower down payments. This means lower monthly payments, which can add up to big savings over time.

If you want to learn more, your best resource for all the options and advantages of VA loans is your team of expert real estate professionals, including a local agent and a trusted lender.

VA home loans offer life-changing assistance, and a trusted lender and agent can help make sure you understand the details and are ready to move forward with a solid plan.

Do you know if you’re eligible for a VA home loans? Talk to a trusted lender who can help you see if you’d qualify.

Many Veterans Don’t Know About This VA Home Loan Benefit

The Hidden Financial Power of VA Home Loans Every Veteran Should Know

For over 80 years, Veterans Affairs (VA) home loans have quietly revolutionized the dream of homeownership for those who’ve worn the uniform. And yet, astonishingly, millions of Veterans are unaware of one of the most powerful benefits embedded within this extraordinary program: the ability for Veterans to buy a home with no down payment at all.

That’s not just helpful—it’s life-changing.

In an era where housing affordability seems like a fading myth, VA home loans still stand as a lighthouse in the storm. But if Veterans don’t know about them, they can’t use them. And that’s a problem. Because buried within the robust toolbox of VA loan benefits is a key homebuying advantage that slashes barriers, reduces costs, and opens doors wide open—literally.

Let’s pull back the curtain.

The Secret That Shouldn’t Be a Secret: No Down Payment

This is not a gimmick. It’s not a limited-time offer. It’s not something buried in legal jargon that disappears with fine print.

Veterans can buy a home with no down payment at all. Zero. Zilch. Nada.

This unique VA home loan benefit removes the single largest roadblock standing in the way for most first-time homebuyers—saving up for a hefty down payment. Traditional loans might require anywhere from 3% to 20% upfront. On a $350,000 home, that’s a minimum of $10,500—and possibly up to $70,000 or more.

With VA loans, qualified Veterans skip that entirely. That means the dream of buying a home doesn’t have to be years away. It can happen now.

And it’s not just about accessibility. It’s about dignity. It’s about recognizing the sacrifices made and honoring them with tangible, practical help that builds a future.

The Overlooked Perks: More Than Just the Down Payment

While the no down payment feature steals the spotlight, VA loans are a veritable treasure chest of other advantages. Let’s unpack the rest of this elite lineup of VA loan benefits:

1. No Private Mortgage Insurance (PMI)

Most conventional loans stick you with Private Mortgage Insurance (PMI) if you don’t pony up a 20% down payment. PMI can be an expensive burden that quietly drains your wallet every single month.

With VA home loans, there’s no mortgage insurance required. Ever. That’s real money staying in your pocket—every single month.

2. Lowest Average Fixed Interest Rates in the Industry

Yes, really. According to multiple mortgage industry reports, VA loans consistently offer the lowest average fixed interest rates. That means lower monthly payments, more manageable budgeting, and a lighter financial load over the life of the loan.

3. Flexible Credit Guidelines

Traditional loan programs often require a pristine credit history. Miss a couple of payments in your past, and you’re often out of luck.

Not so with VA home loans. These loans offer credit guidelines that are more flexible and forgiving. They’re designed to work with real people who’ve faced real challenges—not punish them for it.

4. Limited Closing Costs

Wondering about the types of closing costs Veterans have to pay? The Department of Veterans Affairs puts a cap on them. There are strict limits to how much Veterans can be charged, making the process more affordable and transparent.

These closing costs savings make a huge difference, especially in competitive housing markets where every dollar matters.

The Importance of Building Equity—Fast

Owning a home isn’t just a point of pride—it’s a financial game-changer. Each monthly payment you make isn’t vanishing into a landlord’s account. It’s building wealth. It’s creating security.

You build equity in a home every time you pay down your loan or your property value rises. Over time, that equity becomes one of your most valuable assets. It can fund renovations, support retirement, help send your kids to college—or provide a legacy.

When Veterans use VA home loans to buy a home, they’re not just moving into four walls and a roof. They’re stepping into a wealth-building machine with rocket fuel.

Who’s Eligible?

Eligibility for VA loans is broader than many think. Active-duty service members, certain members of the National Guard and Reserves, Veterans, and in some cases even surviving spouses may qualify.

But here’s the kicker: many who qualify don’t even know they’re eligible.

That’s why working with expert real estate professionals—people who know the ins and outs of VA home loan benefits—is crucial. A trusted lender, a real estate agent familiar with the program, and a local agent who knows the market can be your guiding team.

Local Power: West Palm Beach and the VA Advantage

For those looking to settle in South Florida, especially around West Palm Beach, VA loans can open up golden opportunities.

There’s a strong Veteran presence in this region, and Affordable West Palm Beach home loans tailored for Veterans make the dream attainable.

Looking for the best mortgage rates in West Palm Beach? VA home loans often outperform conventional rates—even more so when you team up with the right West Palm Beach mortgage broker.

Need help navigating the maze? Whether you’re hunting for first time home buyer loans in West Palm Beach, checking West Palm Beach refinancing options, or just playing with numbers on West Palm Beach mortgage calculators, the resources are here.

From property loan advice in West Palm Beach to finding a commercial mortgage broker in West Palm Beach, the key is finding local mortgage lenders in West Palm Beach who understand how to unlock the VA home loan benefit.

Even better, get mortgage preapproval in West Palm Beach before you begin shopping. This makes your offer stronger and your buying process smoother.

Why This Is So Important for Veterans

Let’s face it: Veterans face a unique set of challenges transitioning from military life to civilian life. The structure changes. The income shifts. The benefits can feel confusing or buried in red tape.

That’s why this program matters so much. The VA home loan is one of the most powerful tools Veterans have at their disposal—and too many are leaving it on the table.

It’s not just about loan options. It’s about giving Veterans the homebuying advantage they earned through their service.

What to Do Next

If you’re a Veteran, or know someone who is, now is the time to act. The real estate market moves fast. Interest rates fluctuate. But the benefits of the VA home loan are steady, solid, and ready for action.

Your first step? Connect with expert real estate professionals. Talk to a trusted lender who knows the VA process inside and out. Pair up with a local agent who can show you properties that fit your lifestyle and your budget.

With a good team behind you, the path from “maybe someday” to “welcome home” becomes crystal clear.

The Bottom Line

The fact that only 3 in 10 Veterans know about this VA home loan benefit is more than surprising—it’s unacceptable.

Because when you tally it all up—the no down payment, the lowest average fixed interest rates, the lack of mortgage insurance, the limited closing costs, and the ability to build equity fast—there is no better homebuying advantage in America today for those who’ve served.

So, whether you’re eyeing a cozy condo in Delray, a waterfront villa in Palm Beach, or a suburban retreat in Wellington, know this:

VA loans make it possible.

Your service deserves a home.

Your journey deserves a future.

And your legacy deserves equity.

Let a VA home loan carry you across the threshold.

Keywords included: Benefits, Build Equity, Build Equity In A Home, Buy A Home, Buying A Home, Closing Costs, Credit Guidelines, Department Of Veterans Affairs, Eligibility, Expert Real Estate Professionals, Fixed Interest Rates, Homebuying Advantage, Important For Veterans, Key Homebuying Advantage, Lender, Loan Options, Local Agent, Lowest Average Fixed Interest Rates, Monthly Payments, Mortgage Insurance, No Down Payment, Private Mortgage Insurance (PMI), Real Estate Agent, Real Estate Professionals, The Types Of Closing Costs Veterans Have, Trusted Lender, VA Home Loan, VA Home Loan Benefit, VA Home Loans, VA Loan Benefits, VA Loans, Veterans, Veterans Affairs (VA), Veterans Affairs (VA) Home Loans, Veterans Buy A Home, Veterans Can Buy A Home With No Down Payment At All, Veterans VA Home Loan, West Palm Beach mortgage broker, Affordable West Palm Beach home loans, Best mortgage rates in West Palm Beach, First time home buyer loans in West Palm Beach, West Palm Beach refinancing options, Local mortgage lenders in West Palm Beach, West Palm Beach mortgage calculators, Property loan advice in West Palm Beach, Commercial mortgage broker in West Palm Beach, Mortgage preapproval in West Palm Beach.

Read from source: “Click Me”

© Copyright 2025 Epic Loan Solutions and its licensors | All Rights Reserved.