We write about Epic Loan Solutions!

Subscribe to our newsletter and keep up to date!

We write about Epic Loan Solutions!

Subscribe to our newsletter and keep up to date!

Selling and Buying at the Same Time? Here’s What You Need To Know

Selling and Buying at the Same Time? Here’s What You Need To Know

If you’re a homeowner planning to move, you’re probably wondering what the process is going to look like and what you should tackle first:

Is it better to start by finding your next home?

Or should you sell your current house before you go out looking?

Ultimately, what’s right for you depends on a lot of factors. And that’s where an agent’s experience can really help make your next step clear.

They know your local market, the latest trends, and what’s working for other homeowners right now. And they’ll be able to make a recommendation based on their expertise and your needs.

But here’s a little bit of a sneak peek. In many cases today, getting your current home on the market first can put you in a better spot. Here’s why that order tends to work best (and how an agent can help).

The Advantages of Selling First

1. You’ll Unlock Your Home Equity

Selling your current home before you try to buy your next one allows you to access the equity you’ve built up – and based on home price appreciation over the past few years, that’s no small number. Data from Cotality (formerly CoreLogic) shows the average homeowner is sitting on $302K in equity today.

And once you sell, you can use that equity to pay for the down payment on your next house (and maybe even more). You could even have enough to buy your next house in cash. That’s a big deal, and it could make your next move a whole lot easier on your wallet.

2. You Won’t Be Juggling Two Mortgages

Trying to buy before you sell means you could wind up holding two mortgages, even if just for a few months. That can get expensive, fast – especially if there are unexpected repairs or delays. Selling first removes that stress and helps you move forward without the financial strain. As Ramsey Solutions says:

“It’s best to sell your old home before buying a new one to avoid unnecessary risks and possible headaches.”

3. You’ll Be in a Stronger Position When You Make an Offer

Sellers love a clean, simple offer. If you’ve already sold your house, you don’t need to make your offer contingent on that sale – and that can help you stand out. Your agent can position your offer to be as strong as possible, so you have the best shot at getting the home you want.

This can be a big advantage in competitive markets where sellers prefer buyers with fewer strings attached.

One Thing To Keep in Mind

But, like with anything in life, there are tradeoffs. As you weigh your options, consider this potential drawback, too:

1. You May Need a Place To Stay (Temporarily)

Once your house sells, you may need a short-term rental or to stay with family until you can move into your next home. Your agent can help you negotiate things like a post-closing occupancy (renting the home from the buyer for a set period) or flexible closing dates to help smooth out that transition as much as possible.

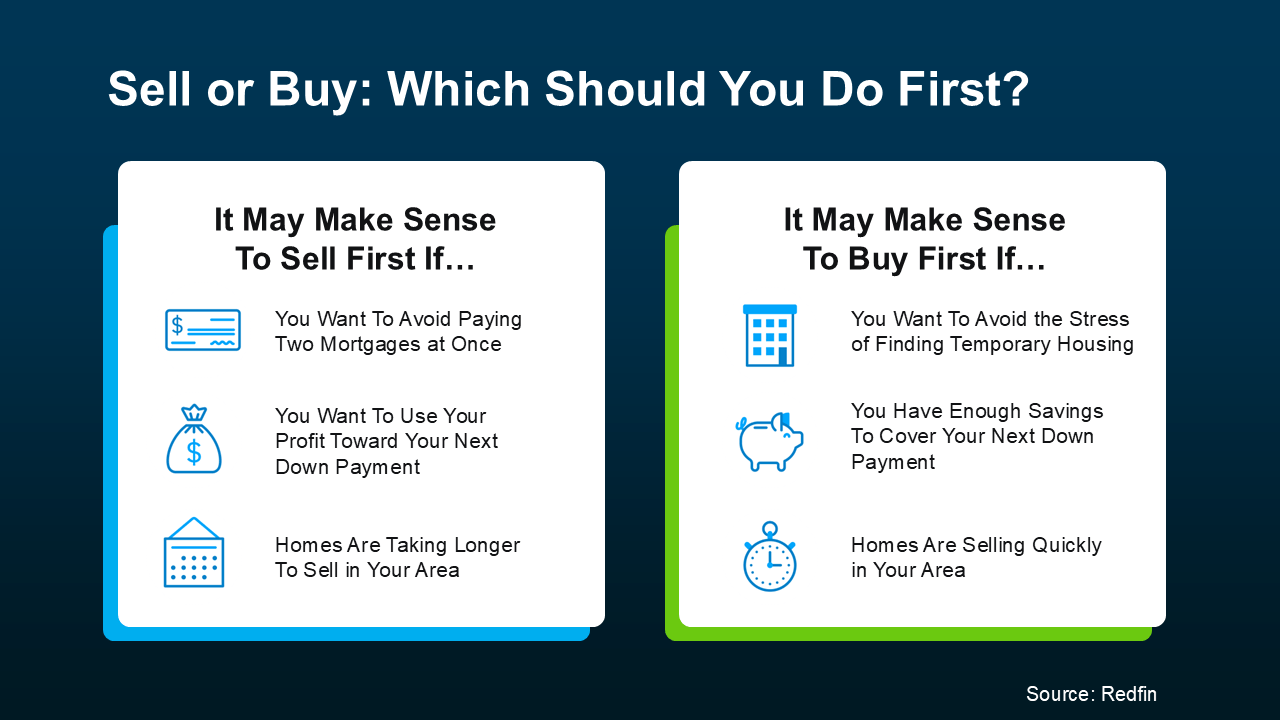

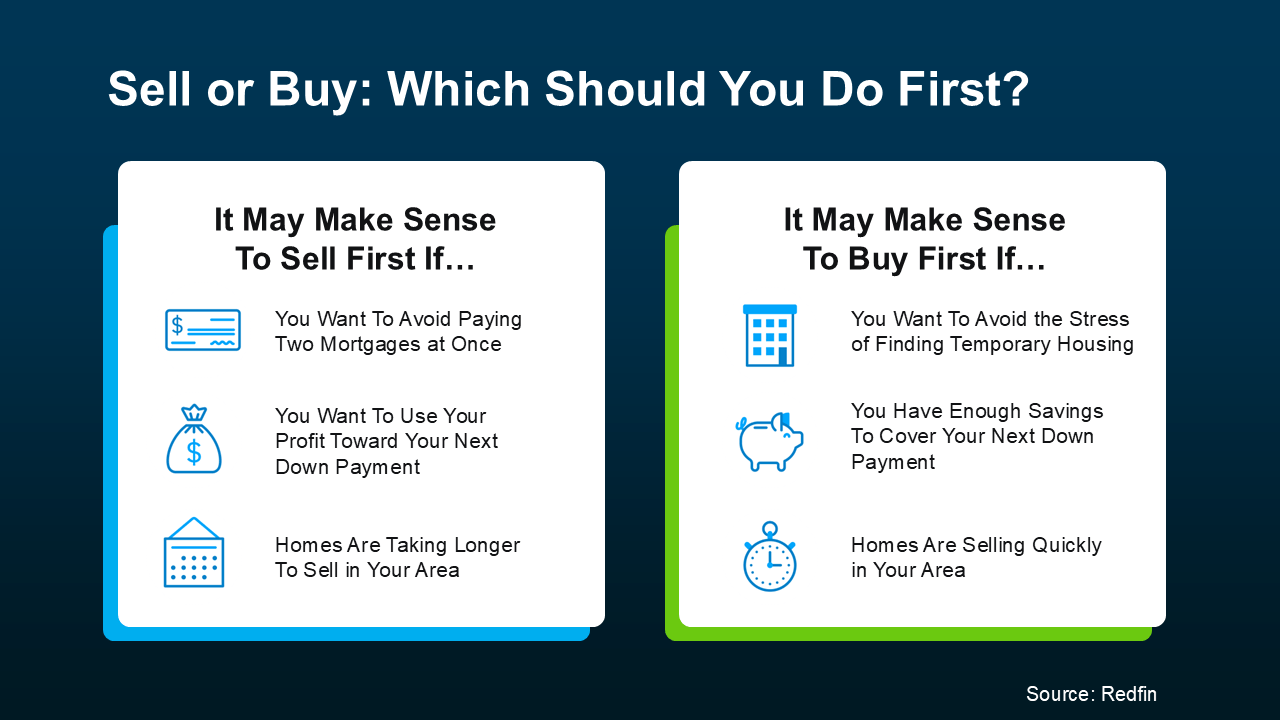

Here’s a simple visual that can help you think through your options (see below):

But the best way to determine what’s best for you and your specific situation? Talk to a trusted local agent.

In many cases, selling first doesn’t just give you clarity, it gives you options. It helps you buy with more confidence, more financial power, and less pressure.

If you’re ready to make a move but you’re not sure where to begin, let’s talk. We can walk through your potential equity, your timing, and your local market conditions so you can decide what’s right for you.

Selling and Buying at the Same Time? Here’s What You Need To Know

Navigating the delicate dance of selling and buying a home simultaneously can feel like walking a tightrope blindfolded. The stakes are high. The timing is crucial. And the logistics? Oh, they’re no walk in the park either.

Whether you’re a homeowner planning to move across the street or across the state, knowing how to orchestrate this complex transition is essential. The good news? It’s not only possible—it can also be wildly successful with the right strategy, the right mindset, and the right guidance.

The First Question: Buy First or Sell First?

This is the million-dollar question—literally. Is it best to sell your old home first, or should you buy before you sell?

The truth? What’s best for you depends on your personal timeline, financial cushion, and the condition of your local market.

Still, in today’s real estate climate, selling first has become the preferred method for many homeowners—and for good reason.

The Financial Freedom of Selling First

Putting your current home on the market and closing the sale before buying a new one unlocks a unique advantage: you can use that equity to pay for your next move.

Yes, that home equity you’ve built over time isn’t just paper value—it’s real, liquid buying power. And with recent home price appreciation, homeowners are sitting on piles of equity. According to recent reports, the average homeowner holds over $300,000 in equity right now. That’s no small change.

When you sell your current house, you’ll access the equity you’ve built up, giving you the chance to use that for a down payment on your next house, or better yet, make a full cash offer.

Now, imagine the cash offer advantage—sellers love it. No financing contingency. No hiccups with lenders. Just a clean, strong offer that’s hard to beat.

Selling First Means Fewer Headaches

Let’s face it—holding two mortgages is not a vibe.

When you buy before you sell, you may find yourself paying two mortgages at once. That’s a heavy burden on your wallet, especially if unexpected moving logistics or repair issues pop up. It introduces serious mortgage risk and potential financial strain.

Selling your current home first allows you to eliminate that burden altogether. You sell, then buy. Simple. Clean. Controlled.

And yes, that means you buy with confidence—or even better—buy with more confidence. You know exactly what you’ve got to work with financially.

Competitive Advantage in a Tight Market

In competitive markets where sellers prefer buyers with fewer strings attached, a contingent offer (one that depends on selling your old home) can be a major red flag to sellers. It introduces uncertainty. It slows down the buying process.

But when you’ve already sold? You walk into negotiations with unmatched offer strength.

You’ve got the money. You’ve got no strings. You’ve got the best shot at getting the home you want.

This is where an experienced real estate agent truly shines. Your agent can help you negotiate with precision, craft a compelling offer, and elevate your buying strategy to outshine the competition.

But… Let’s Talk Temporary Housing

While selling first has its advantages, it’s not without tradeoffs. One of the biggest? You may need temporary housing in between homes.

The market might not align perfectly. Your house sells, but your next home isn’t move-in ready. That’s when you may need a short-term rental, a crash pad with family, or even a hotel suite for a few weeks.

The upside? Your agent can assist in structuring deals with post-closing occupancy, rent-back agreements, or flexible closing dates—tools that can create much-needed breathing room during your transition.

Getting Your Home on the Market First

Want to start smart? Step one: getting your current home on the market as early as possible.

Doing so not only launches your selling process but also gives you a clearer picture of your potential equity and what you can afford when finding your next home.

A seasoned agent with a deep understanding of your local market and current market trends can help you maximize the value of your listing, stage it effectively, and price it competitively.

Because at the end of the day, how an agent can help isn’t just about paperwork—it’s about strategy, timing, and negotiation.

A Game Plan for Dual Success

Balancing the home selling process and the home-buying journey takes more than good luck. It requires vision, coordination, and the right partner to guide you.

Here’s a rough breakdown of the path forward:

Step 1: Meet With a Pro

Before listing or shopping, talk to a trusted local agent. Get a read on your timeline, budget, and market dynamics.

Step 2: List Your Current Home

Let the home on the market do the heavy lifting. Evaluate offers. Negotiate terms. Set expectations for the close date.

Step 3: Explore Your Buying Options

With the sale underway or closed, dive into the buying process. Evaluate your financial strength. Position yourself for success.

Step 4: Strategize Temporary Housing (If Needed)

Discuss short-term rental plans. Negotiate post-closing occupancy or a rent-back agreement if possible.

Step 5: Make Your Move

With funding in hand and strategy in place, move into your next home with clarity, security, and excitement.

West Palm Beach Buyers and Sellers: Special Considerations

If you’re navigating this journey in West Palm Beach, the stakes are even more nuanced. It’s a vibrant, fast-moving real estate environment with high demand and rising prices.

Working with a knowledgeable West Palm Beach mortgage broker can make a dramatic difference.

Explore options like:

Affordable West Palm Beach home loans

Best mortgage rates in West Palm Beach

First time home buyer loans in West Palm Beach

West Palm Beach refinancing options

Local mortgage lenders in West Palm Beach

West Palm Beach mortgage calculators

Property loan advice in West Palm Beach

Commercial mortgage broker in West Palm Beach

Mortgage preapproval in West Palm Beach

Having these tools and relationships in your back pocket will give you more financial power and allow you to act swiftly when your dream home hits the market.

Real Estate Guidance Is Your Greatest Asset

A successful simultaneous sale-and-purchase isn’t just about luck—it’s about preparation and partnering with pros who know the game.

Agents’ experience can really help demystify the journey, protect your financial interests, and streamline every step. Whether it’s pricing your home, evaluating your equity, or positioning your offer, the value of seasoned real estate guidance can’t be overstated.

And if you’re aiming for precision and power, the right mortgage partner matters, too. Whether you’re seeking mortgage preapproval in West Palm Beach or refining your buying strategy, aligning yourself with savvy advisors is a game-changer.

The Bottom Line

When it comes to selling and buying at the same time, don’t settle for a haphazard approach. Be bold. Be strategic.

Sell before you buy to unlock your equity, eliminate financial strain, and increase your offer strength. Utilize tools like flexible closing, post-closing occupancy, and rent-back agreements to smooth the transition. Above all, lean on experienced professionals to help you buy your next house with confidence and clarity.

Because in this market, it’s not just about moving—it’s about buying with confidence, claiming your space, and stepping into the future you’ve been dreaming about.

Read from source: “Click Me”

Selling and Buying at the Same Time? Here’s What You Need To Know

Selling and Buying at the Same Time? Here’s What You Need To Know

If you’re a homeowner planning to move, you’re probably wondering what the process is going to look like and what you should tackle first:

Is it better to start by finding your next home?

Or should you sell your current house before you go out looking?

Ultimately, what’s right for you depends on a lot of factors. And that’s where an agent’s experience can really help make your next step clear.

They know your local market, the latest trends, and what’s working for other homeowners right now. And they’ll be able to make a recommendation based on their expertise and your needs.

But here’s a little bit of a sneak peek. In many cases today, getting your current home on the market first can put you in a better spot. Here’s why that order tends to work best (and how an agent can help).

The Advantages of Selling First

1. You’ll Unlock Your Home Equity

Selling your current home before you try to buy your next one allows you to access the equity you’ve built up – and based on home price appreciation over the past few years, that’s no small number. Data from Cotality (formerly CoreLogic) shows the average homeowner is sitting on $302K in equity today.

And once you sell, you can use that equity to pay for the down payment on your next house (and maybe even more). You could even have enough to buy your next house in cash. That’s a big deal, and it could make your next move a whole lot easier on your wallet.

2. You Won’t Be Juggling Two Mortgages

Trying to buy before you sell means you could wind up holding two mortgages, even if just for a few months. That can get expensive, fast – especially if there are unexpected repairs or delays. Selling first removes that stress and helps you move forward without the financial strain. As Ramsey Solutions says:

“It’s best to sell your old home before buying a new one to avoid unnecessary risks and possible headaches.”

3. You’ll Be in a Stronger Position When You Make an Offer

Sellers love a clean, simple offer. If you’ve already sold your house, you don’t need to make your offer contingent on that sale – and that can help you stand out. Your agent can position your offer to be as strong as possible, so you have the best shot at getting the home you want.

This can be a big advantage in competitive markets where sellers prefer buyers with fewer strings attached.

One Thing To Keep in Mind

But, like with anything in life, there are tradeoffs. As you weigh your options, consider this potential drawback, too:

1. You May Need a Place To Stay (Temporarily)

Once your house sells, you may need a short-term rental or to stay with family until you can move into your next home. Your agent can help you negotiate things like a post-closing occupancy (renting the home from the buyer for a set period) or flexible closing dates to help smooth out that transition as much as possible.

Here’s a simple visual that can help you think through your options (see below):

But the best way to determine what’s best for you and your specific situation? Talk to a trusted local agent.

In many cases, selling first doesn’t just give you clarity, it gives you options. It helps you buy with more confidence, more financial power, and less pressure.

If you’re ready to make a move but you’re not sure where to begin, let’s talk. We can walk through your potential equity, your timing, and your local market conditions so you can decide what’s right for you.

Selling and Buying at the Same Time? Here’s What You Need To Know

Navigating the delicate dance of selling and buying a home simultaneously can feel like walking a tightrope blindfolded. The stakes are high. The timing is crucial. And the logistics? Oh, they’re no walk in the park either.

Whether you’re a homeowner planning to move across the street or across the state, knowing how to orchestrate this complex transition is essential. The good news? It’s not only possible—it can also be wildly successful with the right strategy, the right mindset, and the right guidance.

The First Question: Buy First or Sell First?

This is the million-dollar question—literally. Is it best to sell your old home first, or should you buy before you sell?

The truth? What’s best for you depends on your personal timeline, financial cushion, and the condition of your local market.

Still, in today’s real estate climate, selling first has become the preferred method for many homeowners—and for good reason.

The Financial Freedom of Selling First

Putting your current home on the market and closing the sale before buying a new one unlocks a unique advantage: you can use that equity to pay for your next move.

Yes, that home equity you’ve built over time isn’t just paper value—it’s real, liquid buying power. And with recent home price appreciation, homeowners are sitting on piles of equity. According to recent reports, the average homeowner holds over $300,000 in equity right now. That’s no small change.

When you sell your current house, you’ll access the equity you’ve built up, giving you the chance to use that for a down payment on your next house, or better yet, make a full cash offer.

Now, imagine the cash offer advantage—sellers love it. No financing contingency. No hiccups with lenders. Just a clean, strong offer that’s hard to beat.

Selling First Means Fewer Headaches

Let’s face it—holding two mortgages is not a vibe.

When you buy before you sell, you may find yourself paying two mortgages at once. That’s a heavy burden on your wallet, especially if unexpected moving logistics or repair issues pop up. It introduces serious mortgage risk and potential financial strain.

Selling your current home first allows you to eliminate that burden altogether. You sell, then buy. Simple. Clean. Controlled.

And yes, that means you buy with confidence—or even better—buy with more confidence. You know exactly what you’ve got to work with financially.

Competitive Advantage in a Tight Market

In competitive markets where sellers prefer buyers with fewer strings attached, a contingent offer (one that depends on selling your old home) can be a major red flag to sellers. It introduces uncertainty. It slows down the buying process.

But when you’ve already sold? You walk into negotiations with unmatched offer strength.

You’ve got the money. You’ve got no strings. You’ve got the best shot at getting the home you want.

This is where an experienced real estate agent truly shines. Your agent can help you negotiate with precision, craft a compelling offer, and elevate your buying strategy to outshine the competition.

But… Let’s Talk Temporary Housing

While selling first has its advantages, it’s not without tradeoffs. One of the biggest? You may need temporary housing in between homes.

The market might not align perfectly. Your house sells, but your next home isn’t move-in ready. That’s when you may need a short-term rental, a crash pad with family, or even a hotel suite for a few weeks.

The upside? Your agent can assist in structuring deals with post-closing occupancy, rent-back agreements, or flexible closing dates—tools that can create much-needed breathing room during your transition.

Getting Your Home on the Market First

Want to start smart? Step one: getting your current home on the market as early as possible.

Doing so not only launches your selling process but also gives you a clearer picture of your potential equity and what you can afford when finding your next home.

A seasoned agent with a deep understanding of your local market and current market trends can help you maximize the value of your listing, stage it effectively, and price it competitively.

Because at the end of the day, how an agent can help isn’t just about paperwork—it’s about strategy, timing, and negotiation.

A Game Plan for Dual Success

Balancing the home selling process and the home-buying journey takes more than good luck. It requires vision, coordination, and the right partner to guide you.

Here’s a rough breakdown of the path forward:

Step 1: Meet With a Pro

Before listing or shopping, talk to a trusted local agent. Get a read on your timeline, budget, and market dynamics.

Step 2: List Your Current Home

Let the home on the market do the heavy lifting. Evaluate offers. Negotiate terms. Set expectations for the close date.

Step 3: Explore Your Buying Options

With the sale underway or closed, dive into the buying process. Evaluate your financial strength. Position yourself for success.

Step 4: Strategize Temporary Housing (If Needed)

Discuss short-term rental plans. Negotiate post-closing occupancy or a rent-back agreement if possible.

Step 5: Make Your Move

With funding in hand and strategy in place, move into your next home with clarity, security, and excitement.

West Palm Beach Buyers and Sellers: Special Considerations

If you’re navigating this journey in West Palm Beach, the stakes are even more nuanced. It’s a vibrant, fast-moving real estate environment with high demand and rising prices.

Working with a knowledgeable West Palm Beach mortgage broker can make a dramatic difference.

Explore options like:

Affordable West Palm Beach home loans

Best mortgage rates in West Palm Beach

First time home buyer loans in West Palm Beach

West Palm Beach refinancing options

Local mortgage lenders in West Palm Beach

West Palm Beach mortgage calculators

Property loan advice in West Palm Beach

Commercial mortgage broker in West Palm Beach

Mortgage preapproval in West Palm Beach

Having these tools and relationships in your back pocket will give you more financial power and allow you to act swiftly when your dream home hits the market.

Real Estate Guidance Is Your Greatest Asset

A successful simultaneous sale-and-purchase isn’t just about luck—it’s about preparation and partnering with pros who know the game.

Agents’ experience can really help demystify the journey, protect your financial interests, and streamline every step. Whether it’s pricing your home, evaluating your equity, or positioning your offer, the value of seasoned real estate guidance can’t be overstated.

And if you’re aiming for precision and power, the right mortgage partner matters, too. Whether you’re seeking mortgage preapproval in West Palm Beach or refining your buying strategy, aligning yourself with savvy advisors is a game-changer.

The Bottom Line

When it comes to selling and buying at the same time, don’t settle for a haphazard approach. Be bold. Be strategic.

Sell before you buy to unlock your equity, eliminate financial strain, and increase your offer strength. Utilize tools like flexible closing, post-closing occupancy, and rent-back agreements to smooth the transition. Above all, lean on experienced professionals to help you buy your next house with confidence and clarity.

Because in this market, it’s not just about moving—it’s about buying with confidence, claiming your space, and stepping into the future you’ve been dreaming about.

Read from source: “Click Me”

© Copyright 2025 Epic Loan Solutions and its licensors | All Rights Reserved.