The Housing Market Is Turning a Corner Going into 2026

Why the Housing Market in West Palm Beach Is Turning a Corner — What to Expect in 2026

The housing market in West Palm Beach, North Palm Beach, and Wellington, Florida is quietly shifting. While the past few years have been marked by high mortgage rates and buyer hesitation, there’s a growing sense of momentum—a slow but steady change that could set the stage for a more active 2026.

It’s not a frenzy. But it’s more than just a pause. For homebuyers, sellers, and investors in our local market, now may be the time to start positioning for what’s coming next.

In this post, we’ll break down the three big trends driving this recovery, what the latest forecast from major institutions like Fannie Mae and Freddie Mac says, and how you can make smart moves in West Palm Beach, North Palm Beach, or Wellington with guidance from Christian Penner, your trusted Mortgage Broker, Mortgage Lender, Real Estate Agent, and Real Estate Advisor at America’s Mortgage Solutions (AMS).

1. Mortgage Rates Are Finally Easing

A Broader Trend, Not Just a Dip

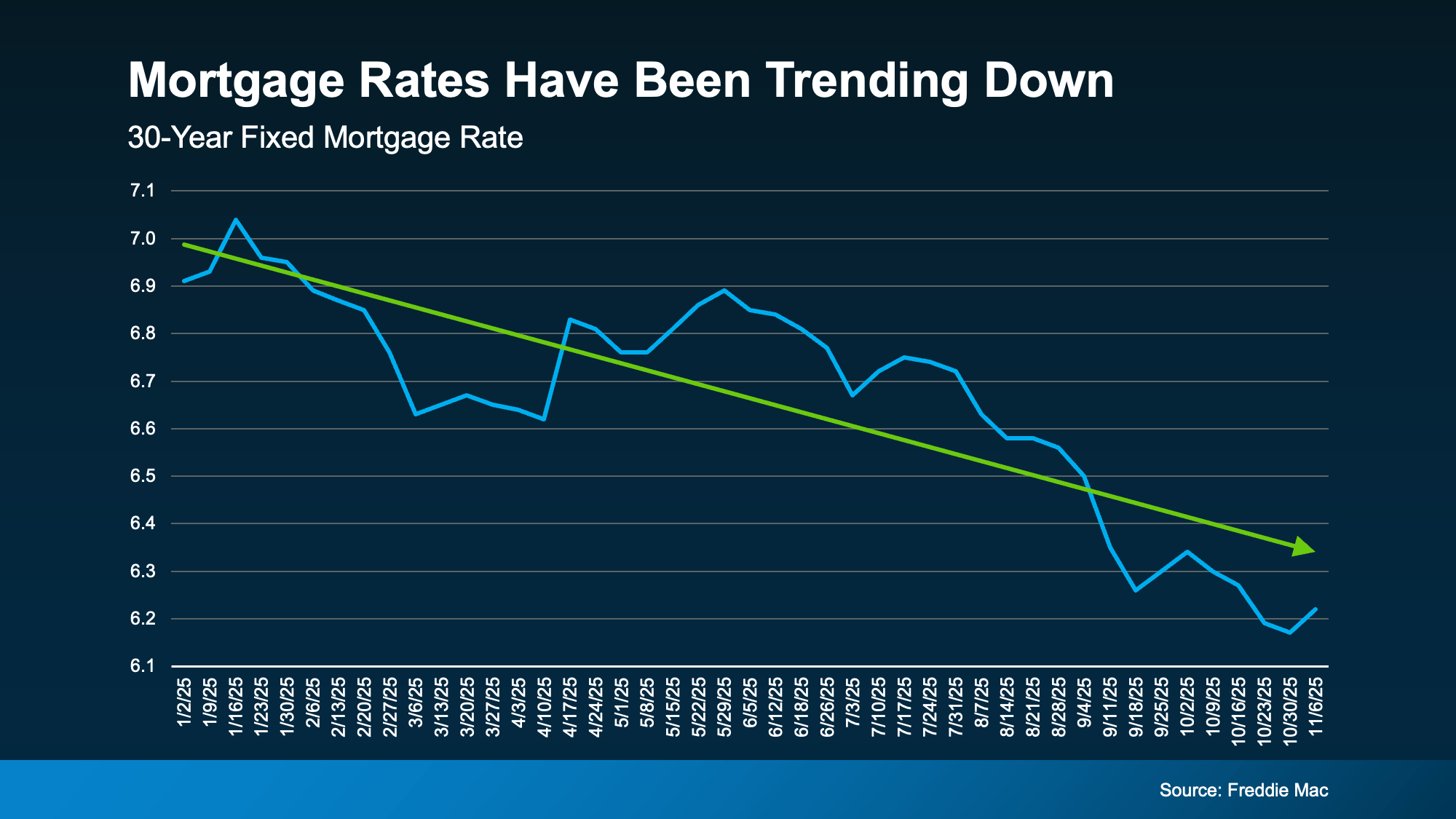

One of the most important developments fueling this shift in the housing market is the steady decline in mortgage rates. While rates always have ups and downs — and volatility is still possible — the larger trajectory is favorable. According to the Fannie Mae Economic and Strategic Research Group, mortgage rates are expected to drop to around 5.9% by the end of 2026. fanniemae.com+1

This decline matters a lot for both affordability and buyer activity. Lower mortgage rates mean lower monthly payments, which gives homebuyers more purchasing power without increasing their monthly budget.

Real Impact for Homebuyers in Palm Beach County

Let’s bring that into a local context: imagine a homebuyer in West Palm Beach or Wellington who has a monthly housing budget of $3,000. At today’s higher rates, that budget might limit them to smaller or less desirable homes. But with rates falling, they could afford a significantly more valuable property — maybe a single-family house in a sought-after neighborhood — simply because their borrowing cost has dropped.

Christian Penner at America’s Mortgage Solutions (AMS) has been working closely with local buyers and notes that more people are re-running their mortgage calculations. “With these mortgage rate trends, many homebuyers are realizing they now qualify for homes that felt out of reach just a few months ago,” he says.

What Experts Are Forecasting

Fannie Mae revised down its mortgage rate projections in its 2025 outlook, expecting a continued drop into 2026. fanniemae.com+1

By the end of 2026, their forecast calls for a 30-year fixed rate near 5.9%. fanniemae.com+1

Some industry analysts, referencing Freddie Mac data, are already pointing to recent mortgage rates of roughly 6.26%, one of the most favorable levels seen in months. Mortgage Professional

For buyers in North Palm Beach, Wellington, or West Palm Beach, this could be a meaningful shift — especially for those who have been waiting on the sidelines for the right time to pull the trigger.

2. Inventory Is Building: More Listings Are Emerging

The “Lock-In” Effect Is Loosening

In recent years, many homeowners held onto their homes because they locked in ultra-low mortgage rates. That lock-in effect drastically limited inventory, especially in desirable markets like West Palm Beach and Wellington.

But as mortgage rates ease, more homeowners are reconsidering. Some are making life changes — relocating, downsizing, retiring — and finally feel it makes sense to list. These life-driven moves, combined with the easing rate environment, are contributing to more homes coming to market.

Local Supply Is Catching Up

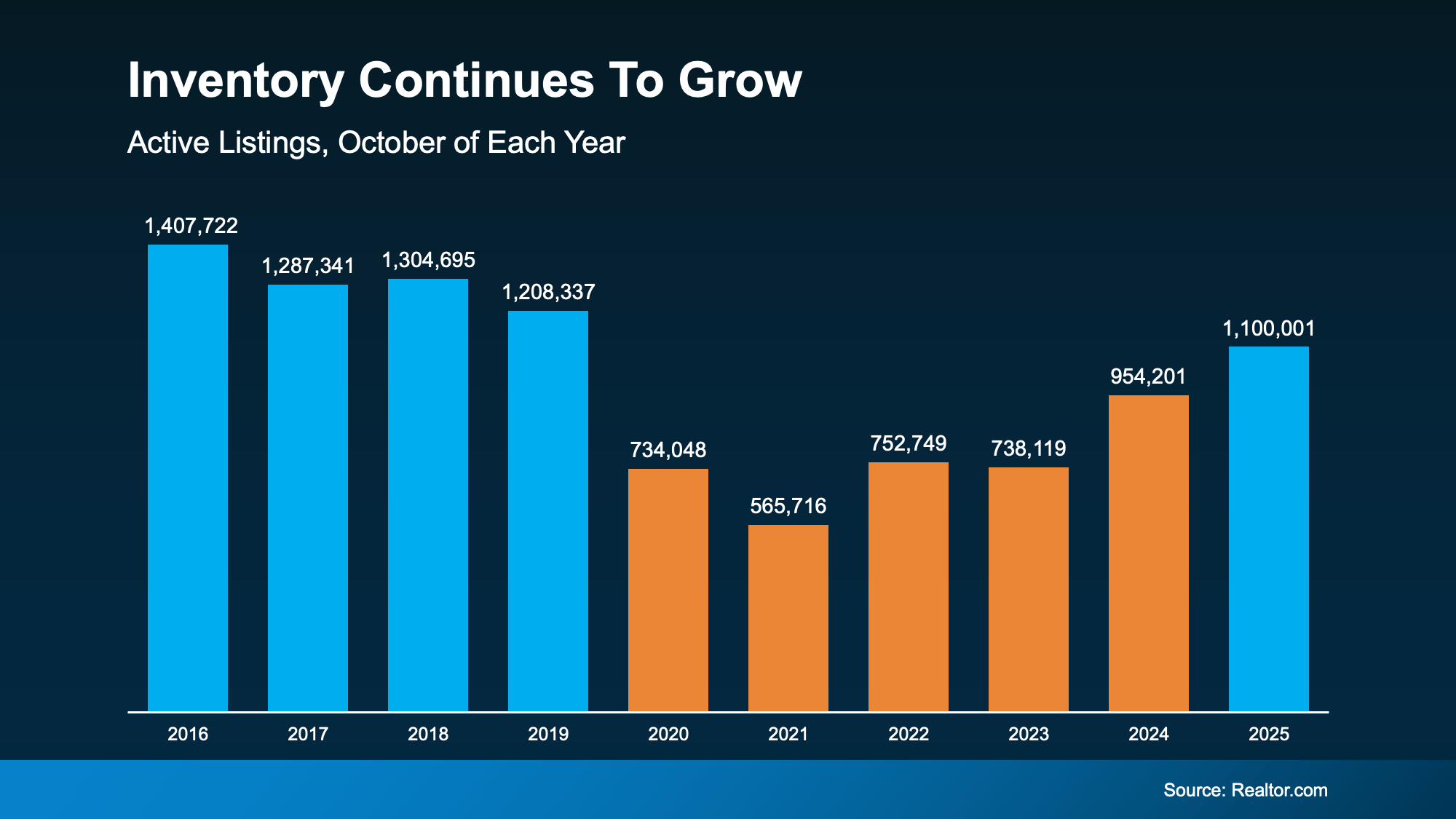

Data for Palm Beach County, which includes West Palm Beach, North Palm Beach, and Wellington, shows that the number of homes for sale is growing. According to local real estate experts, active listings have increased significantly — by over 20% year-over-year in some segments. rhondatownsend.com

This return to more balanced inventory is significant. For buyers, more homes mean more choices — and potentially more negotiating power. For sellers, it signals a chance to list, but with realistic expectations: markets are still competitive, and pricing will need to reflect the increased supply.

What That Means for the Local Market

In West Palm Beach, many real estate agents expect inventory to continue to expand, especially for single-family homes. jeanniehomesforsale.com

With a growing list of more typical, move-in-ready homes, buyers are less pressured to snap up anything that comes on the market.

Sellers can still benefit, but to attract offers, they'll need to price strategically, stage well, and be flexible.

Christian Penner with AMS often advises his seller clients this way: “If you’re thinking about putting your home on the market in North Palm Beach or Wellington, now might be a smart moment. You’re more likely to reach serious and qualified homebuyers, and the competitive landscape is returning.”

3. Buyer Demand Is Re-Engaging

Purchase Applications Are Rising Again

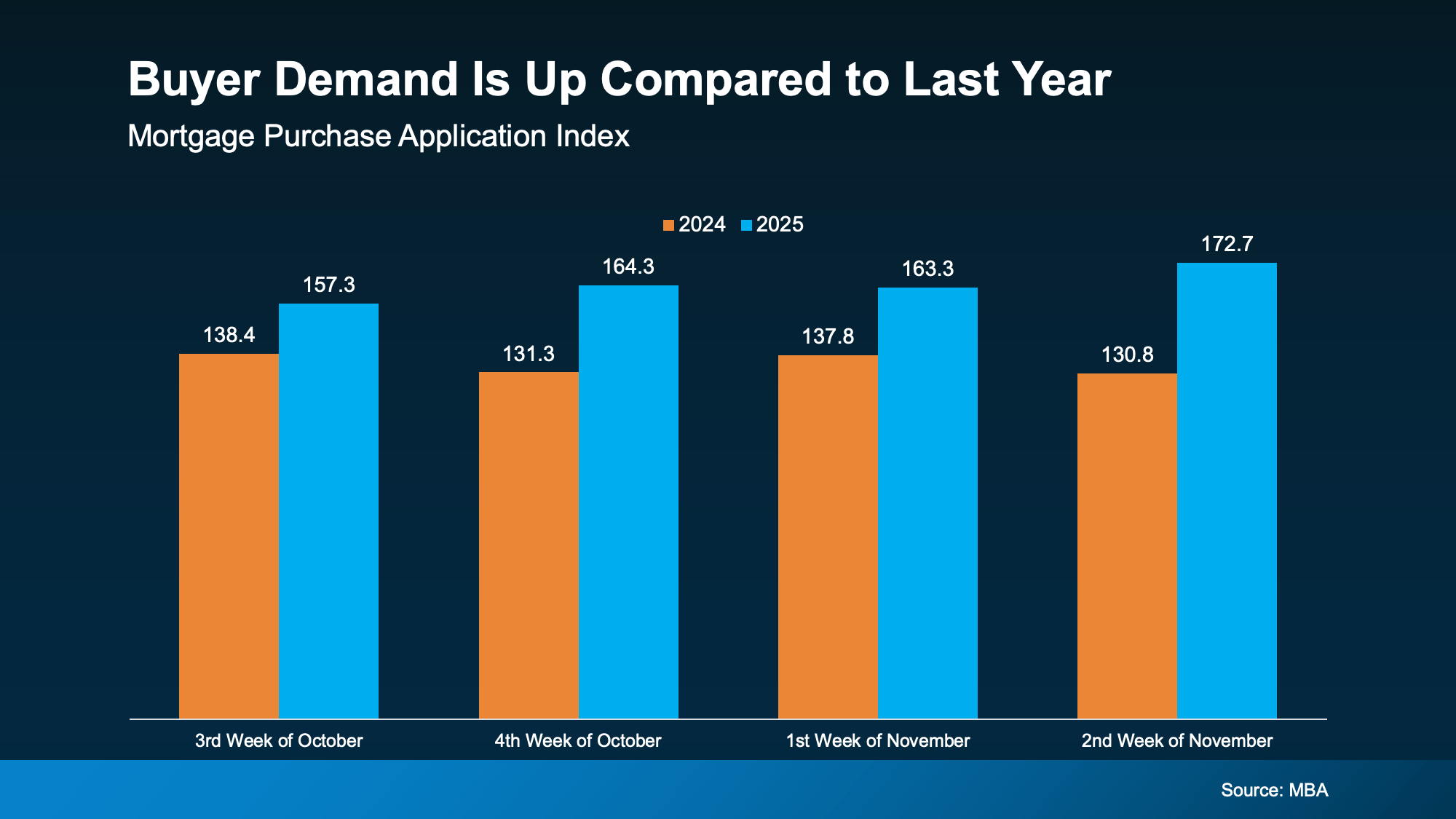

Another key trend fueling the recovery: more buyers are re-entering the market. According to data from the Mortgage Bankers Association (MBA), purchase applications are up compared to last year, which suggests demand is building. This isn’t just casual window shopping — more people are actively applying for mortgages again.

In the Palm Beach area, real estate professionals report that local buyer interest is returning, especially among those who paused their search when rates were at their peak.

Why Local Buyers Are Coming Back

Several factors are contributing to this renewed momentum in West Palm Beach, North Palm Beach, and Wellington:

Improved Affordability — thanks to lower mortgage rates, buyers can stretch their budgets.

Increased Inventory — more listings are giving buyers a better shot at finding what they want.

Life Transitions — people are relocating to South Florida, buying second homes, or upsizing.

Expert Guidance — working with a knowledgeable Real Estate Advisor like Christian Penner helps homebuyers navigate this shifting market.

Christian Penner has seen this firsthand: “I’m getting more calls from serious homebuyers in West Palm Beach who want to lock in financing now, before rates potentially move back up,” he shares. “They’re more confident because they see more options, and they know the forecast is improving.”

4. The 2026 Housing Market Forecast for Palm Beach County

So what’s next? Let’s look at what big institutions are forecasting, and how those predictions might play out in our local market.

What Fannie Mae Predicts

Mortgage Rates: Fannie Mae expects 30-year fixed rates to decline to around 5.9% by the end of 2026. fanniemae.com

Home Sales / Originations: They project about 5.16 million in home sales in 2026, up from around 4.72 million in 2025. fanniemae.com+1

Refinance Activity: With lower rates, the share of refinances is expected to rise — from about 26% in 2025 to 35% by 2026. fanniemae.com

Home Price Growth: In their April 2025 outlook, Fannie Mae revised their home-price forecast to about 2.0% price growth in 2026. fanniemae.com

What Other Forecasts Are Saying

According to local real estate voices in Palm Beach County, including West Palm Beach and Wellington, home prices are expected to grow modestly in 2026 — perhaps in the 3–5% range — driven by a return to balance between supply and demand. rhondatownsend.com

Inventory is projected to continue expanding, potentially reaching 6–7 months of supply for single-family homes in West Palm Beach by early-to-mid 2026. jeanniehomesforsale.com

Some analysts suggest that mortgage rates could dip even further if inflation continues to moderate and economic growth remains steady — though risks remain. fanniemae.com+1

Risks and Local Considerations

It’s important to balance optimism with realism. Here are some of the potential headwinds:

Regional Divergence: While Palm Beach County (and cities like Wellington, North Palm Beach, West Palm Beach) may benefit from increased inventory and demand, not all submarkets will perform equally. Luxury and waterfront segments may behave differently than suburban median-priced homes.

Affordability Pressures: Even with improving mortgage rates, affordability remains a challenge in South Florida. The cost of property taxes, insurance (especially for hurricane risk), and HOA fees can add up.

Supply Constraints: New construction may help, but zoning, permitting, and labor costs could limit how fast inventory grows.

Macroeconomic Uncertainty: Broader economic risks — inflation, interest rate shifts, or any unexpected shocks — could derail some of the more optimistic forecasts.

5. What This Means for You — Whether You’re a Buyer or a Seller

Understanding what’s happening isn’t just theoretical — it has practical implications for people in West Palm Beach, North Palm Beach, and Wellington. And with the help of someone like Christian Penner, you can turn market trends into personal opportunity.

For Buyers

Lock in Now: As mortgage rates trend downward, now could be a smart time to secure financing. Christian, with AMS, can help you lock in a rate that takes advantage of the current forecast.

Get Pre-Approved: With more purchase applications coming in, being pre-approved gives you a leg up when you find the right home.

Explore Different Neighborhoods: Use the expanding inventory to your advantage. Whether you're looking in West Palm Beach, North Palm Beach, or Wellington, there may be hidden gems that weren’t available when supply was tighter.

Plan for Total Costs: Don’t just think about mortgage rates — factor in property taxes, flood insurance (in coastal areas), HOA dues, and maintenance.

For Sellers

Time Your Listing: If you're ready to sell, the improving market conditions may be favorable. As more buyers come back, competition increases — but so does inventory, so it's not quite a seller’s bubble.

Price Strategically: Use data and comps for West Palm Beach and Wellington to price realistically. Work with Christian to determine how your home fits into the local shift.

Stage and Prepare: With more listings and longer days on market possible, clean, staged, and well-maintained homes will stand out.

Work With a Local Pro: Christian Penner at America’s Mortgage Solutions (AMS) wears multiple hats — as a Real Estate Agent and Real Estate Advisor, he not only helps with listing strategy but connects sellers to serious homebuyers and lenders.

For Investors

Opportunities Are Emerging: With both forecasted rate declines and a supply increase, now could be a favorable time to invest — especially in West Palm Beach and surrounding neighborhoods.

Watch for Long-Term Trends: As inventory grows and buyer demand steadies, you may find value in rental properties or flip opportunities.

Partner Wisely: Work with experienced local professionals like Christian who understand how mortgage rates, forecast trends, and our local market dynamics intersect.

6. Why Christian Penner and America’s Mortgage Solutions (AMS) Are Key to Your Strategy

Navigating this turning point in the housing market requires expert guidance — and that’s where Christian Penner comes in. As a trusted Mortgage Broker, Mortgage Lender, Real Estate Agent, and Real Estate Advisor with America’s Mortgage Solutions (AMS), he offers a holistic, on-the-ground perspective that few can match.

Here’s how he can help you:

Rate Insight & Mortgage Strategy

Christian stays on top of mortgage rate movements and forecast data from Fannie Mae, Freddie Mac, and other institutions. He helps homebuyers lock in favorable financing and advises sellers on how to structure their sales in the current rate environment.Access to Local Listings

With deep ties in West Palm Beach, North Palm Beach, and Wellington, Christian knows the neighborhoods, the inventory flow, and which homes are likely to perform well in this shifting market.Comprehensive Planning

Whether you’re buying, selling, or investing, Christian guides you through the full process — from pre-approval to negotiation to closing — ensuring your strategy aligns with both national forecast trends and the nuances of our local market.Trusted Advisor Role

As a Real Estate Advisor, Christian doesn’t just transact. He partners with you for the long term, helping you make decisions that are not only smart for today, but poised for what’s ahead in 2026 and beyond.

7. Voice-Search Friendly FAQs for Local Buyers and Sellers

Q: Are mortgage rates going to drop below 6% in 2026?

Yes — according to Fannie Mae, mortgage rates are expected to fall to around 5.9% by the end of 2026. fanniemae.com+1

Q: Will there be more homes for sale in West Palm Beach in 2026?

Yes — inventory is growing locally, as more homeowners are willing to list now that rate-lock pressures are easing in our local market. More listings are expected to continue through 2026.

Q: Is now a good time to buy a house in Wellington or North Palm Beach?

It could be. With better affordability, rising purchase applications, and more inventory, homebuyers may find more favorable conditions in 2025–2026 than they have in recent years.

Q: What does the 2026 housing market forecast look like for Palm Beach County?

Most forecasts, including those from Fannie Mae, suggest moderate home price growth, declining mortgage rates, and an increase in mortgage originations. That said, affordability, regional dynamics, and construction could influence how these projections play out locally.

Q: How can I make the most of this turning point in the housing market?

Work with a local expert like Christian Penner at America’s Mortgage Solutions (AMS). He can help you with everything from financing to navigating our local market, whether you're buying or selling.

Conclusion

The housing market in West Palm Beach, North Palm Beach, and Wellington, Florida is quietly transforming. The alignment of three major trends — declining mortgage rates, rising inventory, and renewed buyer demand — is setting the stage for a more balanced and active forecast for 2026.

For buyers, now may be the moment to lock in favorable financing, explore more options, and make your move. For sellers, it’s a chance to list strategically, price wisely, and take advantage of the re-engaged market. And for investors, shifting conditions could bring compelling opportunities.

Throughout it all, Christian Penner, Mortgage Broker, Mortgage Lender, Real Estate Agent, and Real Estate Advisor at America’s Mortgage Solutions (AMS), is a trusted partner. With localized knowledge and national-level insight, he’s uniquely positioned to help you leverage this turning point.

Let’s connect and talk about our local market — whether you're thinking of buying, selling, or investing, 2026 just might be the year you act.

FOR MORE INFO..

Mortgage Rates Have Been Coming Down

Mortgage rates are always going to have their ups and downs – that's just how rates work. Especially with the general economic uncertainty right now, some volatility is to be expected. But, if you zoom out, it’s the larger trend that really matters most.

And overall, rates have been trending down for most of this year (see graph below):

And in just the last few months, we’ve seen the best rates of 2025. According to Sam Khater, Chief Economist at Freddie Mac:

“On a median-priced home, this could allow a homebuyer to save thousands annually compared to earlier this year, showing that affordability is slowly improving.”

Data from Realtor.com shows just how much the number of homes for sale has grown. And the really interesting part is that the market is approaching levels that haven’t been seen for the past six years (see the blue on the graph below):

That return to more normal inventory levels is a really good thing. It gives buyers more options than they’ve had in years. And it’s helping to bring the market closer to balance.

The Mortgage Bankers Association (MBA) reports purchase applications are up compared to last year, a clear signal that demand is building again (see graph below):

And experts think this momentum will continue. Economists from Fannie Mae, the Mortgage Bankers Association (MBA), and the National Association of Realtors (NAR) all forecast moderate sales growth going into 2026.

Source: “America's Mortgage Solutions (AMS)”